- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Citizen Watch (TSE:7762): Evaluating Valuation Following Removal from Nikkei 225 Index

Reviewed by Kshitija Bhandaru

Citizen Watch (TSE:7762) is in focus after its removal from the Nikkei 225 Index. This event puts the stock under the microscope as index-based funds adjust their portfolios and market attention shifts.

See our latest analysis for Citizen Watch.

Citizen Watch's removal from the Nikkei 225 comes on the heels of a steady, if unspectacular, run, with the stock's 1-year total shareholder return up just 0.16%. In recent weeks, momentum has faded as market attention recalibrates, despite its long-term total shareholder returns painting a more robust picture.

If times of change make you curious about what stands out elsewhere, consider widening your lens and discovering fast growing stocks with high insider ownership

With mixed signals from recent returns and questions about the company’s future trajectory, it is worth asking whether Citizen Watch is currently undervalued and represents a buying opportunity, or if the market has already priced in all expected growth.

Price-to-Earnings of 10.3x: Is it justified?

Citizen Watch’s shares currently trade at a price-to-earnings (P/E) ratio of 10.3x, noticeably below both peer and industry averages and well under the broader Japanese market. This low P/E suggests the market is placing a moderate value on the company's future earnings, even after a recent period of steady, if unspectacular, results.

The price-to-earnings ratio reflects how much investors are willing to pay per yen of reported annual profit. It serves as a quick gauge of whether a stock might be cheap or expensive compared to its fundamentals. For Citizen Watch, this is especially meaningful, as its recent earnings growth has slowed, possibly tempering investor enthusiasm and keeping the multiple in check.

Compared to the JP Electronic industry average of 14.2x and the peer average of 19.8x, Citizen Watch looks attractively valued on this basis. The company is also trading under its estimated fair price-to-earnings ratio of 12.2x, a level the market could move toward if confidence returns and earnings stabilize or improve.

Explore the SWS fair ratio for Citizen Watch

Result: Price-to-Earnings of 10.3x (UNDERVALUED)

However, slowing annual revenue growth and a recent dip in net income highlight lingering performance risks that could weigh on further investor optimism.

Find out about the key risks to this Citizen Watch narrative.

Another View: Discounted Cash Flow Says Something Different

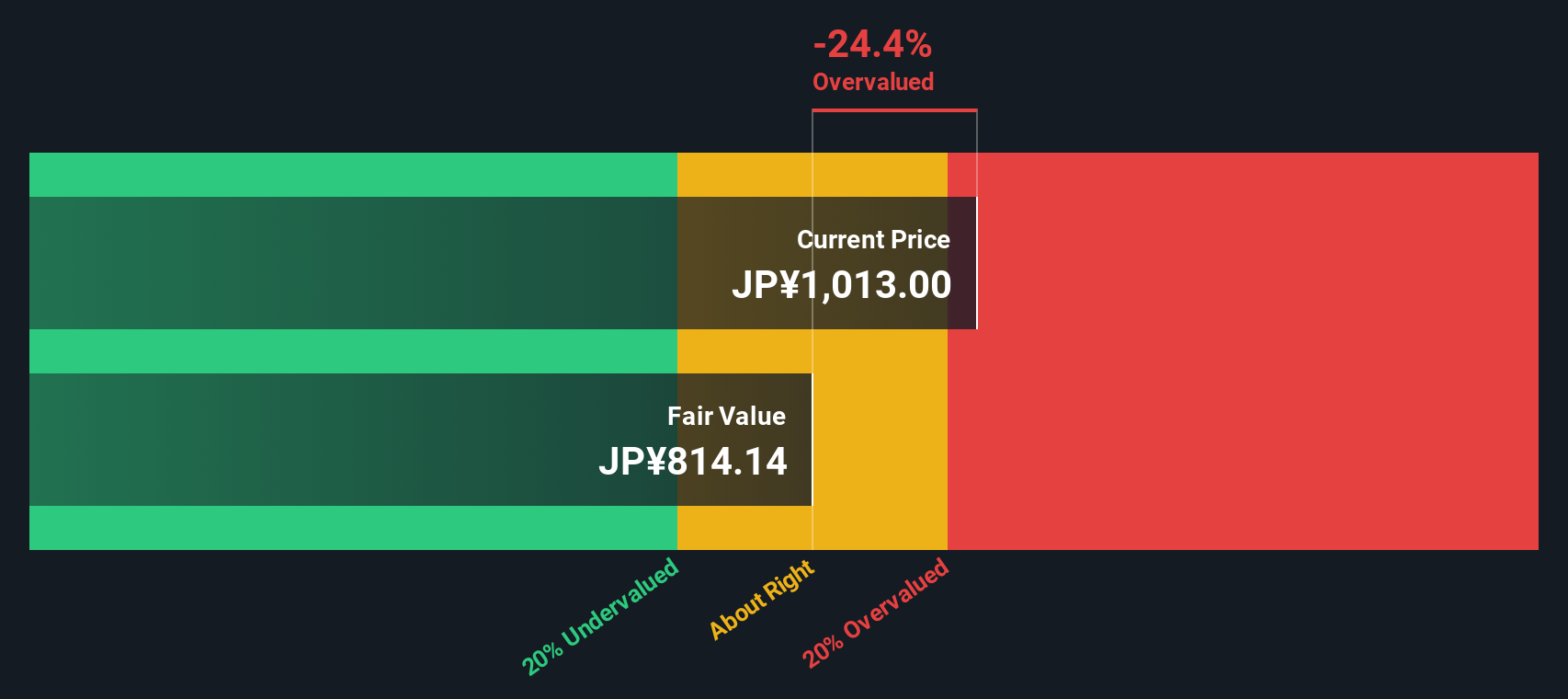

While Citizen Watch appears undervalued when looking at its earnings multiple, our DCF model tells a more cautious story. According to this method, the shares are trading around ¥1039, notably above the estimated fair value of ¥808, making the stock look overvalued by DCF standards. So which view holds more weight for investors: market sentiment, or cash flow fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Citizen Watch for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Citizen Watch Narrative

If you see things differently or want to dig deeper into the numbers yourself, it only takes a few minutes to create your own view. Why not Do it your way?

A great starting point for your Citizen Watch research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great opportunities await beyond Citizen Watch, and you do not want to miss out. Use the Simply Wall Street Screener for your next smart move.

- Supercharge your portfolio with growth by targeting these 904 undervalued stocks based on cash flows, where real value meets future potential before the crowd catches on.

- Capture steady income with ease by tapping into these 19 dividend stocks with yields > 3%, built for those aiming to maximize yield with reliable, high-paying stocks.

- Put yourself at the forefront of innovation when you check out these 78 cryptocurrency and blockchain stocks, tracking the most promising blockchain and crypto-focused companies riding the wave of digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion