- Japan

- /

- Tech Hardware

- /

- TSE:7752

Will Sitma USA Partnership Expansion Change Ricoh Company's (TSE:7752) Packaging and Fulfillment Narrative?

Reviewed by Sasha Jovanovic

- On October 22, 2025, Sitma USA, a Tecnau company, announced it is expanding its partnership with Ricoh USA to deliver enhanced end-to-end packaging, mailing, and fulfillment solutions across the U.S. and Canada.

- This deeper collaboration enables Ricoh to offer an integrated workflow from print production to final packaging, broadening its service capabilities for customers in these markets.

- With Ricoh now positioned to deliver full-spectrum workflow and packaging solutions, we'll consider how this development shapes the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ricoh Company's Investment Narrative?

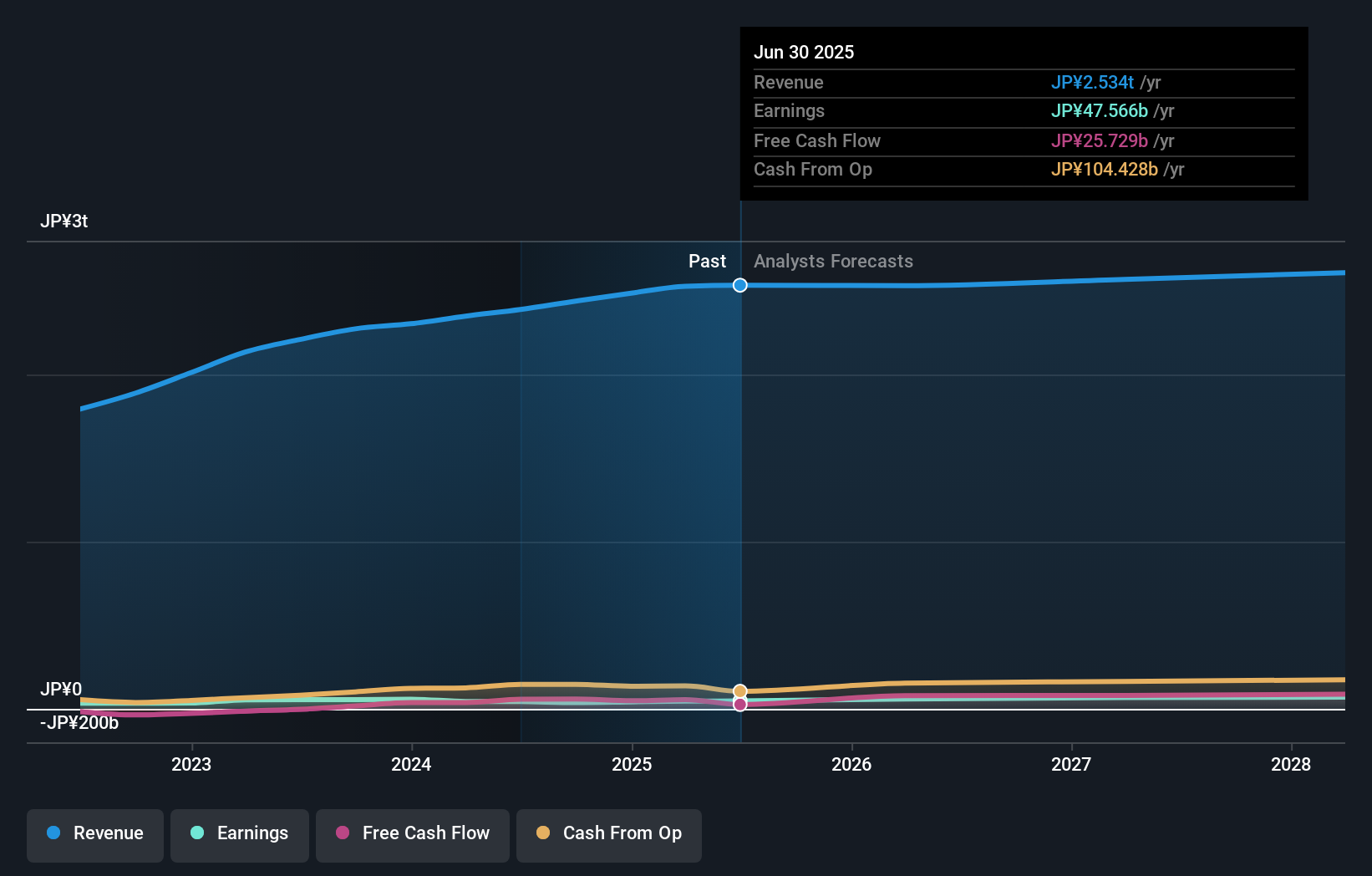

For anyone considering Ricoh, the big picture is about its effort to pivot from traditional print to integrated workflow and digital solutions. The recent expansion of Ricoh’s partnership with Sitma USA signals a move towards deeper service offerings in packaging and fulfillment, practical steps that could influence Ricoh’s near-term catalysts. While Ricoh’s earnings growth has outpaced its sector and analyst targets still see upside, the company’s modest revenue growth, soft short-term price performance, and low return on equity signal underlying headwinds. The Sitma deal may support Ricoh’s push for broader recurring revenue streams, potentially enhancing short-term customer wins, but its impact is not likely to be immediately material given the scale of Ricoh’s business and current market reactions. At the same time, investors must weigh ongoing risks, like limited revenue acceleration and recent one-off losses.

But here’s what could really matter if current headwinds persist.

Exploring Other Perspectives

Explore another fair value estimate on Ricoh Company - why the stock might be worth just ¥1417!

Build Your Own Ricoh Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ricoh Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ricoh Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ricoh Company's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7752

Ricoh Company

Develops, manufactures, and sells digital products and services in Japan, the Americas, Europe, the Middle East, Africa, China, South East Asia, and Oceania.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives