- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8084

3 Reliable Dividend Stocks To Consider With Up To 4.2% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, investors continue to seek stability amid uncertainty. In this environment, dividend stocks offer a potential source of reliable income, providing investors with regular payouts that can help buffer against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

Click here to see the full list of 1941 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

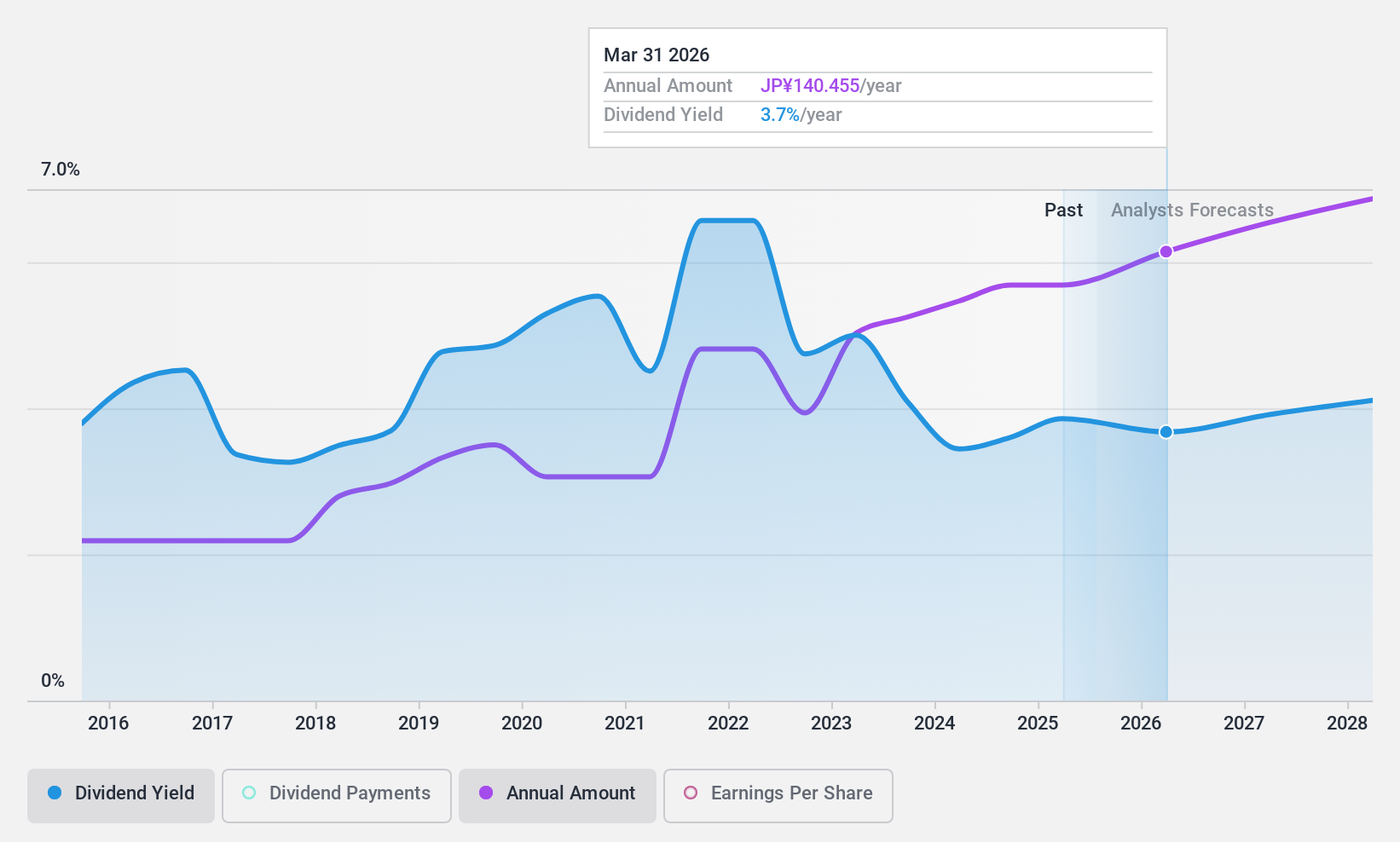

Sumitomo (TSE:8053)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Corporation operates as a general trading company with a market capitalization of approximately ¥4.15 trillion.

Operations: Sumitomo Corporation's revenue is primarily derived from its Steel segment at ¥1.66 billion, Media & Digital segment at ¥508.61 million, and Transportation & Construction Systems segment at ¥1.43 billion.

Dividend Yield: 3.8%

Sumitomo Corporation's dividend payments are well covered by earnings and cash flow, with payout ratios of 43.7% and 44.2%, respectively, indicating sustainability despite a volatile dividend history over the past decade. The stock trades at a discount to its estimated fair value, offering potential value for investors. Recent strategic partnerships, including ventures in IT services and industrial park expansion, could support future growth prospects but do not directly impact its current dividend reliability or yield standing in Japan's top quartile.

- Click here and access our complete dividend analysis report to understand the dynamics of Sumitomo.

- The valuation report we've compiled suggests that Sumitomo's current price could be quite moderate.

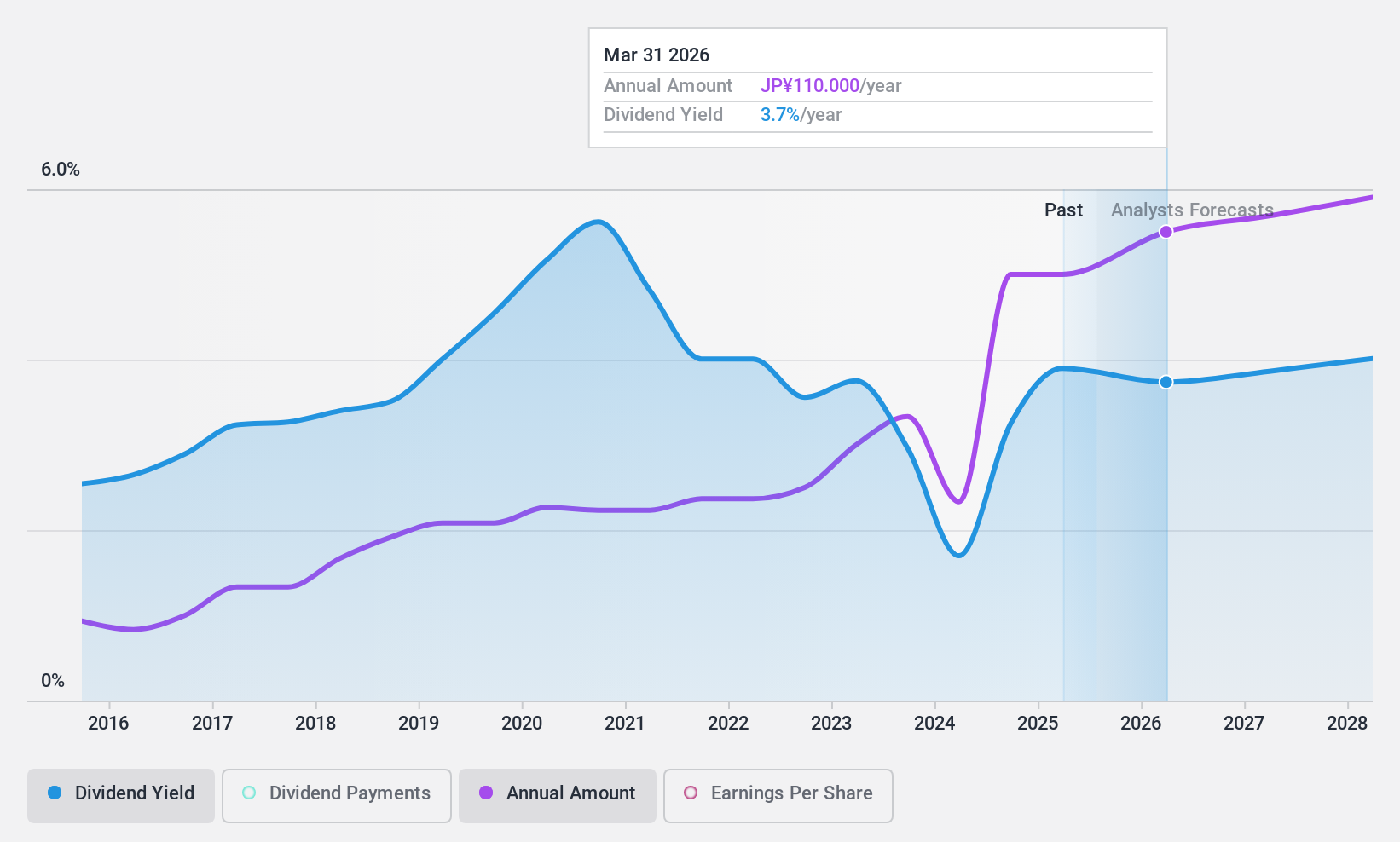

Mitsubishi (TSE:8058)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Corporation operates globally across various sectors including natural gas, industrial materials, infrastructure, chemicals, mineral resources, automotive and mobility, food and consumer industries, power solutions, and urban development with a market cap of ¥10.35 trillion.

Operations: Mitsubishi Corporation's revenue segments include Food Industry (¥2.36 billion), Power Solution (¥1.38 billion), Mineral Resources (¥3.27 billion), Materials Solution (¥2.39 billion), Smart-Life Creation (¥3.53 billion), and Environmental Energy (¥1.14 billion).

Dividend Yield: 3.8%

Mitsubishi's dividends are well supported by earnings and cash flows, with payout ratios of 31.2% and 36.1%, respectively, though the dividend history has been volatile over the past decade. The stock trades at a significant discount to its estimated fair value, presenting potential value for investors. Recent strategic partnerships in the Philippines may bolster future growth but do not immediately affect dividend stability or its yield ranking among Japan's top quartile payers.

- Unlock comprehensive insights into our analysis of Mitsubishi stock in this dividend report.

- Our valuation report here indicates Mitsubishi may be undervalued.

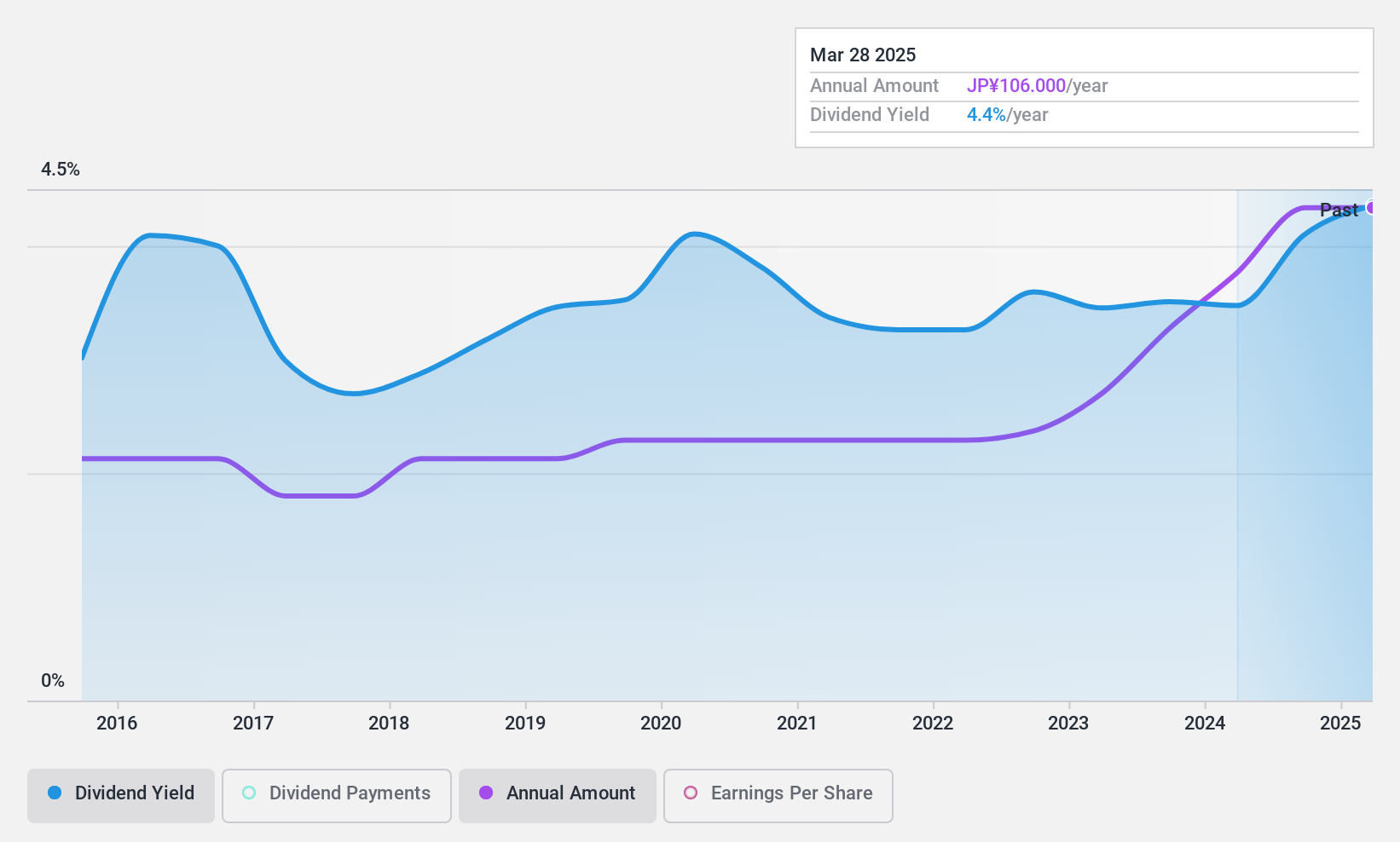

Ryoden (TSE:8084)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ryoden Corporation operates in the sale of factory automation systems, cooling and heating systems, information and communication technologies, facilities systems, and electronics both in Japan and internationally, with a market cap of ¥54.10 billion.

Operations: Ryoden Corporation's revenue is derived from the following segments: Electronics at ¥149.31 billion, Factory Automation Systems at ¥49.93 billion, and X - Tech at ¥7.51 billion.

Dividend Yield: 4.3%

Ryoden's dividend payments, while covered by earnings and cash flows with payout ratios of 51.8% and 25.1%, have been volatile over the past decade, impacting reliability. Despite this instability, dividends have grown over ten years and currently yield 4.3%, ranking in Japan's top quartile. The stock trades significantly below its estimated fair value but faces challenges from revised earnings guidance due to delayed recovery in FA systems and economic weakness in China.

- Navigate through the intricacies of Ryoden with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ryoden's shares may be trading at a discount.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1941 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8084

Ryoden

Sells factory automation (FA) systems, cooling and heating systems, information and communication technologies (ICT) and facilities systems, and electronics in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives