- Japan

- /

- Transportation

- /

- TSE:9005

Tokyu (TSE:9005) Dividend Hike Prompts Fresh Look at Valuation and Long‑Term Upside Potential

Reviewed by Simply Wall St

Tokyu (TSE:9005) just lifted its interim dividend to JPY 14 per share from JPY 11 a year ago, a clear signal that management feels comfortable with cash flows and medium term earnings.

See our latest analysis for Tokyu.

The higher interim payout comes after a board meeting on a planned transfer of a specified subsidiary. The stock has delivered a 6.28 percent year to date share price return alongside a robust 5 year total shareholder return of 47.87 percent, suggesting steady but not explosive momentum.

With Tokyu rewarding patient holders, this could be a good moment to see what else fits a long term strategy via fast growing stocks with high insider ownership.

Yet with earnings growth muted, revenue only inching higher, and the share price still sitting about 16 percent below analyst targets, is Tokyu quietly undervalued or already pricing in the next leg of growth?

Most Popular Narrative: 12.9% Undervalued

Compared with the last close of ¥1,793.5, the most popular narrative points to a higher fair value, framing Tokyu as modestly mispriced today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the JP Transportation industry at 13.1x.

Want to see why a mature railway and real estate group gets a premium style earnings multiple, rising margins and shrinking share count baked in, not out?

Result: Fair Value of ¥2,060 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising construction costs and a potential economic slowdown could squeeze margins and tenant demand, which could quickly challenge today’s quietly optimistic valuation narrative.

Find out about the key risks to this Tokyu narrative.

Another View: Market Ratios Tell a Different Story

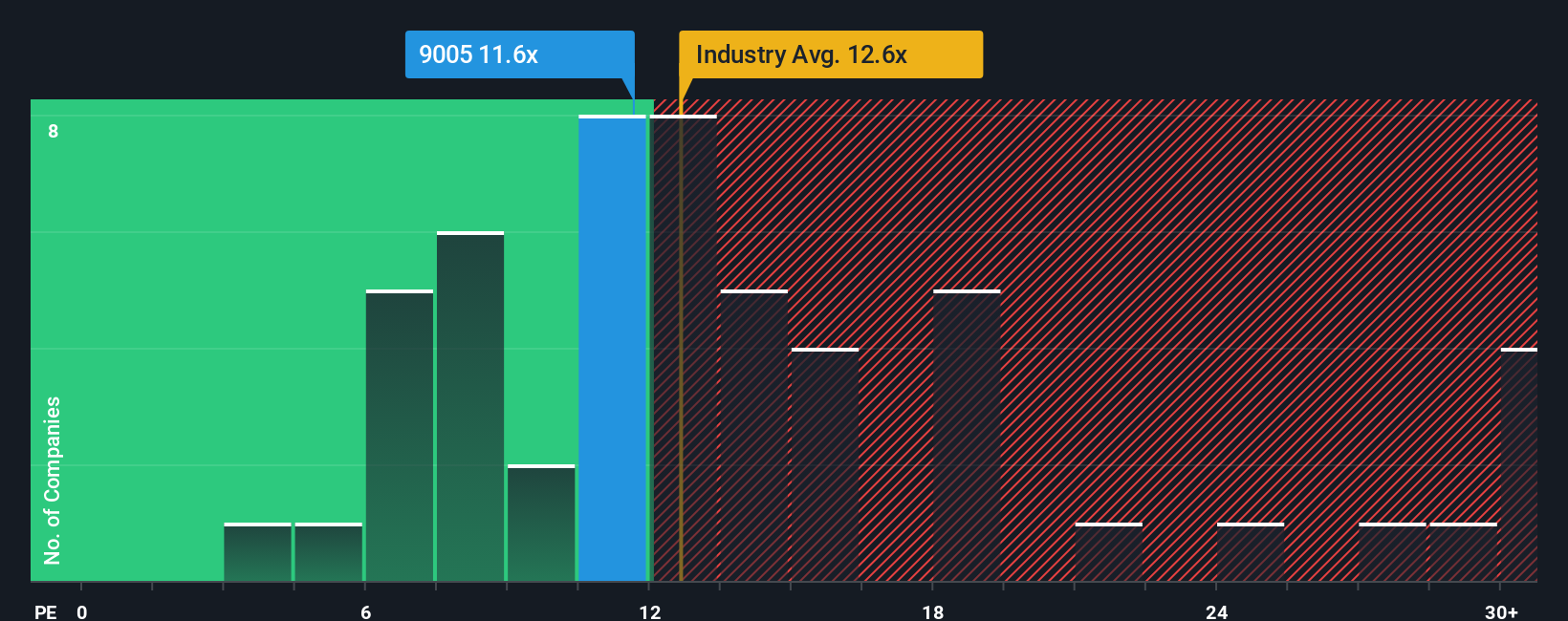

Market ratios point in the opposite direction to the fair value narrative. Tokyu trades on a price to earnings of 11.8x, slightly richer than the Transportation industry at 11.7x but cheaper than peers at 13.5x and below a fair ratio of 14.8x. This raises the question: is the risk skewed to multiple compression or upside re rating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tokyu Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Tokyu research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in a shortlist of fresh opportunities with the Simply Wall Street Screener and spot themes your portfolio is currently missing.

- Capture potential multi baggers early by scanning these 3571 penny stocks with strong financials with strong balance sheets and real, growing businesses behind the small price tags.

- Ride structural growth trends by targeting these 30 healthcare AI stocks that blend medical expertise with scalable AI driven platforms and expanding addressable markets.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that combine resilient cash flows with yields that can meaningfully move your total return.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9005

Tokyu

Engages in the transportation, real estate, life service, and hotel and resort businesses in Japan and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026