- Japan

- /

- Wireless Telecom

- /

- TSE:9434

Examining The Valuation of SoftBank's Stock After Investor Debate

Reviewed by Bailey Pemberton

If you’ve been thinking about whether to stick with SoftBank or add it to your portfolio, you’re definitely not alone. With a storied reputation for bold bets and big swings, SoftBank’s stock has just as many admirers as skeptics. The numbers tell quite a story: over the past year, the stock has gained an impressive 18.8%, and if you zoom out further, the five-year return stands tall at 128.9%. But lately, there have been some headwinds. The stock dipped 6.1% in the past month and is barely down for the week, despite clocking in a solid 9.9% return over the year to date. These short-term bumps have coincided with global tech sector shifts and lingering uncertainties around macroeconomic policy, and they might have some investors rethinking how much risk they want to take on.

Looking at valuation, SoftBank currently lands a score of 1 by our metrics, meaning it is considered undervalued in just one out of six key checks. That alone might not make it a screaming buy, but valuation is never a one-size-fits-all situation. So, how exactly are we breaking down these numbers? Is there a smarter way to decide what the stock is really worth? Let’s dive into the methods analysts use to judge value, with an eye toward a more nuanced approach that investors will want to consider.

SoftBank scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown .

Approach 1: SoftBank Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model helps estimate a company’s true value by projecting its future cash flows and then discounting them back to today’s terms. This approach is especially helpful for investors who want a long-term outlook on a business’s earning power.

SoftBank’s current Free Cash Flow stands at ¥629.3 billion. Analysts have estimated free cash flow data for the next five years, with projections ranging from ¥582.7 billion in 2026 up to ¥709.9 billion in 2029. Looking further ahead, projections, which rely on Simply Wall St’s extrapolations after 2029, suggest FCF could be about ¥540.2 billion by the year ending March 2030. All these figures are based on the 2 Stage Free Cash Flow to Equity model and represent substantial, ongoing cash generation.

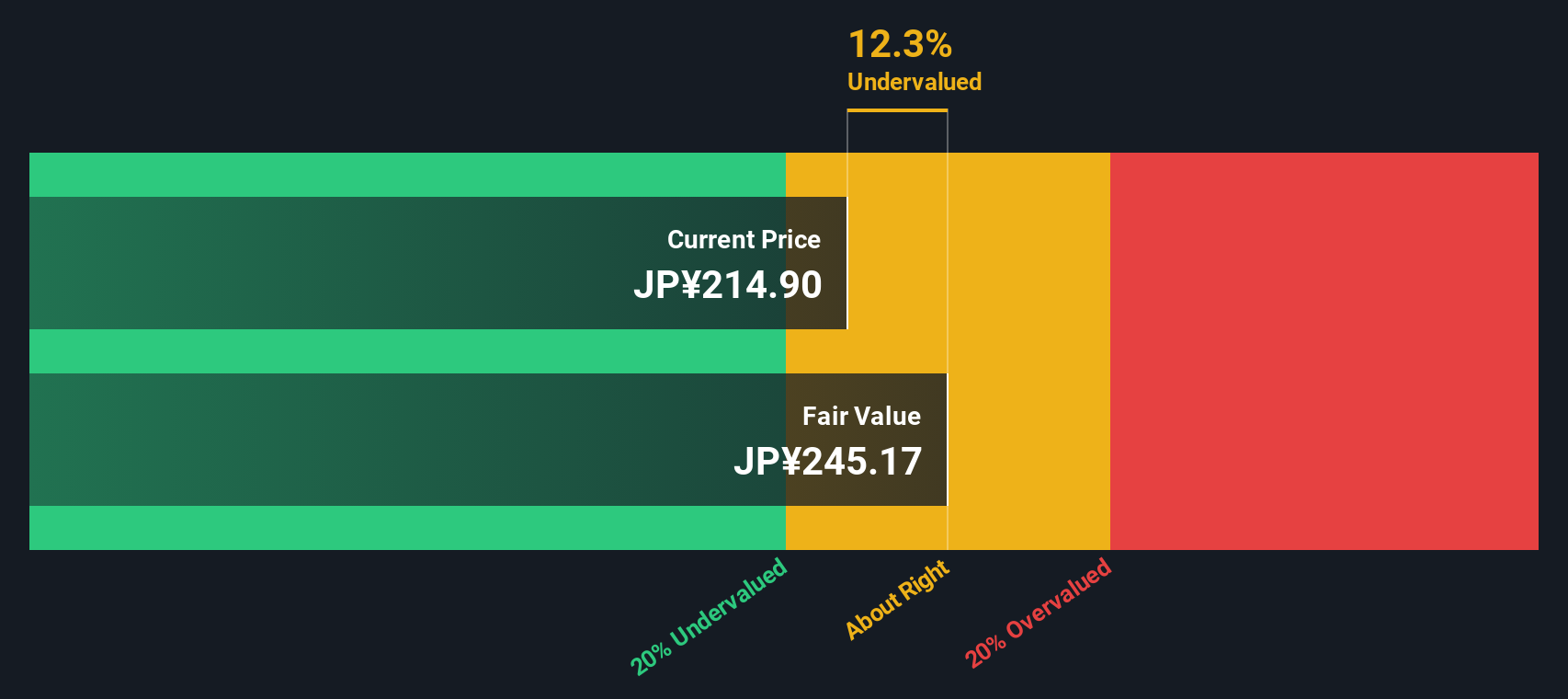

Using this method, the DCF model calculates SoftBank’s intrinsic value at ¥245.17 per share. With the current share price trading 12.0% below this fair value estimate, the DCF model indicates that SoftBank is undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SoftBank is undervalued by 12.0%. Track this in your watchlist or portfolio , or discover more undervalued stocks .

Approach 2: SoftBank Price vs Earnings (PE)

For profitable companies like SoftBank, the price-to-earnings (PE) ratio is a widely trusted valuation metric. It essentially shows how much investors are willing to pay for every ¥1 of the company’s earnings, making it a straightforward way to gauge if the stock is priced reasonably in light of its profitability.

The “right” PE ratio is not set in stone. Growth prospects, potential risks, profit margins, and overall market sentiment all play a part in determining what’s fair. Companies expected to grow faster or operate with less risk typically command higher PE ratios, while riskier or slower-growth businesses usually trade at lower multiples.

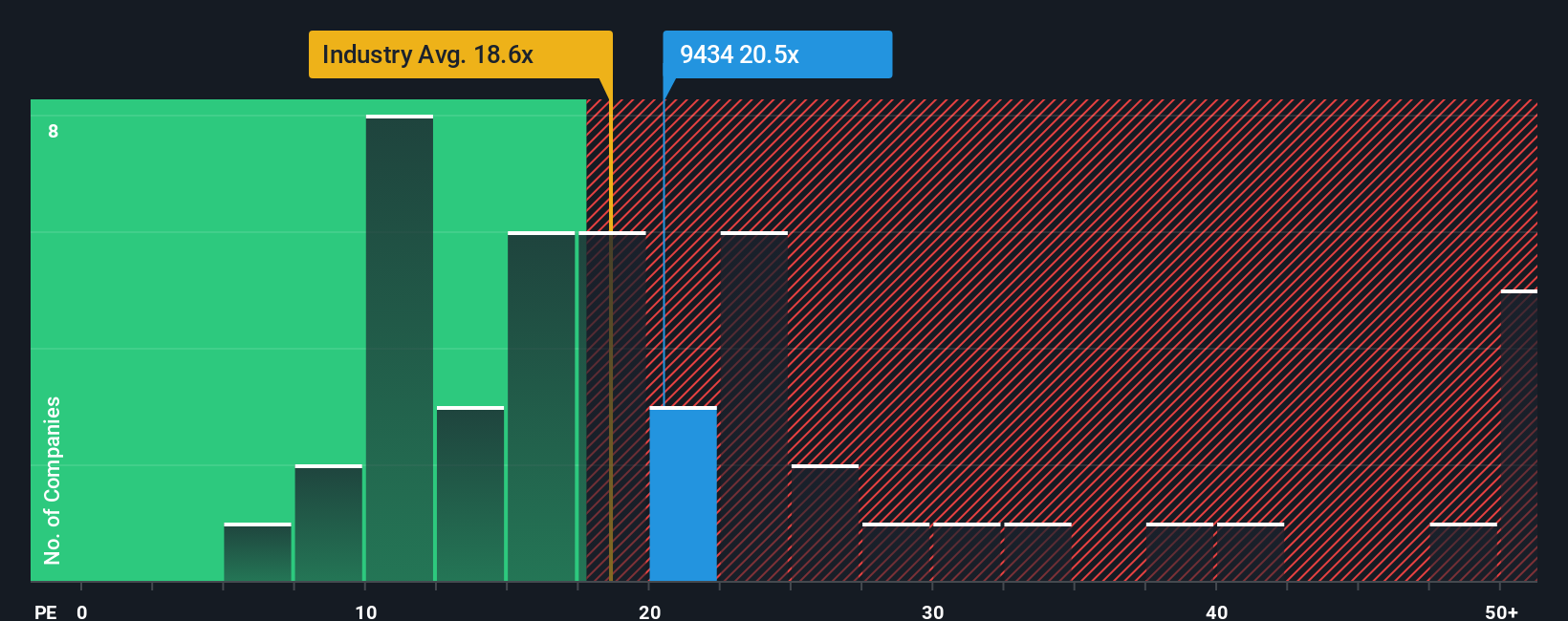

SoftBank is currently trading at a PE ratio of 20.5x. This stands above both the industry average of 18.1x and the peer average of 16.3x, signaling a market premium. However, averages can miss important context. That is where Simply Wall St’s “Fair Ratio” comes in. Unlike a simple comparison with peers or the industry, the Fair Ratio (20.0x for SoftBank) is calculated by factoring in specifics like the company’s growth rate, profit margins, its place in the industry, company size, and unique risks.

This tailored approach offers investors a more nuanced baseline, especially when companies differ in key ways from their competitors. In SoftBank’s case, the stock’s current PE ratio is extremely close to its Fair Ratio, suggesting the market is pricing it quite appropriately at the moment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth .

Upgrade Your Decision Making: Choose your SoftBank Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple but powerful way for you to frame your view of a company by connecting its business story, such as new technologies, market shifts, or potential risks, to a realistic financial forecast and resulting fair value. Instead of just relying on stock metrics, Narratives allow investors to create and share their unique perspective on SoftBank’s future by outlining their assumptions for revenue growth, margins, and profitability, and seeing how these feed directly into their own fair value estimate.

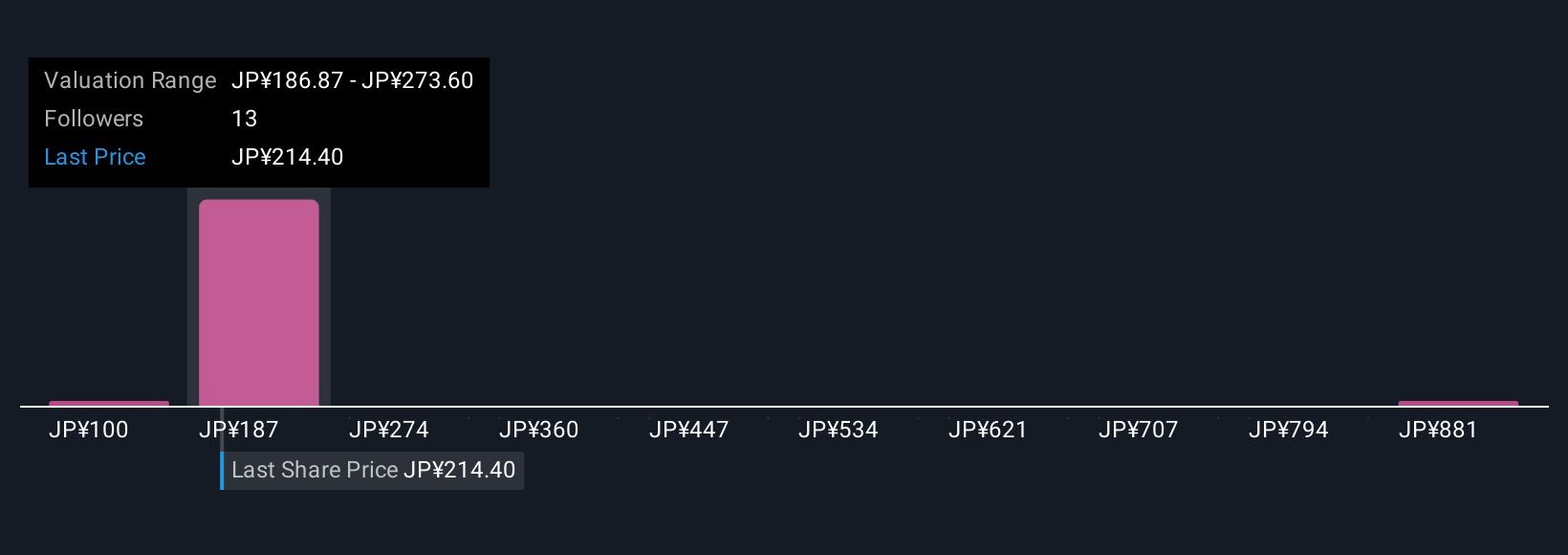

On Simply Wall St’s Community page, millions of investors use Narratives to guide decisions about buying or selling, easily comparing their personalized fair value with the current price. Narratives update automatically as new earnings or news breaks, ensuring your view evolves with the business. For example, some investors are optimistic, projecting a price target as high as ¥270 if AI and fintech successes accelerate. Others take a more cautious stance with targets as low as ¥200 due to competitive and cost pressures. Narratives make it easy for you to see which scenario fits your beliefs and to track how new developments could impact your outlook.

Do you think there's more to the story for SoftBank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives