- Japan

- /

- Transportation

- /

- TSE:9041

Kintetsu Group HoldingsLtd (TSE:9041) investors are sitting on a loss of 36% if they invested five years ago

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Kintetsu Group Holdings Co.,Ltd. (TSE:9041) shareholders for doubting their decision to hold, with the stock down 39% over a half decade. And it's not just long term holders hurting, because the stock is down 23% in the last year. More recently, the share price has dropped a further 8.1% in a month. But this could be related to poor market conditions -- stocks are down 7.3% in the same time.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the share price declined over five years, Kintetsu Group HoldingsLtd actually managed to increase EPS by an average of 8.6% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We don't think that the 1.6% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 17% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

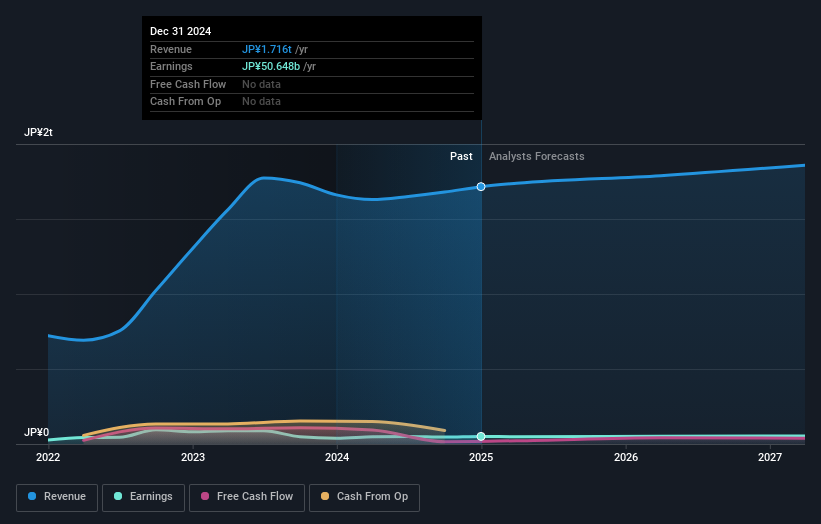

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Kintetsu Group HoldingsLtd has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Kintetsu Group HoldingsLtd stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Kintetsu Group HoldingsLtd, it has a TSR of -36% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Kintetsu Group HoldingsLtd shareholders are down 22% for the year (even including dividends), but the market itself is up 0.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Kintetsu Group HoldingsLtd that you should be aware of before investing here.

We will like Kintetsu Group HoldingsLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kintetsu Group HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9041

Kintetsu Group HoldingsLtd

Engages in the transportation, real estate, logistics, merchandise, hotel, leisure, and other businesses in Japan and internationally.

Second-rate dividend payer with questionable track record.

Market Insights

Community Narratives