- Japan

- /

- Telecom Services and Carriers

- /

- TSE:3843

Market Might Still Lack Some Conviction On FreeBit Co., Ltd. (TSE:3843) Even After 26% Share Price Boost

FreeBit Co., Ltd. (TSE:3843) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 44%.

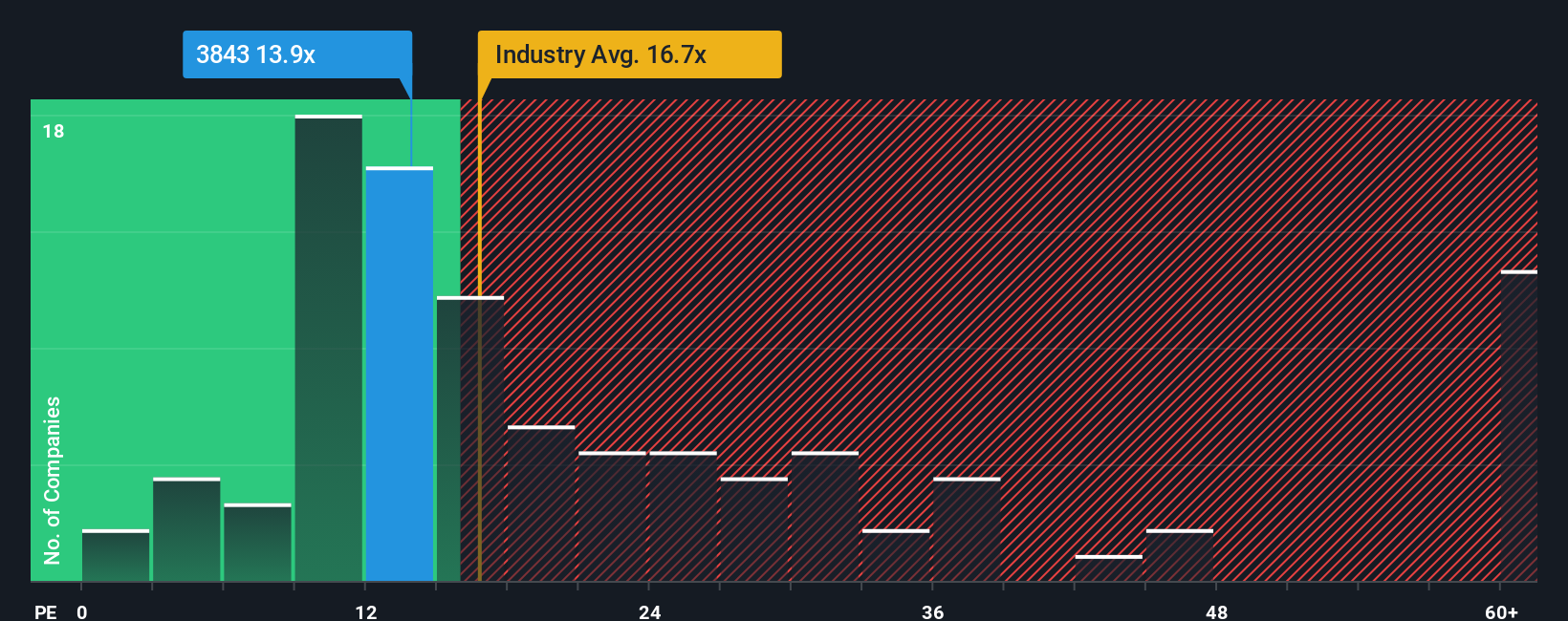

In spite of the firm bounce in price, it's still not a stretch to say that FreeBit's price-to-earnings (or "P/E") ratio of 13.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

FreeBit could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for FreeBit

Is There Some Growth For FreeBit?

The only time you'd be comfortable seeing a P/E like FreeBit's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 202% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 12% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 9.5% per year, which is noticeably less attractive.

With this information, we find it interesting that FreeBit is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On FreeBit's P/E

FreeBit's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that FreeBit currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for FreeBit with six simple checks on some of these key factors.

If you're unsure about the strength of FreeBit's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3843

FreeBit

Operates as a supporting Internet business, and broadband business company.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.