- Japan

- /

- Transportation

- /

- TSE:9009

The Market Doesn't Like What It Sees From Keisei Electric Railway Co., Ltd.'s (TSE:9009) Earnings Yet As Shares Tumble 25%

To the annoyance of some shareholders, Keisei Electric Railway Co., Ltd. (TSE:9009) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

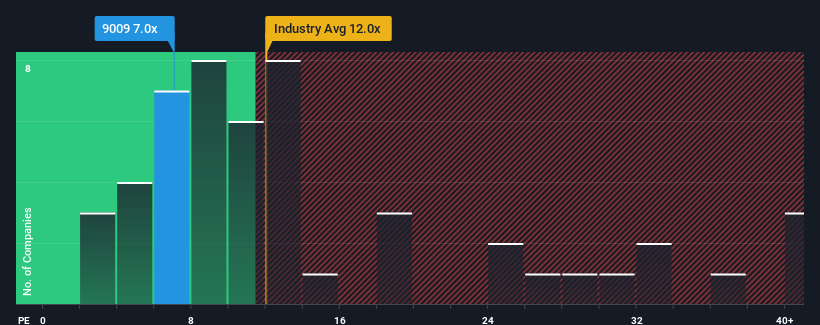

Although its price has dipped substantially, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Keisei Electric Railway as an attractive investment with its 7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Keisei Electric Railway certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Keisei Electric Railway

Is There Any Growth For Keisei Electric Railway?

Keisei Electric Railway's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 174% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 14% per year over the next three years. That's not great when the rest of the market is expected to grow by 9.6% per year.

With this information, we are not surprised that Keisei Electric Railway is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Keisei Electric Railway's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Keisei Electric Railway maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Keisei Electric Railway has 3 warning signs (and 2 which can't be ignored) we think you should know about.

You might be able to find a better investment than Keisei Electric Railway. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Keisei Electric Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9009

Keisei Electric Railway

Engages in the provision of public railway transportation services for local communities in Japan.

Fair value with low risk.

Market Insights

Community Narratives