- Japan

- /

- Transportation

- /

- TSE:9005

Tokyu (TSE:9005) Valuation in Focus After Completion of Share Buyback Program

Reviewed by Kshitija Bhandaru

Tokyu (TSE:9005) just wrapped up its latest share buyback program, purchasing around 0.7% of its outstanding shares as originally planned. Investors often watch these events for signals on management’s outlook and company valuation.

See our latest analysis for Tokyu.

Tokyu's share buyback wrapped up against a backdrop of shifting market sentiment. After a solid run earlier this year, the stock saw some pressure in recent weeks with a 1-month share price return of -8.4%. Its long-term picture remains positive, with a 44.7% total shareholder return over five years. This reflects the kind of resilience that often attracts longer-term investors even as short-term momentum fades.

If you’re curious what other companies are gaining traction right now, it might be the perfect time to expand your search and discover fast growing stocks with high insider ownership

With the buyback now complete and Tokyu’s shares recently under pressure, the key question is whether the current valuation reflects an overlooked opportunity or if future growth is already fully factored in by the market.

Most Popular Narrative: 16.6% Undervalued

The most widely followed narrative places Tokyu’s fair value well above the last close, hinting at potential upside versus current levels. This view sets the backdrop for a deeper look at the core drivers of the valuation.

Tokyu's expansion into high-demand areas like Shibuya with competitive real estate projects can drive rental income growth, ultimately boosting revenue. Active measures to manage rising construction costs and inflation through strategic portfolio management can protect profit margins and enhance overall earnings.

What is the secret ingredient powering this upbeat valuation? It all comes down to ambitious forecasts for both revenue growth and profit margins, with these riding on strategic expansion bets. Ever wondered which future financial milestones could push this price target even higher? Get the full blueprint behind Tokyu’s valuation and see what’s fueling analyst optimism.

Result: Fair Value of ¥2,060 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising construction costs and a sluggish passenger recovery could easily challenge expectations for Tokyu’s future earnings trajectory.

Find out about the key risks to this Tokyu narrative.

Another View: Market Value Signals More Caution

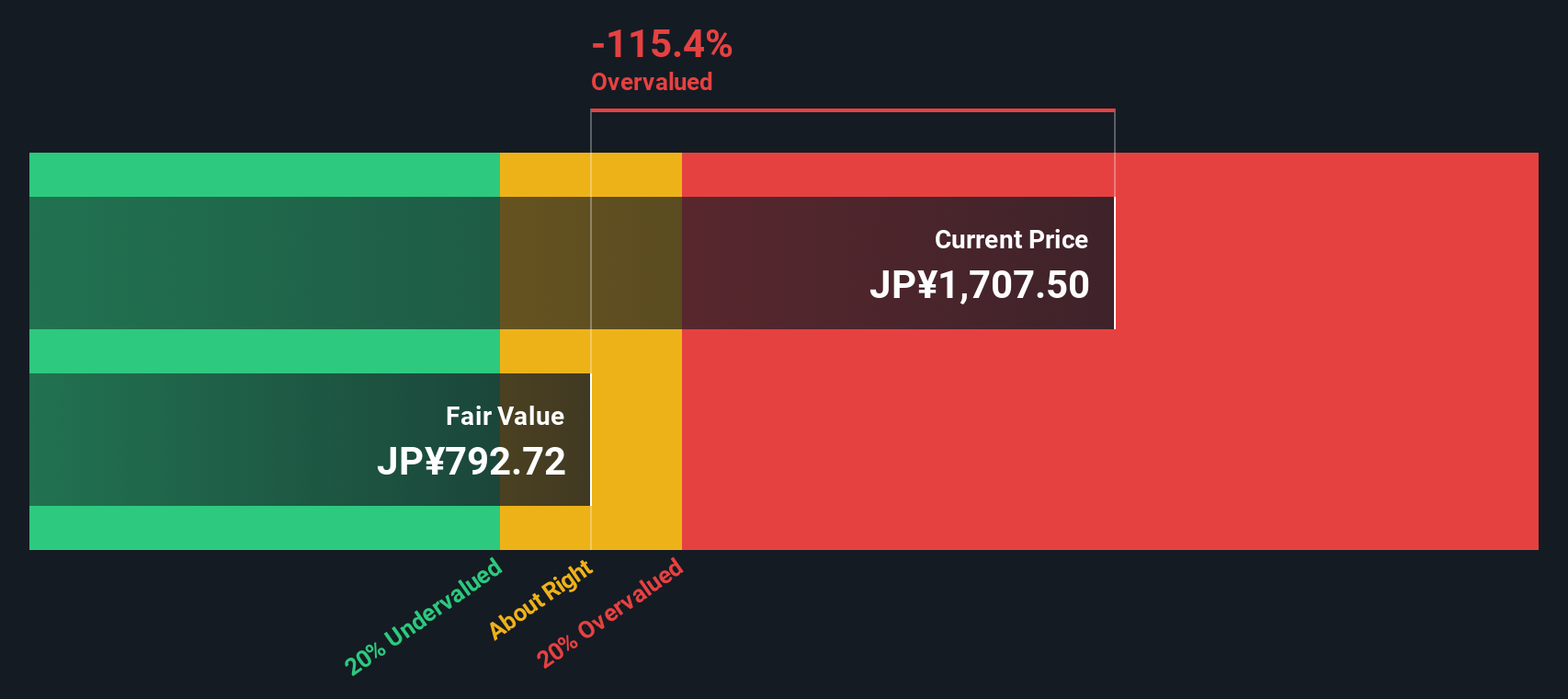

While analyst forecasts suggest Tokyu is undervalued, our DCF model paints a different picture. Based on our DCF, Tokyu’s shares currently trade above what we estimate to be their fair value. This raises important questions about the assumptions behind the optimism. Which perspective will the market follow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyu Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own valuation narrative in just a few minutes with Do it your way.

A great starting point for your Tokyu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Keep your momentum going by zeroing in on stand-out opportunities beyond Tokyu. The market is full of unique themes and hidden gems worth your attention right now. Choose confidently and don’t let possibilities pass you by.

- Capture the income potential by checking out these 20 dividend stocks with yields > 3% featuring companies consistently delivering yields above 3% for your portfolio.

- Ride the next wave of innovation when you explore these 24 AI penny stocks shaping tomorrow’s world with artificial intelligence breakthroughs and vision.

- Seize overlooked bargains through these 874 undervalued stocks based on cash flows and spot companies primed for value-driven returns based on powerful cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9005

Tokyu

Engages in the transportation, real estate, life services, and hotel and resort businesses in Japan and internationally.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives