- Japan

- /

- Wireless Telecom

- /

- TSE:9434

SoftBank (TSE:9434): Evaluating Valuation as Shares Retrace Despite Steady Revenue Growth

Reviewed by Kshitija Bhandaru

See our latest analysis for SoftBank.

Despite some recent choppiness, SoftBank’s momentum over the past year has been positive, with a total shareholder return of roughly 15%. This suggests investors see growth potential, even as price swings reflect shifting market sentiment and headline events.

If SoftBank’s latest moves have you thinking about where the next growth story might come from, it could be an ideal moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares now trading at a discount to analyst targets, the key question is whether SoftBank is truly undervalued right now or if the market has already priced in expectations for further growth ahead.

Most Popular Narrative: 8.8% Undervalued

SoftBank’s most widely followed narrative places its fair value nearly 9% above the last closing price. This suggests notable upside based on forward growth expectations. This projection depends on big bets in technology and digital infrastructure that could reshape the business trajectory.

Integration of AI solutions (e.g., contact center agentic AI) into financial services partnerships with firms like Sumitomo Mitsui Card and PayPay creates new monetization channels. This further increases transaction volume and cross-selling opportunities, supporting top-line revenue and net income growth.

Curious what bold financial moves and future breakdowns underlie such optimism? The narrative teases a blend of tech-driven expansion and aggressive margin forecasts, with key details that could surprise even seasoned investors. Craving the quantitative playbook or the insider logic behind these numbers? Only the full narrative reveals the specific assumptions powering this valuation.

Result: Fair Value of ¥234.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing price competition in Japan and surging operational costs could quickly challenge these optimistic projections if profitability or market share declines.

Find out about the key risks to this SoftBank narrative.

Another View: Multiples Signal a Premium Price

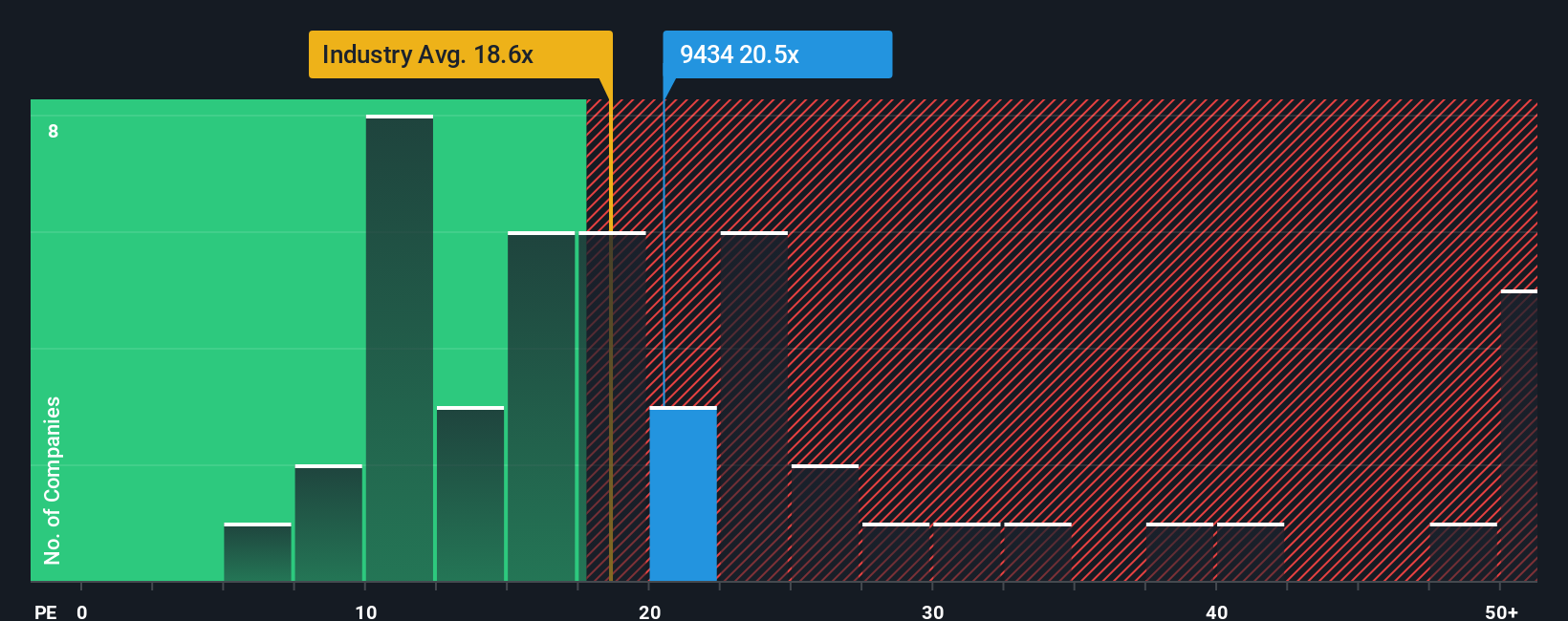

While analysts see SoftBank as undervalued on growth prospects, a look at its price-to-earnings ratio tells a different story. At 20.4x, SoftBank trades higher than both its industry average (18.6x) and peers (15.5x), and just above its estimated fair ratio of 20x. This suggests investors are already paying up for expected growth, which increases valuation risk if results disappoint. Does this premium reflect true potential, or could markets pull back if targets aren’t met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoftBank Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own SoftBank story in just a few minutes: Do it your way.

A great starting point for your SoftBank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by targeting fresh opportunities outside your comfort zone. These handpicked strategies can connect you with strong momentum and untapped growth themes before others spot them.

- Boost your income with stocks offering generous yields by checking out these 19 dividend stocks with yields > 3%.

- Tap into fast-growing trends in healthcare using advanced technology with these 31 healthcare AI stocks.

- Position yourself for potential upside by targeting overlooked bargains among these 901 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives