- Japan

- /

- Wireless Telecom

- /

- TSE:9984

Is There Still Value in SoftBank After Its 82% Rally in 2025?

Reviewed by Bailey Pemberton

- Curious if SoftBank Group is still a bargain after its headline-grabbing gains? Let’s dig into what’s driving the stock and whether there is real value left on the table.

- Despite a recent dip of 1.6% in the last week and a dramatic 38.4% slide over the past month, the stock is still up a staggering 82.2% year-to-date and 89.0% over the last year, keeping long-term holders well ahead.

- Sharp price swings have tracked big headlines. SoftBank’s high-profile tech investments and strategic moves in AI and chip design have commanded market attention, as investors react to both opportunities and perceived risks in its rapidly evolving portfolio.

- SoftBank Group currently scores a 3 out of 6 on our undervaluation checks, so there is plenty to unpack about what those checks mean, how different valuation methods stack up, and why some investors believe there is an even smarter way to judge value. We will walk through all that and more right here.

Approach 1: SoftBank Group Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation approach that estimates a company’s intrinsic value based on its expected future dividends, assuming these dividends will continue to grow at a stable rate indefinitely. This method is especially useful for mature companies with a predictable dividend policy.

For SoftBank Group, the DDM is built on a projected dividend per share (DPS) of ¥46.14, with a modest growth rate capped at 0.6%, based on historical returns on equity and payout ratios. The dividend growth estimate has been capped at 0.60% because of the company's relatively low return on equity of 4.18% and a high payout ratio of 206.37%. These factors highlight potential limits to future dividend growth and raise questions about the long-term sustainability of current payouts.

Using this model, the fair value per share is estimated at ¥1,098.64. However, with significant recent gains in the stock price, the DDM suggests that SoftBank Group shares are trading about 1,431% higher than this intrinsic value. This makes the stock appear extremely overvalued when judged solely by its long-term dividend prospects.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests SoftBank Group may be overvalued by 1431.0%. Discover 925 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoftBank Group Price vs Earnings

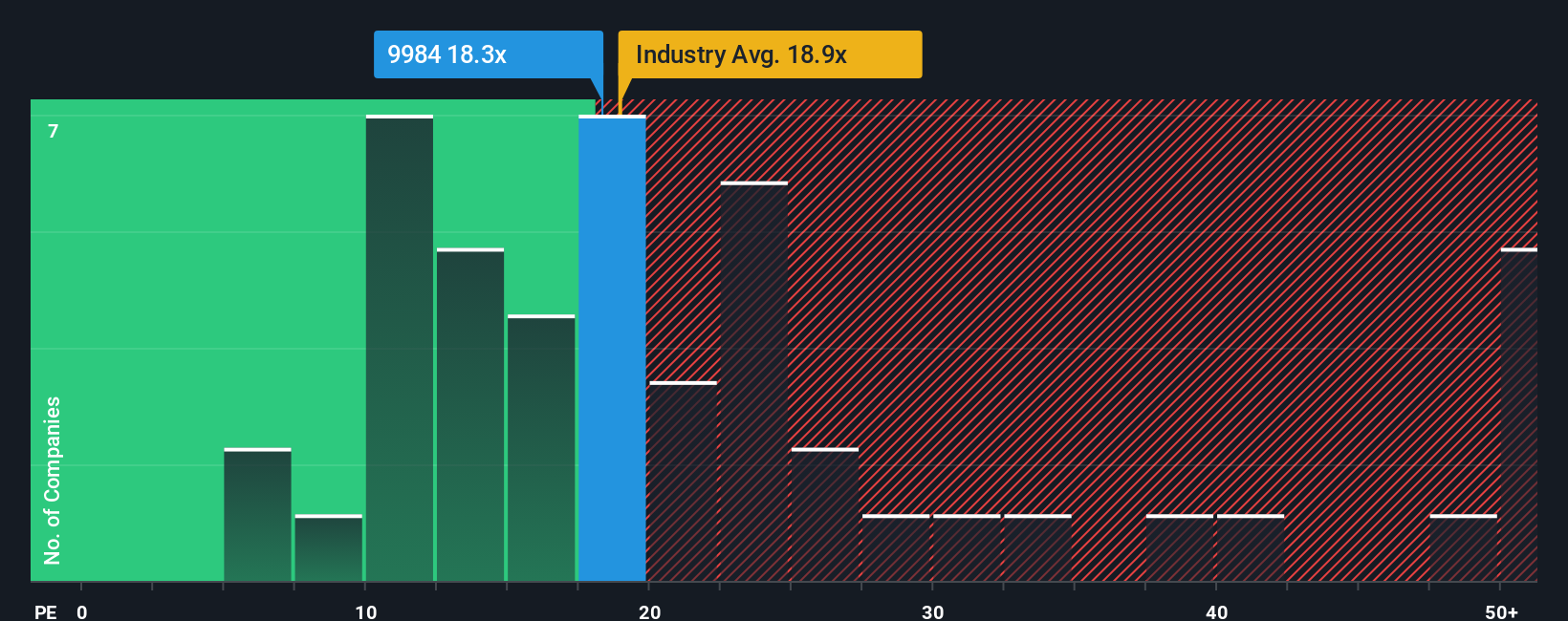

The Price-to-Earnings (PE) ratio is the most widely used valuation multiple for profitable companies, like SoftBank Group, because it relates a company’s stock price to its actual earnings. This ratio helps investors quickly gauge how much they are paying for each unit of earnings, which is especially relevant when the business generates steady profits.

A "normal" or "fair" PE ratio is usually influenced by expectations for future growth and the perceived risks of a company’s operations. Companies with rapid growth prospects or less risk often trade with higher PE ratios, while those facing challenges may warrant lower multiples.

SoftBank Group’s current PE ratio sits at 7.6x, noticeably lower than both the wireless telecom industry average of 18.2x and the peer group average of 16.7x. At first glance, this could signal that SoftBank Group shares are undervalued relative to peers and the broader sector.

However, using the proprietary Simply Wall St “Fair Ratio” adds a more nuanced perspective. The Fair Ratio, at 19.8x, incorporates the company’s growth outlook, risk profile, profitability, industry characteristics, and market capitalization. This tailored calculation offers a more accurate benchmark than blunt peer or industry averages by factoring in specifics like SoftBank’s unique risk and return profile.

Comparing SoftBank Group’s actual PE (7.6x) with its Fair Ratio (19.8x) suggests the stock remains significantly undervalued according to this deeper analysis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoftBank Group Narrative

Earlier we mentioned that there is even a better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful framework where investors tell the story they believe about a company’s future, then link that story to a financial forecast. This covers factors like expected revenues, margins, and fair value. Narratives connect the bigger picture (why you believe SoftBank Group will thrive or struggle) with precise numbers, making it easy to see how your expectations compare to the broader market.

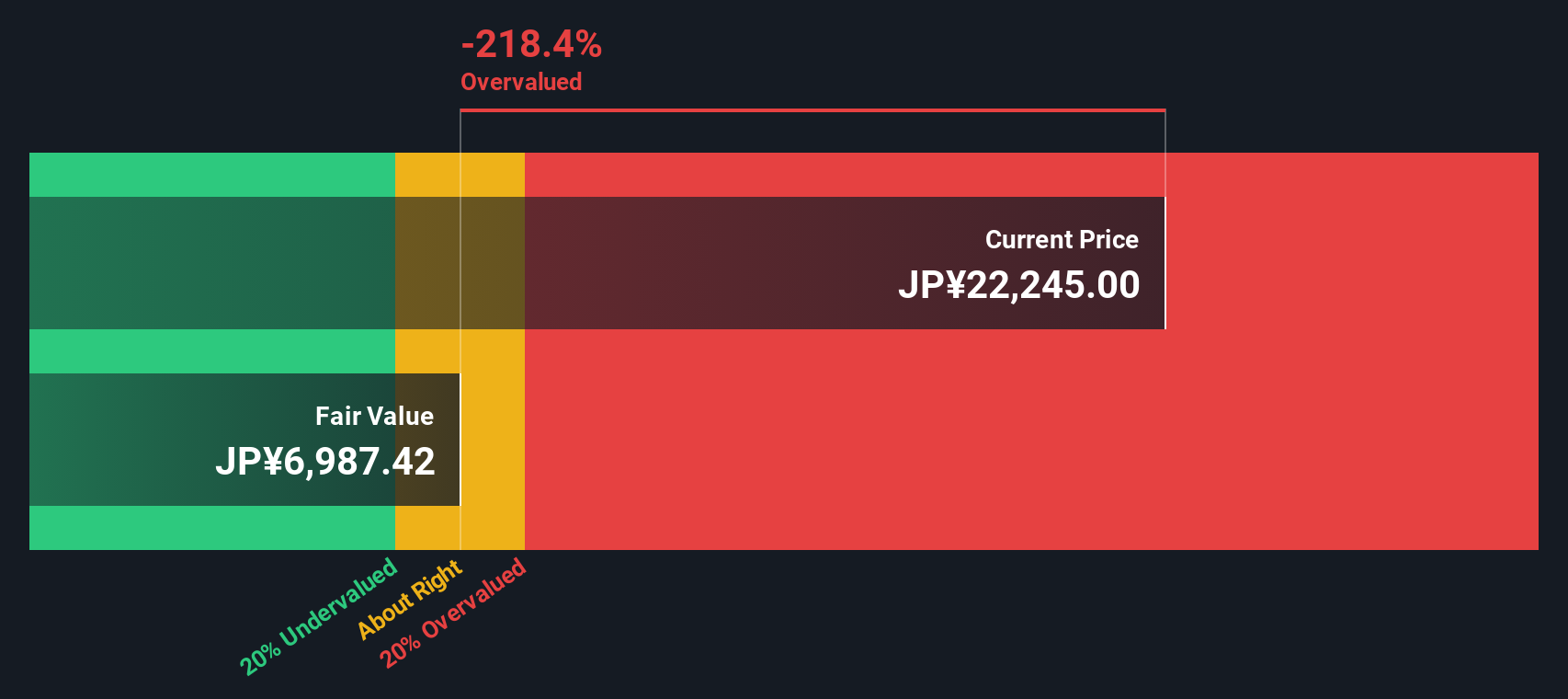

On Simply Wall St’s Community page, millions of investors share and update these Narratives in real-time as new information, such as earnings results or major news, emerges. Narratives help you decide when to buy or sell by comparing your estimated Fair Value with the current market price, letting you act with greater confidence and context. For example, one view on SoftBank Group projects a fair value of ¥22,477, driven by sustained AI and robotics investments, while a more cautious perspective sets fair value as low as ¥9,400, focusing on high leverage and uncertain monetization. Narratives let you clearly see the full range of possibilities and choose a path that fits your own outlook.

Do you think there's more to the story for SoftBank Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.