- Japan

- /

- Infrastructure

- /

- TSE:9364

3 Dividend Stocks To Consider With Yields Up To 4.5%

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and consumer spending concerns, major indexes have experienced fluctuations, with the S&P 500 recently reaching record highs before ending the week lower. Amidst this backdrop of uncertainty and cautious economic sentiment, dividend stocks can offer a measure of stability through regular income, making them an attractive option for investors seeking to balance potential risks with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

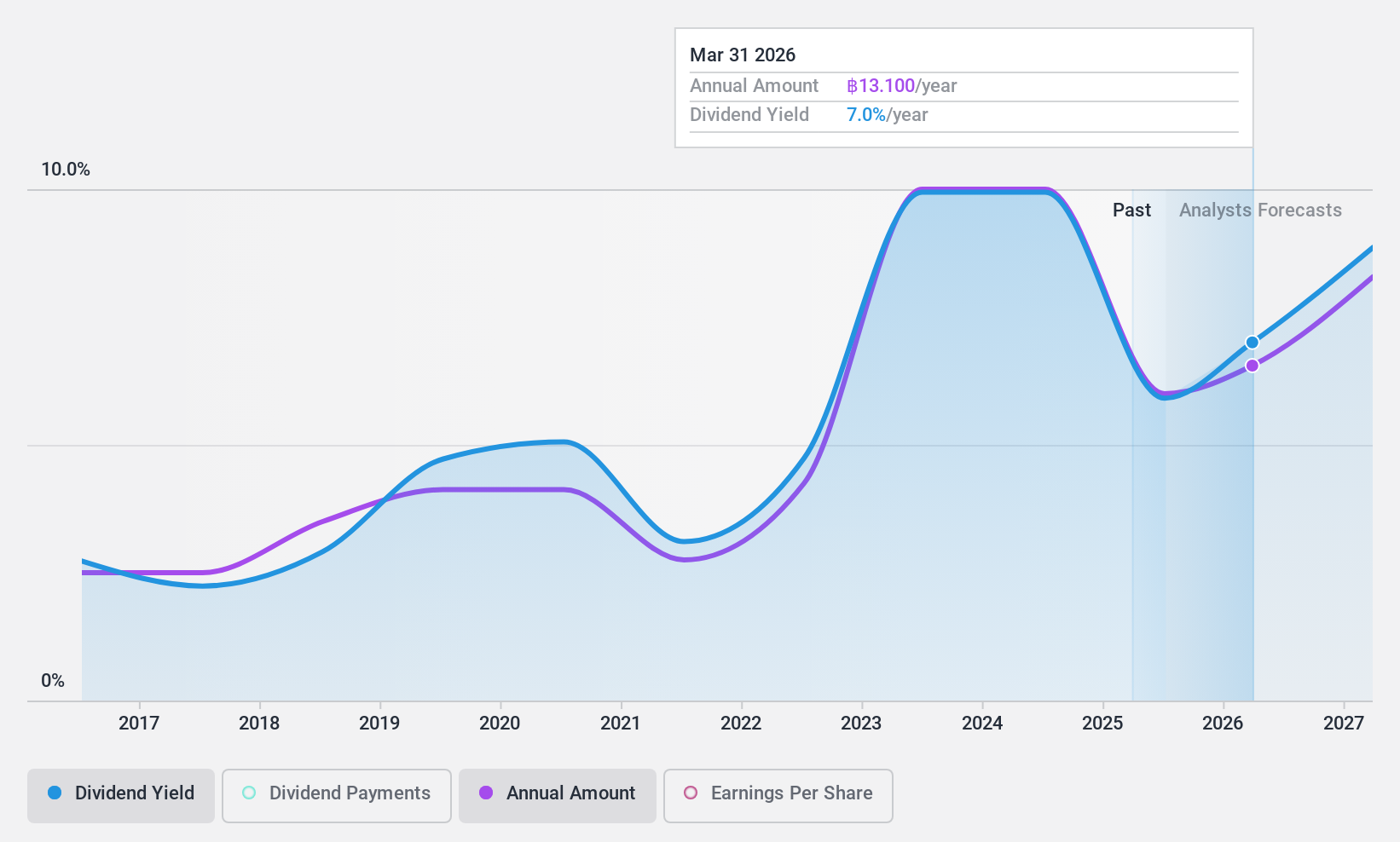

Thai Stanley Electric (SET:STANLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Stanley Electric Public Company Limited manufactures and sells automotive bulbs, lighting equipment, molds and dies, and product designs in Thailand with a market cap of THB16.86 billion.

Operations: Thai Stanley Electric's revenue is primarily derived from its Auto Parts & Accessories segment, which generated THB12.89 billion.

Dividend Yield: 4.5%

Thai Stanley Electric's dividend yield of 4.55% is below the top tier in the Thai market, yet its payout ratios are sustainable, with earnings and cash flows covering dividends at 52.9% and 53.6%, respectively. Despite trading at a significant discount to fair value, its dividend history is unreliable due to volatility over the past decade. Recent earnings show declines in sales and net income compared to last year, potentially impacting future payouts.

- Take a closer look at Thai Stanley Electric's potential here in our dividend report.

- Our valuation report here indicates Thai Stanley Electric may be overvalued.

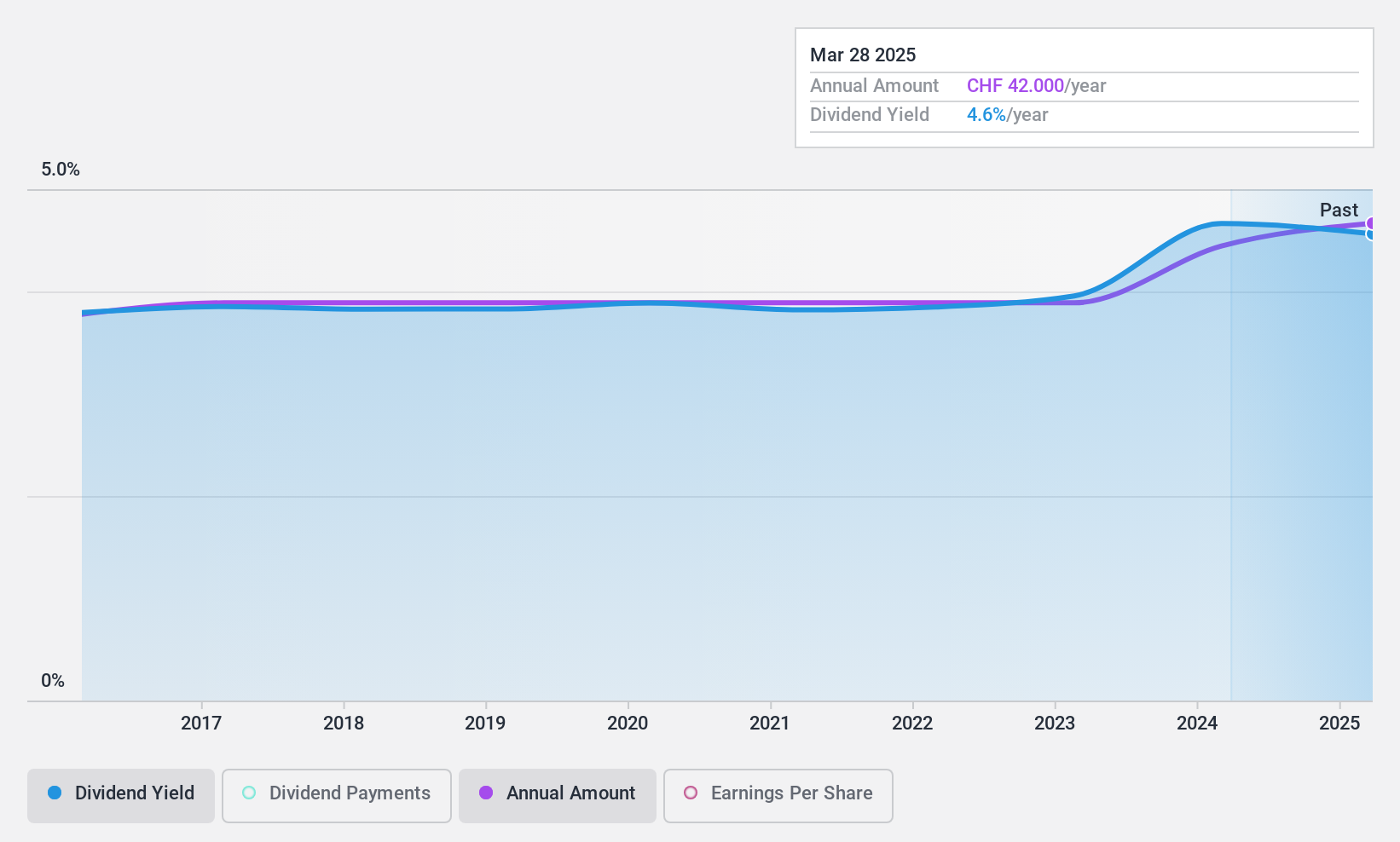

Basellandschaftliche Kantonalbank (SWX:BLKB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private and corporate clients in Switzerland, with a market cap of CHF1.96 billion.

Operations: Basellandschaftliche Kantonalbank generates revenue of CHF466.77 million from its banking segment, serving both private and corporate customers in Switzerland.

Dividend Yield: 4.4%

Basellandschaftliche Kantonalbank offers a high dividend yield of 4.41%, placing it among the top 25% in the Swiss market. Over the past decade, its dividends have been stable and reliable, with consistent growth. The reasonable payout ratio of 56.7% indicates earnings cover these payments. Despite trading at a discount to its estimated fair value, there's insufficient data to assess future dividend sustainability or coverage beyond three years due to outdated financial reports and low bad loan allowance (51%).

- Navigate through the intricacies of Basellandschaftliche Kantonalbank with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Basellandschaftliche Kantonalbank's share price might be too optimistic.

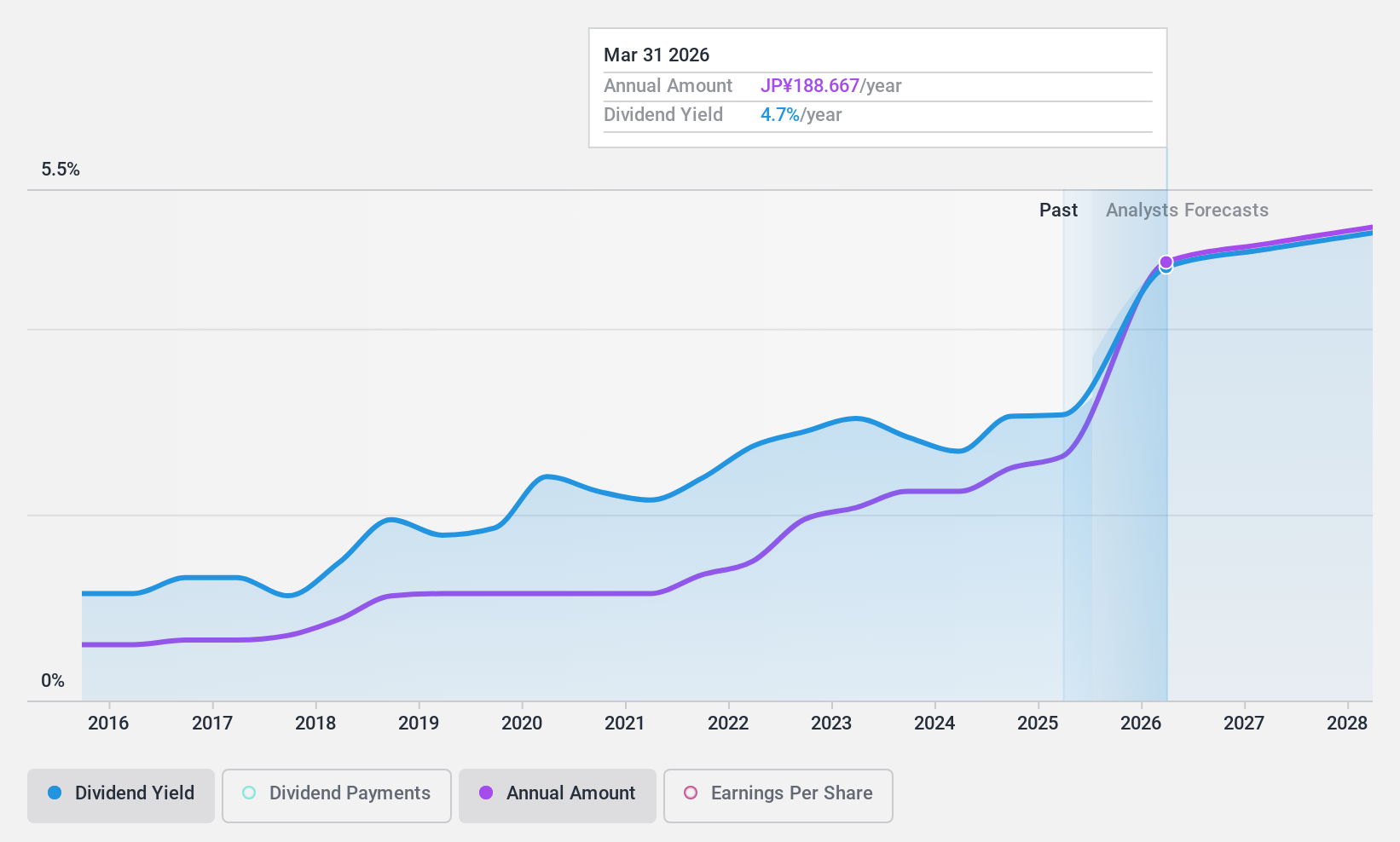

Kamigumi (TSE:9364)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kamigumi Co., Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥333.30 billion.

Operations: Kamigumi Co., Ltd.'s revenue segments include integrated logistics services provided domestically and internationally.

Dividend Yield: 3.1%

Kamigumi offers a stable dividend yield of 3.15%, supported by a low payout ratio of 22.2% and cash payout ratio of 30.9%, ensuring dividends are well-covered by earnings and cash flows. Despite recent executive changes, the company maintains reliable dividend payments over the past decade with consistent growth, although its yield is modest compared to top-tier Japanese dividend payers. Recent share buybacks totaling ¥16,999.72 million may further support shareholder value amidst slightly declining earnings forecasts.

- Get an in-depth perspective on Kamigumi's performance by reading our dividend report here.

- Our valuation report unveils the possibility Kamigumi's shares may be trading at a premium.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 2008 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kamigumi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9364

Kamigumi

Provides integrated logistics services in Japan and internationally.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives