- Singapore

- /

- Construction

- /

- SGX:F9D

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by mixed economic signals, such as Japan's fluctuating stock performance and China's persistent manufacturing challenges, investors are increasingly looking toward stable income sources. In this context, dividend stocks offer a compelling opportunity to enhance portfolios with their potential for regular income and resilience amidst market uncertainty.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.70% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 4.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.90% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.28% | ★★★★★★ |

Click here to see the full list of 1052 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore, Australia, and the United States, with a market capitalization of SGD918.60 million.

Operations: Boustead Singapore Limited's revenue is primarily derived from its Geospatial segment at SGD221.35 million, followed by Energy Engineering at SGD158.89 million, Real Estate Solutions at SGD134.35 million, and Healthcare at SGD12.14 million.

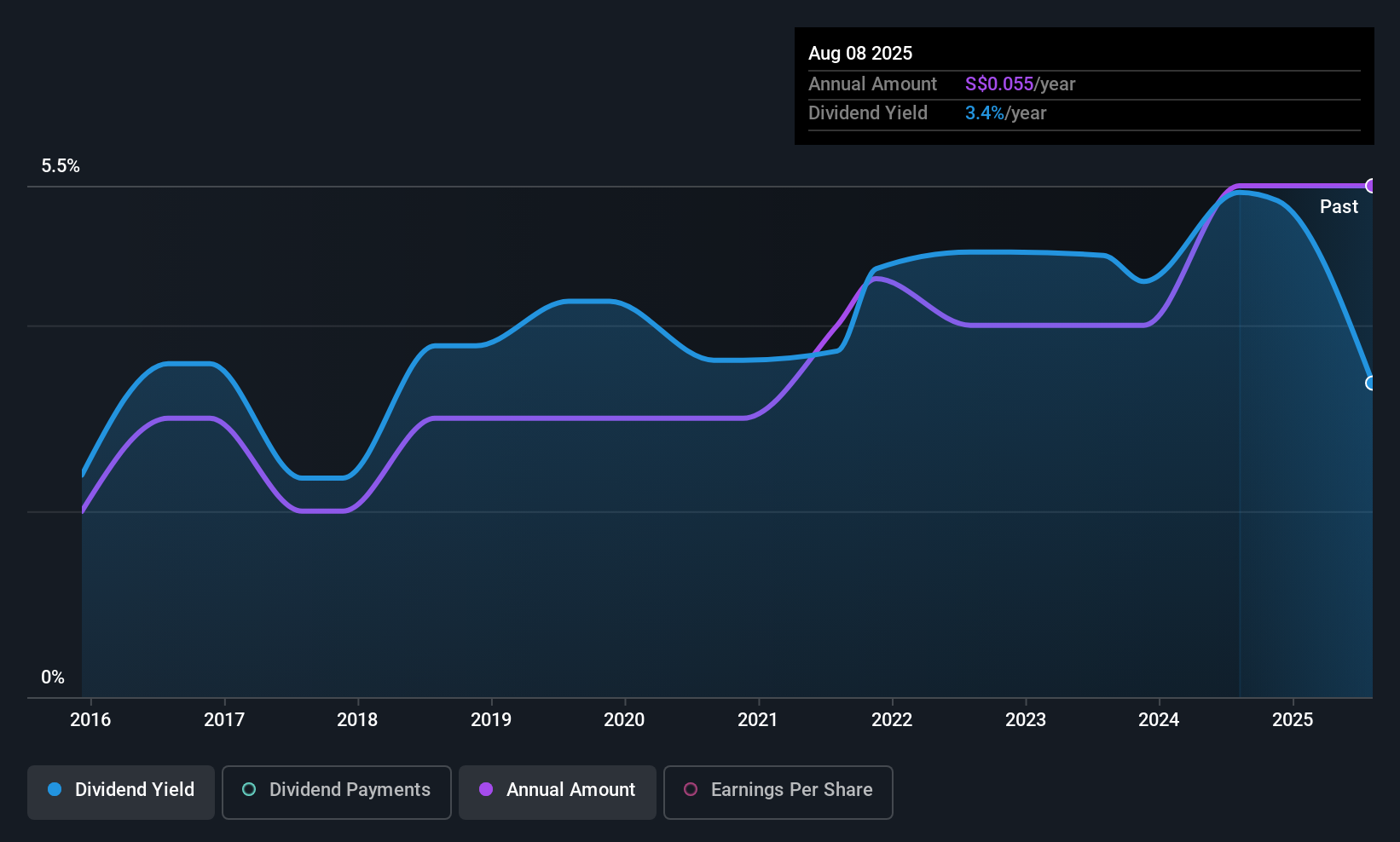

Dividend Yield: 3%

Boustead Singapore's dividend payments are well covered by both earnings and cash flows, with payout ratios of 28.1% and 39.8%, respectively. Despite this, the dividends have been volatile over the past decade, impacting reliability. The stock trades at a discount to its estimated fair value but offers a lower yield compared to top dividend payers in Singapore. Recent developments include Boustead’s addition to the S&P Global BMI Index and termination of its S$500 million debt issuance programme.

- Click here and access our complete dividend analysis report to understand the dynamics of Boustead Singapore.

- Insights from our recent valuation report point to the potential undervaluation of Boustead Singapore shares in the market.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trading of crude palm oil and palm kernel in Indonesia, with a market cap of SGD2.08 billion.

Operations: Bumitama Agri Ltd.'s revenue from its Plantations and Palm Oil Mills segment amounts to IDR18.87 trillion.

Dividend Yield: 5.3%

Bumitama Agri's dividends are supported by earnings and cash flows, with payout ratios of 70.8% and 52%, respectively. However, past volatility raises concerns about sustainability despite a decade-long increase in payments. The dividend yield is slightly below top-tier Singaporean payers, but the stock trades significantly below its estimated fair value. Recent earnings showed strong growth with net income rising to IDR 1.27 trillion from IDR 856.79 billion year-over-year, reflecting robust financial performance.

- Take a closer look at Bumitama Agri's potential here in our dividend report.

- Our valuation report here indicates Bumitama Agri may be undervalued.

NS United Kaiun Kaisha (TSE:9110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NS United Kaiun Kaisha, Ltd. operates in marine transportation services both in Japan and internationally, with a market cap of ¥127.73 billion.

Operations: NS United Kaiun Kaisha, Ltd. generates its revenue from two main segments: Ocean Shipping Business, which accounts for ¥208.15 billion, and Domestic Shipping Business, contributing ¥31.75 billion.

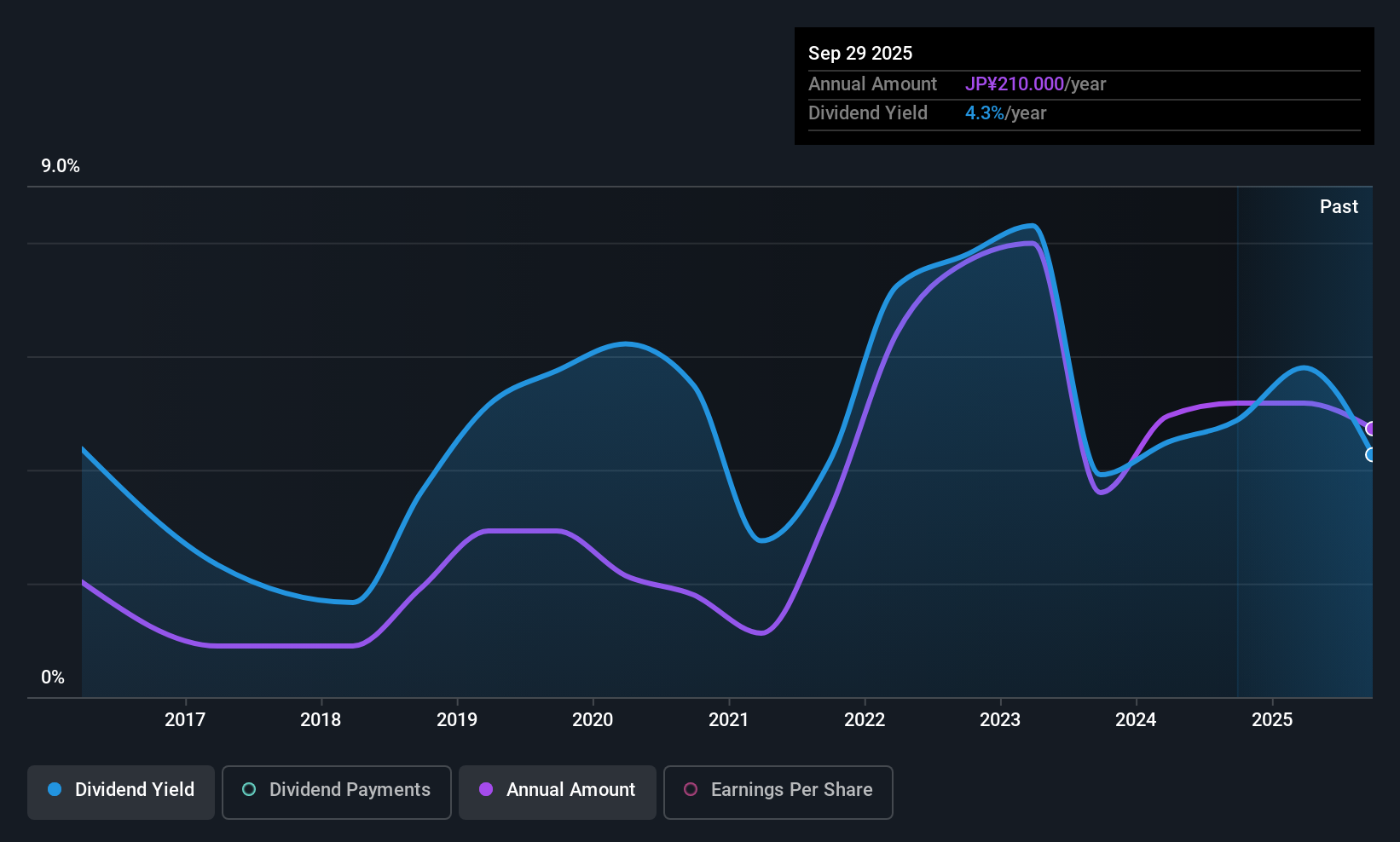

Dividend Yield: 3.9%

NS United Kaiun Kaisha's dividends are well-covered by earnings and cash flows, with payout ratios of 30% and 30.3%, respectively, though past volatility raises reliability concerns. Despite a recent dividend decrease to JPY 105 per share for FY2026, the yield remains in Japan's top quartile. The stock trades significantly below its estimated fair value. Revised guidance indicates improved financial performance amid a recovering dry bulk market and favorable currency conditions, suggesting potential stability ahead.

- Unlock comprehensive insights into our analysis of NS United Kaiun Kaisha stock in this dividend report.

- Our comprehensive valuation report raises the possibility that NS United Kaiun Kaisha is priced lower than what may be justified by its financials.

Key Takeaways

- Gain an insight into the universe of 1052 Top Asian Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boustead Singapore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F9D

Boustead Singapore

An investment holding company, provides energy engineering, real estate, geospatial, and healthcare technology solutions in Singapore, Australia, Malaysia, the United States, Europe, rest of Asia Pacific, North and South America, the Middle East, and Africa.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives