- South Korea

- /

- Transportation

- /

- KOSE:A403550

Growth Companies Insiders Are Backing In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration and fluctuating interest rate expectations, investors are keenly observing sectors poised for growth amidst policy shifts. In this environment, companies with high insider ownership often signal confidence from those who know the business best, making them intriguing prospects for growth-oriented portfolios.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| Medley (TSE:4480) | 34% | 31.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

SOCAR (KOSE:A403550)

Simply Wall St Growth Rating: ★★★★☆☆

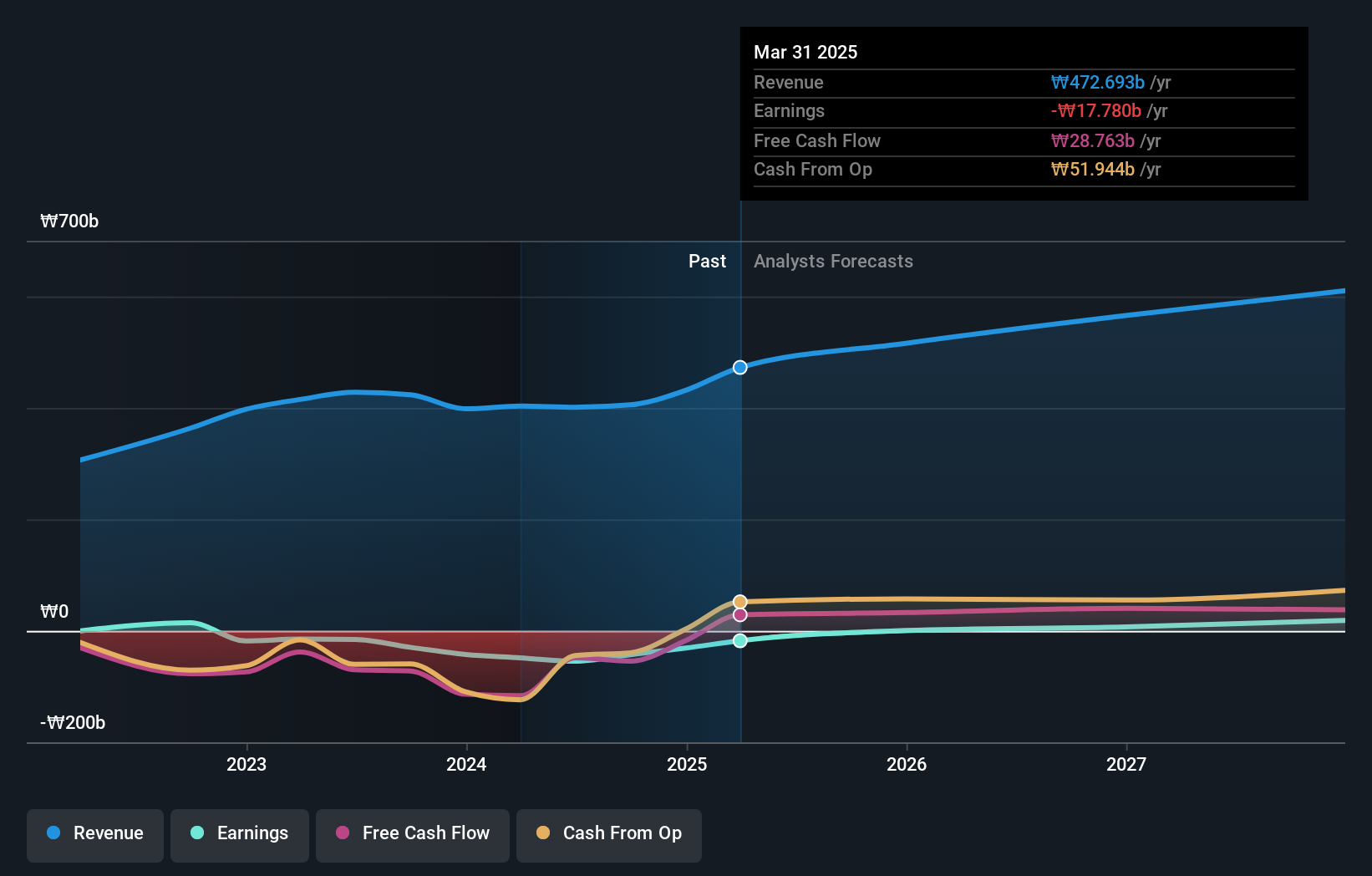

Overview: SOCAR Inc. is a mobility company based in South Korea with a market capitalization of approximately ₩573.93 billion.

Operations: The company's revenue segments include Car Sharing at ₩372.90 billion, Micro Mobility at ₩22.03 billion, and Platform Parking Service at ₩7.80 billion.

Insider Ownership: 13.7%

SOCAR's revenue is forecast to grow at 18% annually, outpacing the KR market's 9.8%. Despite trading at 88.2% below its estimated fair value, it has a limited cash runway of less than one year. Earnings are expected to grow significantly at over 100% per year, with profitability anticipated within three years. Analysts agree on a potential stock price increase of over 50%, although return on equity remains low at an estimated future rate of 7.1%.

- Take a closer look at SOCAR's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that SOCAR is priced lower than what may be justified by its financials.

Soracom (TSE:147A)

Simply Wall St Growth Rating: ★★★★★☆

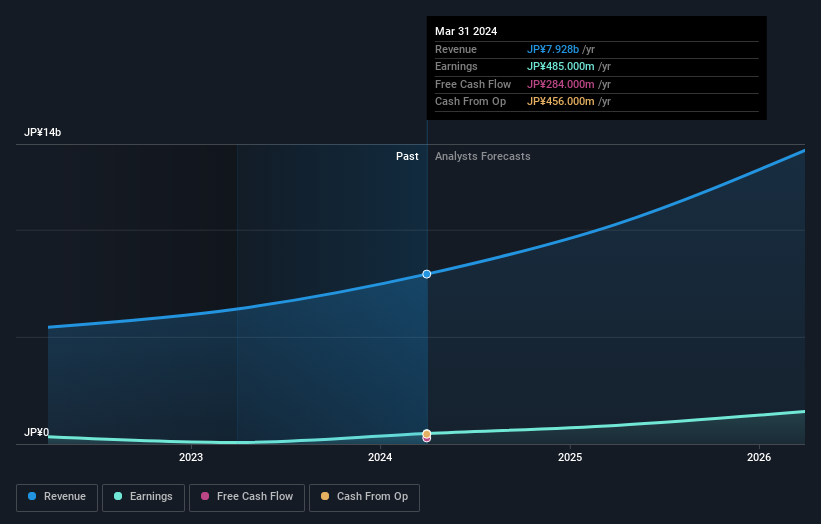

Overview: Soracom, Inc. offers Internet of Things (IoT) based cellular connectivity solutions and has a market capitalization of ¥46.93 billion.

Operations: The company's revenue is primarily generated from its IoT Platform segment, which amounts to ¥7.93 billion.

Insider Ownership: 16.5%

Soracom's earnings are projected to grow significantly at 48% annually, surpassing the JP market's 8% growth rate. Revenue is also expected to increase by 26.1% per year, well above the market average of 4.2%. Despite recent share price volatility and limited insider trading information, Soracom has shown substantial profit growth of over 500% in the past year. The company reports high non-cash earnings quality but lacks data on future return on equity forecasts.

- Navigate through the intricacies of Soracom with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Soracom shares in the market.

Komehyo HoldingsLtd (TSE:2780)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Komehyo Holdings Co., Ltd. operates in Japan, focusing on the purchase and sale of used and new products through its retail stores, with a market capitalization of ¥38.69 billion.

Operations: The company generates revenue through the purchase and sale of both pre-owned and new merchandise via its retail outlets across Japan.

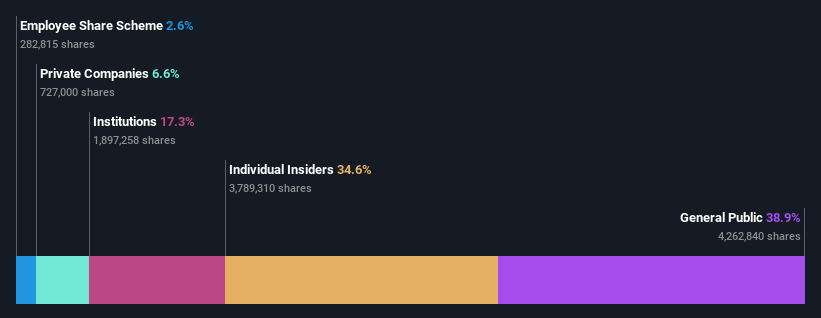

Insider Ownership: 32.9%

Komehyo Holdings Ltd. is expected to see significant earnings growth of 22.8% annually, outpacing the JP market's 8%. Revenue is forecast to grow at 16.7% per year, also above market averages. Despite trading at a substantial discount to its estimated fair value and good relative value compared to peers, the company faces challenges with a volatile share price and dividends not fully covered by free cash flows. Limited insider trading activity has been observed recently.

- Click here to discover the nuances of Komehyo HoldingsLtd with our detailed analytical future growth report.

- Our valuation report here indicates Komehyo HoldingsLtd may be undervalued.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1546 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A403550

Good value with reasonable growth potential.

Market Insights

Community Narratives