- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Citizen Watch (TSE:7762): Assessing Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

Price-to-Earnings of 10.2x: Is it justified?

Citizen Watch is currently trading at a Price-To-Earnings (P/E) ratio of 10.2x, notably below both the peer average (20.5x) and the broader Japanese Electronic industry average (14.4x). This suggests the market is pricing Citizen Watch at a discount relative to how similar companies are valued.

The P/E ratio is a widely used valuation tool that compares a company's share price to its earnings per share. For manufacturers and technology companies like Citizen Watch, it is especially relevant as it allows investors to quickly gauge how much the market is willing to pay for current and future profitability compared to industry norms.

A lower P/E multiple like this may indicate that investors hold modest expectations for growth or are discounting the company due to anticipated declines in earnings. However, compared to peers, it could also suggest the market is underappreciating Citizen Watch's earning potential or not fully pricing in its recent performance turnaround.

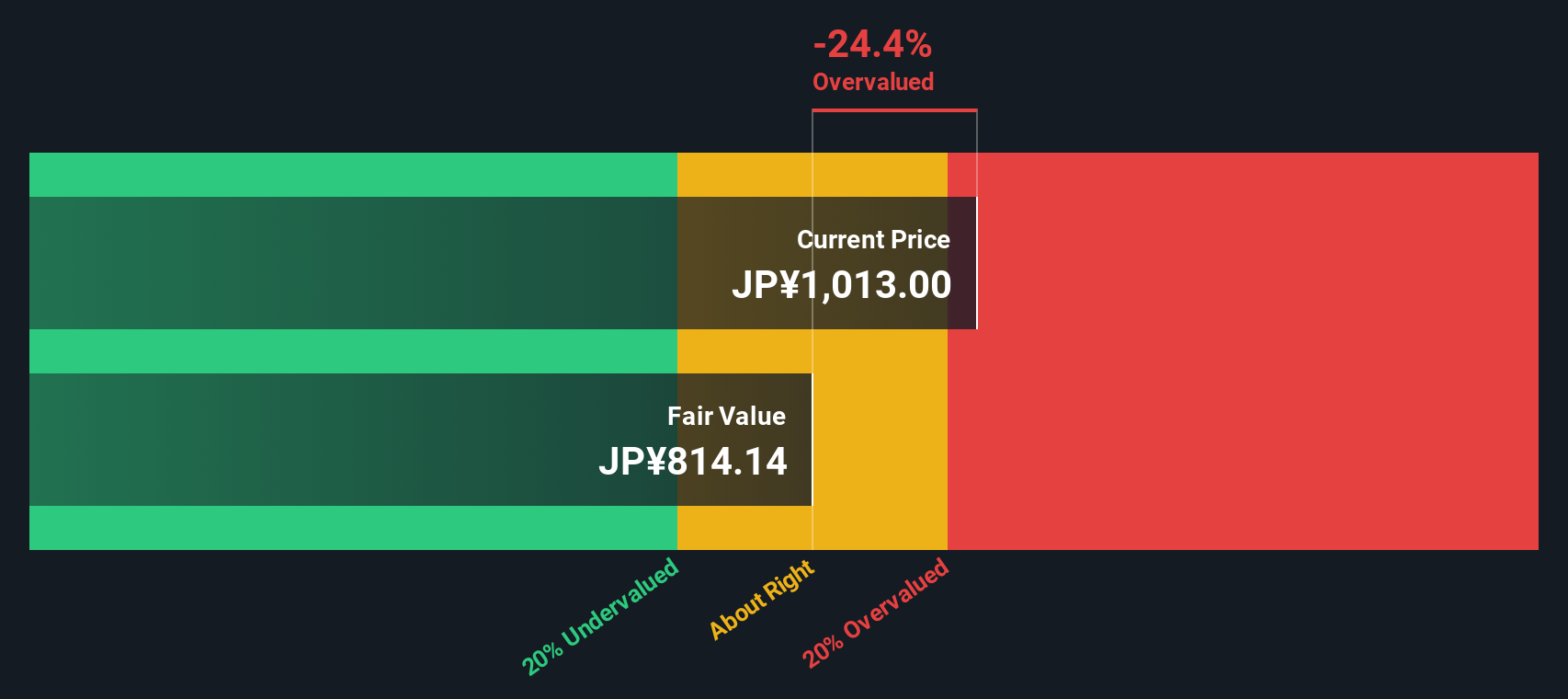

Result: Fair Value of ¥815.62 (OVERVALUED)

See our latest analysis for Citizen Watch.However, continued weakness in net income or a reversal in recent momentum could challenge the bullish outlook and lead to a market reassessment.

Find out about the key risks to this Citizen Watch narrative.Another View: The SWS DCF Model Perspective

While the earnings multiple approach paints Citizen Watch as attractive compared to industry norms, our SWS DCF model offers a different take. It currently signals the shares might be priced above their fundamental value. This raises a key question for investors: which verdict will the market believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Citizen Watch Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own take in just a few minutes with our tools. Do it your way

A great starting point for your Citizen Watch research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for just one opportunity when you can stay ahead of the crowd. Use these powerful tools to uncover stocks that fit your style and ambitions, because the right pick could be one click away.

- Capture hidden gems with massive upside by targeting undervalued stocks based on cash flows, designed to spotlight companies trading below their true worth.

- Unlock passive income potential and find strong payouts by checking out dividend stocks with yields > 3% for stocks boasting high, consistent dividend yields.

- Tap into the future of artificial intelligence by seeking out innovators identified in AI penny stocks, which are transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives