- Japan

- /

- Wireless Telecom

- /

- TSE:9984

SoftBank Group (TSE:9984) Valuation Check After Strong One-Year Shareholder Returns

Reviewed by Simply Wall St

SoftBank Group (TSE:9984) has quietly become one of the more polarizing names in Japan, with the stock swinging sharply this year as investors weigh its investment bets against uneven profit trends.

See our latest analysis for SoftBank Group.

The latest 5.41% one day and 14.03% seven day share price returns show momentum snapping back after a 15.26% one month pullback. At the same time, a 112.82% one year total shareholder return underlines how strongly sentiment has turned in SoftBank Group’s favor.

If this rebound has you thinking about where else growth narratives could surprise, it is worth exploring fast growing stocks with high insider ownership as a source of fresh ideas.

With SoftBank Group still trading below analyst targets despite triple digit one year returns, the key question now is whether investors are underestimating its earnings power or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 15.8% Undervalued

With SoftBank Group last closing at ¥19,185 against a most popular narrative fair value of ¥22,780.8, the debate shifts to whether earnings assumptions can support that gap.

Analysts expect earnings to reach ¥620.6 billion (and earnings per share of ¥433.31) by about September 2028, down from ¥1731.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥1250.7 billion in earnings, and the most bearish expecting ¥107.5 billion.

Want to see how a company with shrinking projected profits can still land a higher implied value? The narrative leans on steady growth, thinner margins, and a punchy future earnings multiple that is more often associated with market darlings than cyclical turnarounds. Curious which exact assumptions have to click for that to hold?

Result: Fair Value of ¥22,780.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on AI valuations and IPO markets remaining supportive, while leverage and regulatory shifts do not derail exit plans or balance sheet flexibility.

Find out about the key risks to this SoftBank Group narrative.

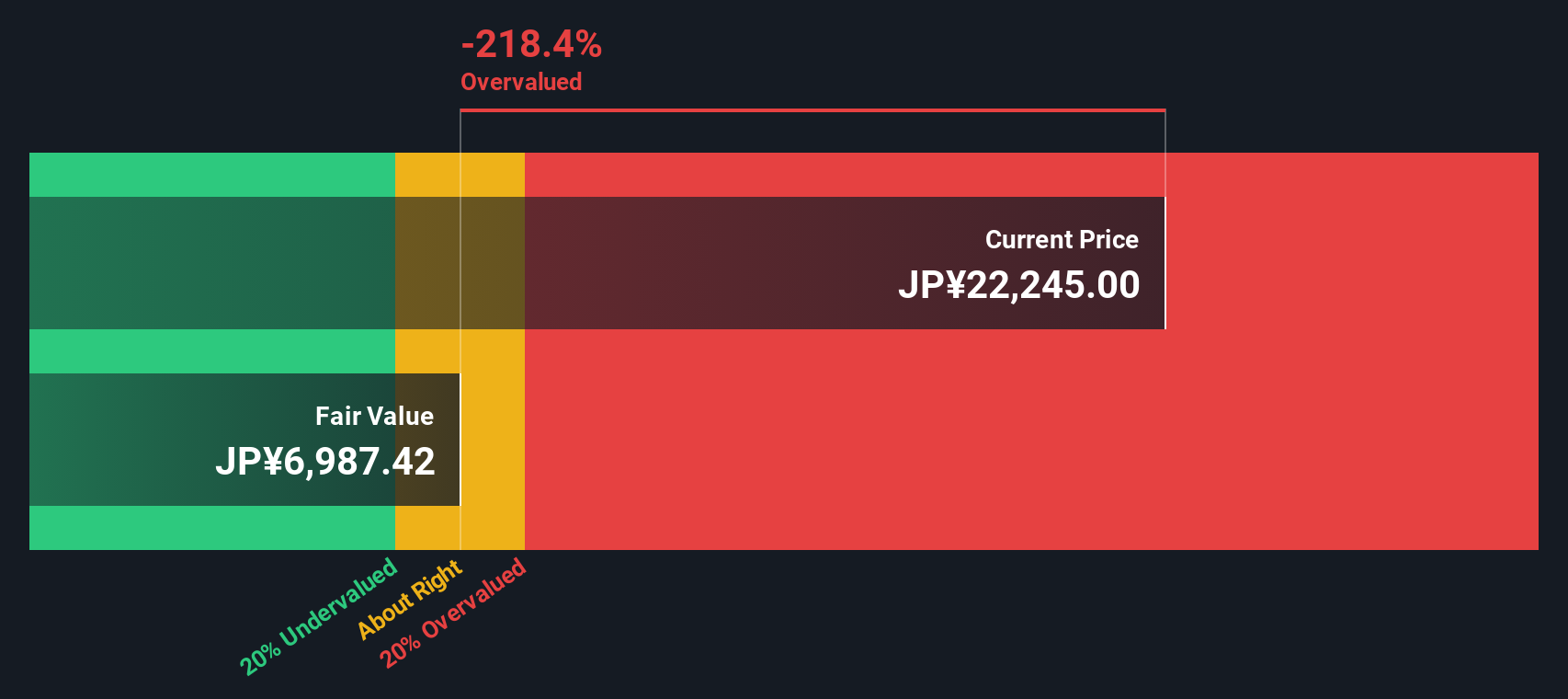

Another View: Market Ratios Tell a Different Story

Our SWS DCF model suggests a very different picture, pointing to a fair value near ¥1,099, which would make SoftBank Group look significantly overvalued at current levels. If the cash flows disappoint or AI enthusiasm cools, today’s optimism could quickly unwind.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SoftBank Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SoftBank Group Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a custom view in just minutes: Do it your way

A great starting point for your SoftBank Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

If SoftBank Group has sharpened your curiosity, do not stop here. Use the Simply Wall Street Screener now to uncover the next wave of opportunities.

- Capture potential market mispricing by reviewing these 912 undervalued stocks based on cash flows that could offer stronger upside than widely followed blue chips.

- Position ahead of the next digital finance wave by scanning these 81 cryptocurrency and blockchain stocks that are building real businesses on blockchain and cryptocurrency infrastructure.

- Secure your income stream by targeting these 15 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals instead of stretching for risky payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026