- Japan

- /

- Wireless Telecom

- /

- TSE:9436

Undiscovered Gems with Promising Potential for January 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of new political developments and economic indicators, major indexes such as the S&P 500 have reached record highs, driven by optimism around trade policies and advancements in artificial intelligence. While large-cap stocks have generally outperformed their smaller counterparts, small-cap companies continue to offer unique opportunities for investors seeking growth potential in a dynamic market landscape. In this context, identifying promising small-cap stocks involves looking for those with strong fundamentals and innovative business models that can thrive amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Alpha Group (SZSE:002292)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group operates as an animation and entertainment company in China and internationally, with a market cap of CN¥14.43 billion.

Operations: Alpha Group generates revenue primarily from its Games & Toys segment, which brought in CN¥2.73 billion.

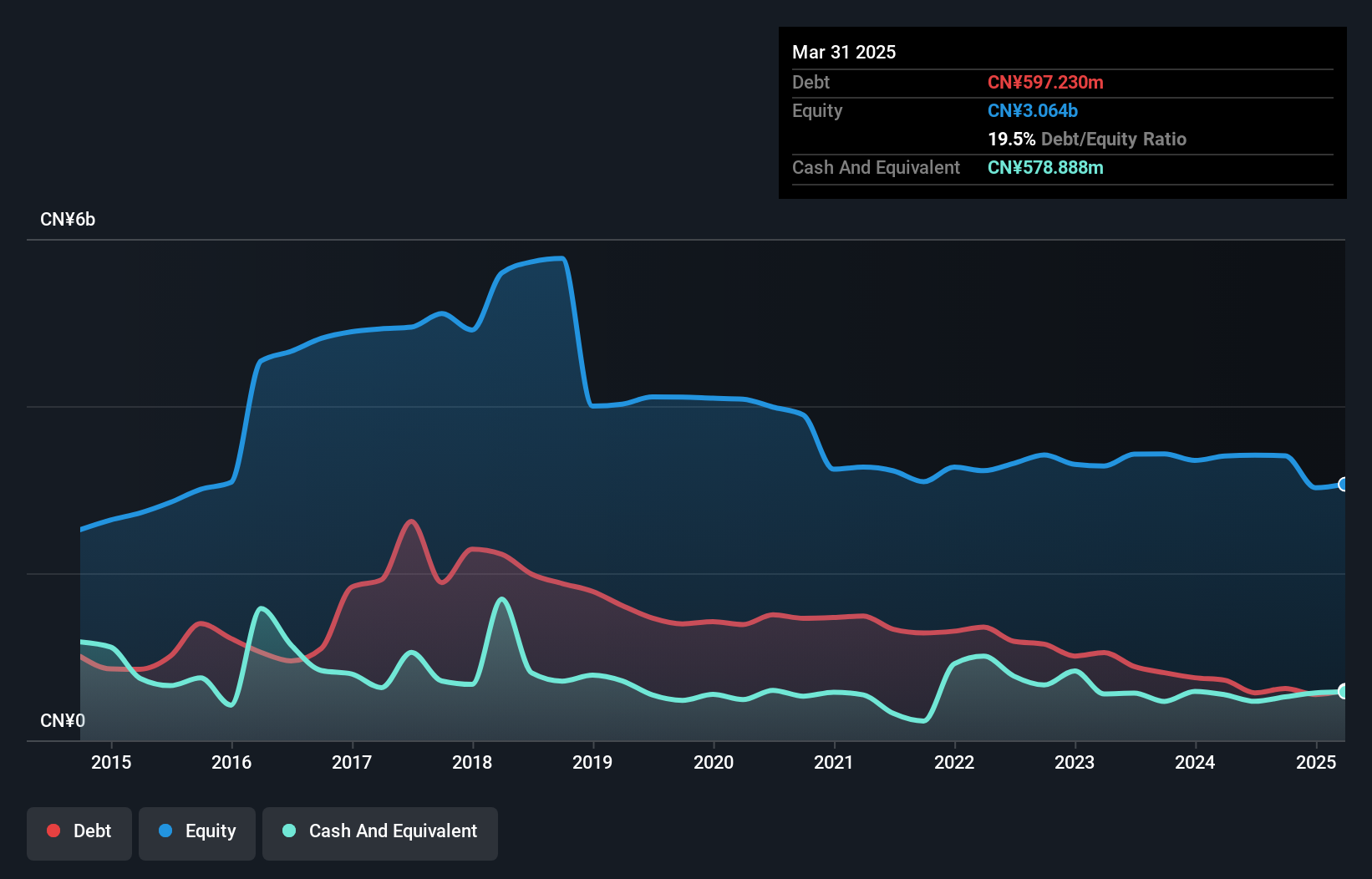

Alpha Group, a smaller player in the market, has recently shown signs of profitability with its debt to equity ratio decreasing from 33.9% to 18.2% over five years, indicating improved financial health. The company's interest payments are well-covered by EBIT at 8.7 times, reflecting strong operational performance despite a volatile share price in recent months. While sales for the first nine months of 2024 were CNY 2 billion compared to last year's CNY 2 billion, net income slightly dipped to CNY 71 million from CNY 81 million previously. This suggests that while challenges persist, Alpha is navigating them with notable resilience and quality earnings.

EM Systems (TSE:4820)

Simply Wall St Value Rating: ★★★★★☆

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan, with a market cap of ¥52.24 billion.

Operations: EM Systems generates revenue primarily from its Dispensing System Business, which accounts for ¥18.94 billion, followed by the Medical System Business at ¥2.39 billion. The company also earns from its Nursing/Welfare System Business with ¥581 million in revenue.

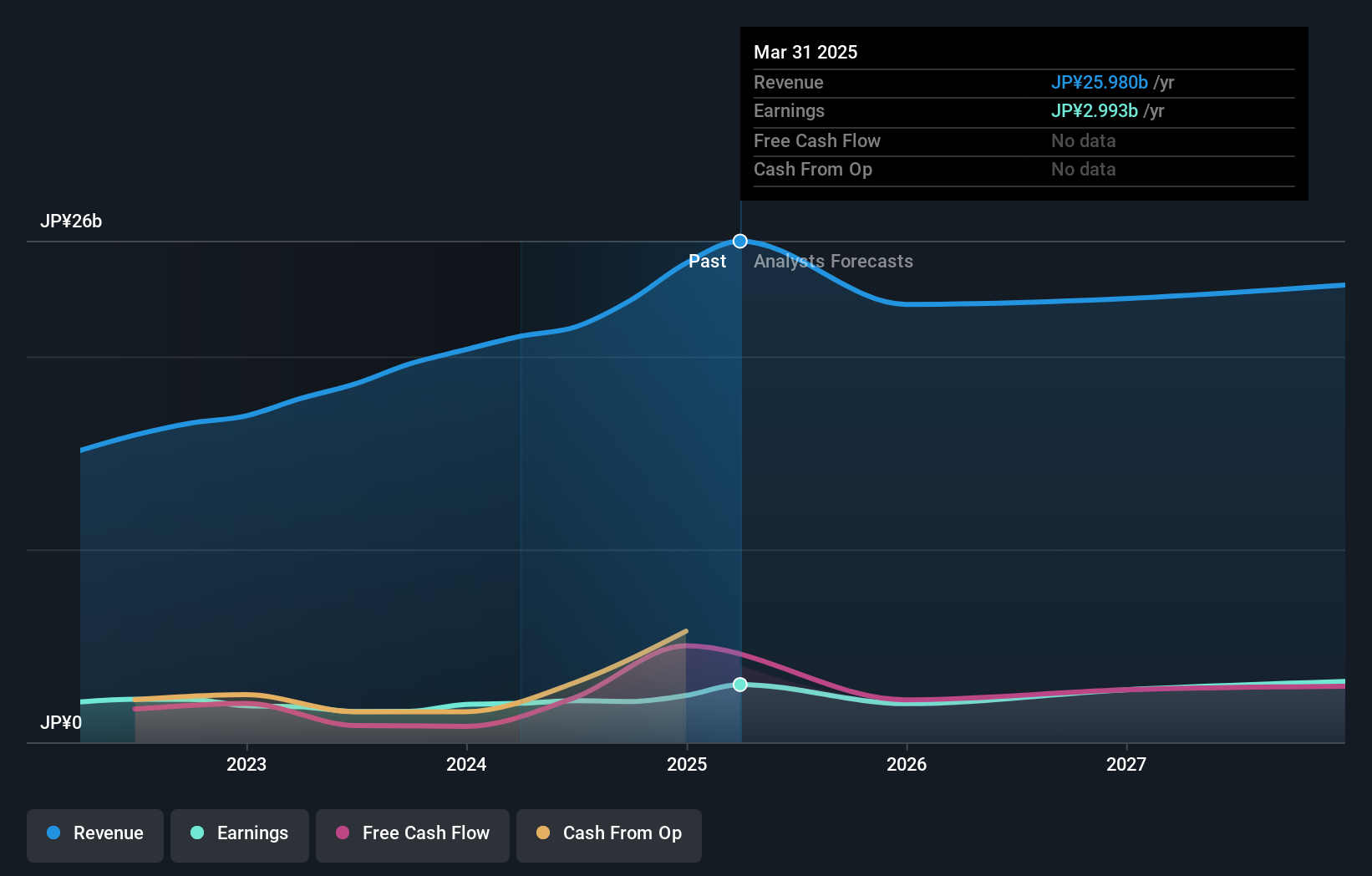

EM Systems, a promising player in the healthcare services sector, has been navigating some financial turbulence. A significant one-off loss of ¥1.4 billion affected its recent performance, yet it continues to show resilience with earnings growth of 31.7% over the past year, outpacing industry peers at 20.4%. The company is trading at a notable discount of 29.6% below its estimated fair value and maintains a healthy balance with more cash than total debt despite an increase in its debt-to-equity ratio from 0.5 to 8.2 over five years. Recently, it completed a share buyback program worth ¥999 million for about 2.28% of shares outstanding, indicating confidence in future prospects despite current volatility concerns.

- Click to explore a detailed breakdown of our findings in EM Systems' health report.

Understand EM Systems' track record by examining our Past report.

Okinawa Cellular Telephone (TSE:9436)

Simply Wall St Value Rating: ★★★★★★

Overview: Okinawa Cellular Telephone Company offers telecommunication and mobile phone services in Japan with a market capitalization of ¥205.12 billion.

Operations: The company generates revenue primarily from its telecommunications business, amounting to ¥81.10 billion. The focus on this segment highlights its significance in the company's overall financial structure.

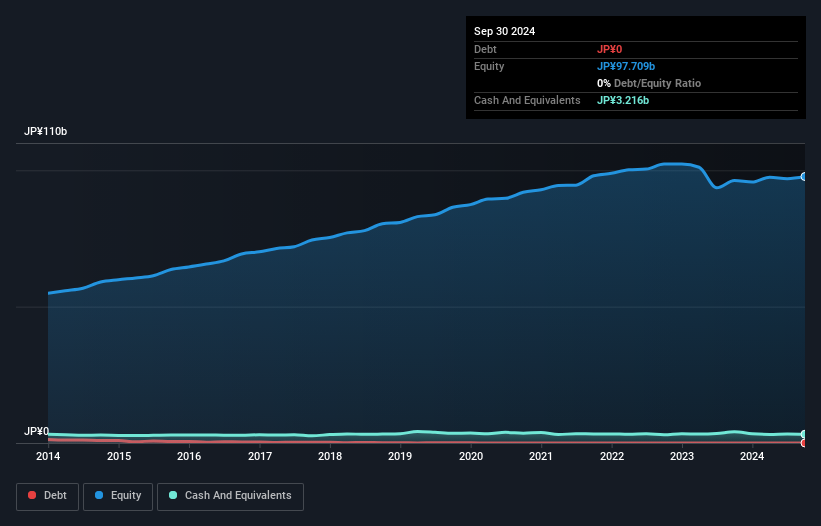

Okinawa Cellular, a nimble player in the telecom sector, stands out with its high-quality earnings and trades at 30.8% below estimated fair value. The company has demonstrated resilience with a 2.4% earnings growth over the past year, surpassing the industry's -10.3%. Notably debt-free for five years, it enjoys strong financial health without interest payment concerns. Recent activities include repurchasing 988,100 shares for ¥3.99 billion, reflecting confidence in its prospects. With positive free cash flow and forecasted annual growth of 2.69%, Okinawa Cellular seems poised to maintain its competitive edge in challenging market conditions.

Next Steps

- Delve into our full catalog of 4670 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9436

Okinawa Cellular Telephone

Provides telecommunication and mobile phone services in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives