- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Citizen Watch (TSE:7762) Is Up 15.1% After Profits Surge and Earnings Forecast Raised—What's Changed

Reviewed by Sasha Jovanovic

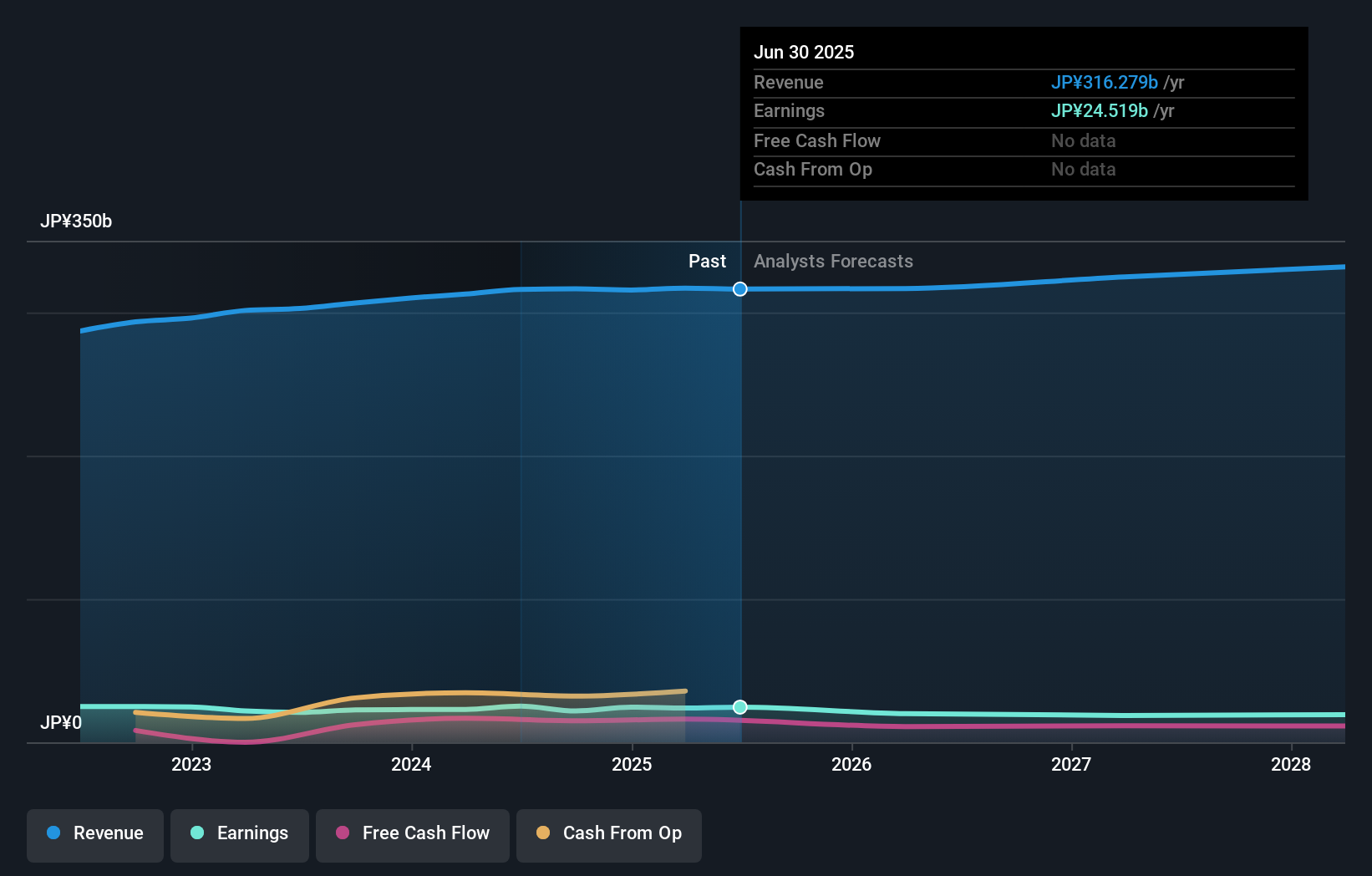

- Earlier this month, Citizen Watch reported a 1.7% increase in net sales and a notable 32.0% rise in ordinary profit for the six months ending September 30, 2025, and revised its full-year earnings forecast upward while announcing a dividend increase.

- Sales growth was led by strong performance in North America and higher unit selling prices, alongside improved profitability in its e-commerce business.

- We'll examine how Citizen Watch's improved profitability and raised forecast may influence its broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Citizen Watch's Investment Narrative?

For anyone considering Citizen Watch as a shareholder, the core belief centers on the company’s ability to improve profitability in a globally competitive watch industry, bolstered by its brand, pricing, and expanding e-commerce reach. The recent jump in ordinary profit, upward revision to earnings forecasts, and dividend growth reflect operational progress that could shift sentiment on previously key short-term catalysts like earnings momentum and market share gains, particularly after a period of muted revenue growth and forecasts of declining earnings. While the robust performance in North America and rising unit prices strengthen near-term prospects, the removal from the Nikkei 225 and historical concerns over sustainable profit growth remain present. The news is likely material as it temporarily alleviates downward pressure on forecasts, but it doesn’t fully resolve questions about longer-term earnings direction or the risk of slow sales growth as seen in previous analyst projections. Investors need to know how these dynamics could evolve with continued execution, especially if recent operational gains prove durable.

But with the Nikkei 225 exit and earnings trajectory still in question, there’s more to consider. Citizen Watch's shares are on the way up, but they could be overextended by 47%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Citizen Watch - why the stock might be a potential multi-bagger!

Build Your Own Citizen Watch Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citizen Watch research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Citizen Watch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citizen Watch's overall financial health at a glance.

No Opportunity In Citizen Watch?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives