Exploring November 2024's Undiscovered Gems With Solid Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of economic policies and fluctuating indices, small-cap stocks have shown a mix of resilience and vulnerability amidst broader market sentiment. With the S&P 600 reflecting these dynamics, investors may find opportunities in lesser-known stocks that possess strong fundamentals and adaptability to current economic conditions. Identifying such undiscovered gems involves looking for companies with solid financial health, growth potential, and strategic positioning within their industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tait Marketing & Distribution | NA | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Advanced Ceramic X (TPEX:3152)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Ceramic X Corporation designs, manufactures, and sells RF front-end devices and modules for wireless communication applications globally, with a market cap of NT$11.42 billion.

Operations: The primary revenue stream for Advanced Ceramic X comes from the high-frequency integration of components and modules, generating NT$1.65 billion. The company's financial performance includes a gross profit margin trend that has shown notable variation over recent periods.

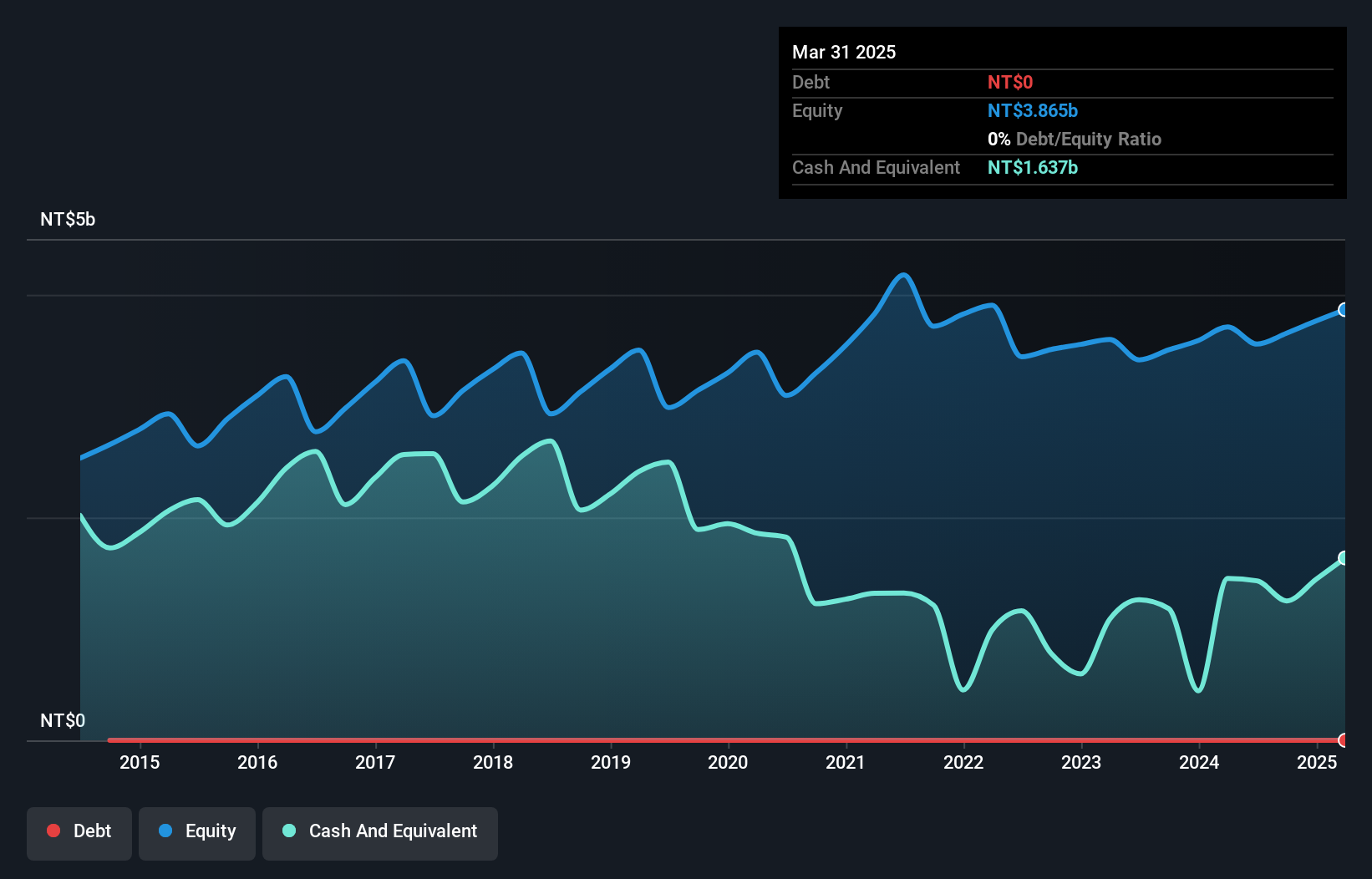

Advanced Ceramic X, a nimble player in the ceramics industry, has showcased impressive financial resilience. Over the past year, earnings surged by 68.3%, outpacing the Communications industry's meager 0.6% growth. This momentum is reflected in their recent quarterly results where sales reached TWD 428.64 million and net income hit TWD 98.81 million, both up from last year’s figures of TWD 396.04 million and TWD 90.87 million respectively. With no debt on its books for five years and positive free cash flow, this company seems well-positioned to capitalize on future opportunities without financial strain.

- Click here and access our complete health analysis report to understand the dynamics of Advanced Ceramic X.

Gain insights into Advanced Ceramic X's past trends and performance with our Past report.

Hamakyorex (TSE:9037)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamakyorex Co., Ltd. operates in the 3PL logistics and truck transportation sector both domestically in Japan and internationally, with a market capitalization of ¥95.80 billion.

Operations: Hamakyorex's revenue is primarily derived from its 3PL logistics and truck transportation services, both domestically and internationally. The company focuses on optimizing its cost structure to enhance operational efficiency. Notably, it has achieved a net profit margin of 4.5%, reflecting its ability to manage expenses effectively while generating profits from its core operations.

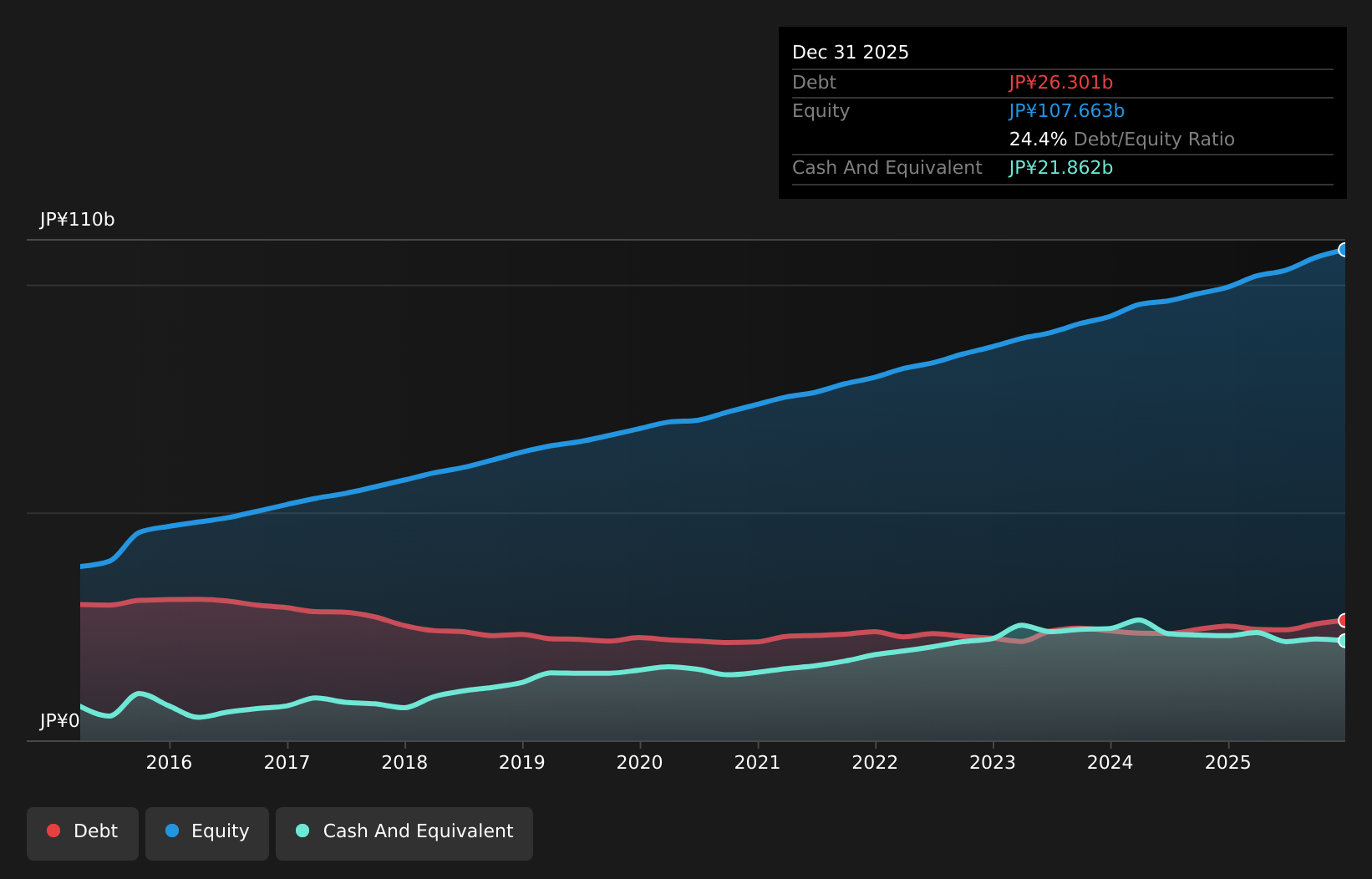

Hamakyorex, a notable player in logistics, has been making strategic moves with its recent share repurchase program. The company repurchased 158,400 shares valued at ¥200 million, reflecting a commitment to flexible capital management. This aligns with its strong financial health; the net debt to equity ratio stands at a satisfactory 1.3%, and earnings have grown by 17.9% over the past year, outpacing industry growth of 8.4%. Furthermore, Hamakyorex is expanding through a joint venture in Japan with Motherson, aiming to enhance logistics services including warehousing and third-party logistics solutions.

- Navigate through the intricacies of Hamakyorex with our comprehensive health report here.

Examine Hamakyorex's past performance report to understand how it has performed in the past.

M1 Kliniken (XTRA:M12)

Simply Wall St Value Rating: ★★★★★☆

Overview: M1 Kliniken AG, along with its subsidiaries, offers aesthetic medicine and plastic surgery services across several countries including Germany, Austria, and the United Kingdom, with a market cap of €311.73 million.

Operations: M1 Kliniken AG generates revenue primarily from its Trade segment with €251.09 million and its Beauty segment contributing €82.23 million.

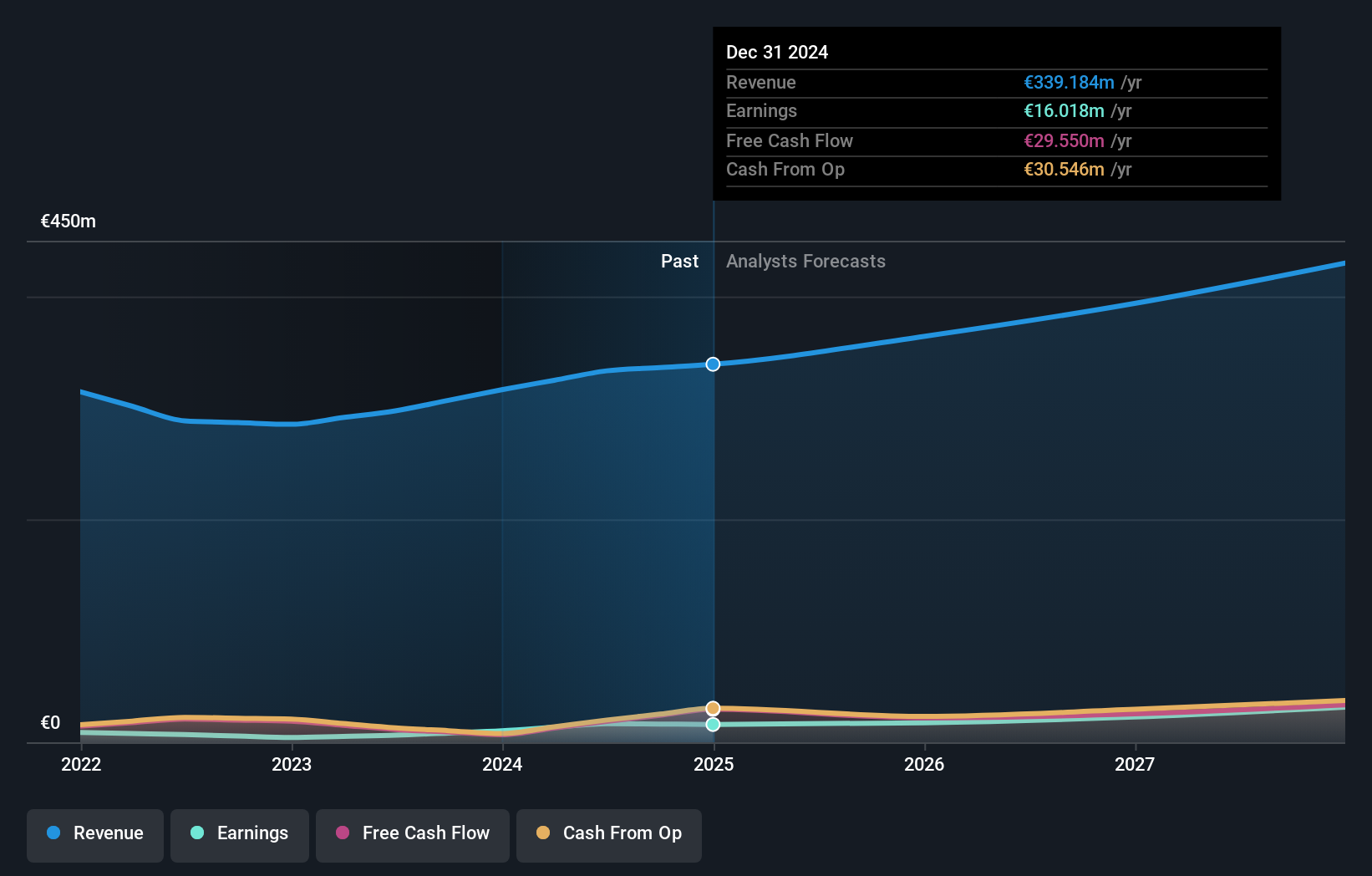

M1 Kliniken, a dynamic player in the healthcare sector, has recently showcased impressive financial growth. Earnings surged 163.7% over the past year, significantly outpacing the industry average of 40.5%. The company's net income for the first half of 2024 reached €9.9 million, up from €3.42 million in the previous year, with sales climbing to €167.74 million from €150.79 million. Despite a volatile share price in recent months, M1 Kliniken trades at an attractive valuation—65% below its estimated fair value—and maintains a satisfactory net debt to equity ratio of 1%, reflecting prudent financial management amidst expansion efforts.

- Dive into the specifics of M1 Kliniken here with our thorough health report.

Gain insights into M1 Kliniken's historical performance by reviewing our past performance report.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4646 more companies for you to explore.Click here to unveil our expertly curated list of 4649 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamakyorex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9037

Hamakyorex

Engages in 3PL logistics and truck transportation business in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.