- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7732

High Growth Tech Stocks to Watch in Japan September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%, as exporters faced currency headwinds and economic growth was revised lower. In this environment, identifying high-growth tech stocks becomes crucial, particularly those that can navigate currency fluctuations and capitalize on technological advancements to drive future growth.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥154.70 billion.

Operations: The company generates revenue primarily from its platform business, which reported ¥25.43 billion. It focuses on delivering cloud-based accounting and HR software solutions in Japan.

freee K.K. is making significant strides in Japan's tech sector, with its revenue expected to grow at 18.2% annually, outpacing the broader JP market's 4.2% growth rate. Despite being currently unprofitable, earnings are forecasted to surge by 74.7% per year, indicating strong future potential. The company recently proposed amendments to its articles of incorporation to expand business activities, reflecting a strategic pivot towards diversification and growth opportunities. Investing heavily in R&D has been a key driver for freee K.K., with expenses contributing significantly to their innovation pipeline and product development capabilities. For the fiscal year ending June 30, 2025, they project net sales of ¥33 billion ($224 million), showcasing robust revenue prospects amidst an evolving business landscape that increasingly favors SaaS models for recurring subscription revenues.

- Delve into the full analysis health report here for a deeper understanding of freee K.K.

Explore historical data to track freee K.K's performance over time in our Past section.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market cap of ¥1.19 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), followed by the Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company operates across diverse sectors including industrial automation, healthcare, and social systems globally.

OMRON's revenue is projected to grow at 5.6% annually, outpacing the broader JP market's 4.2% growth rate, while earnings are expected to surge by 46.22% per year over the next three years. The company has invested heavily in R&D, with expenditures reaching ¥20 billion ($135 million) in the last fiscal year, driving significant innovation in automation and AI technologies. Recent earnings calls highlighted a strategic focus on expanding their healthcare and industrial automation segments, which could substantially impact future profitability and market positioning.

- Get an in-depth perspective on OMRON's performance by reading our health report here.

Evaluate OMRON's historical performance by accessing our past performance report.

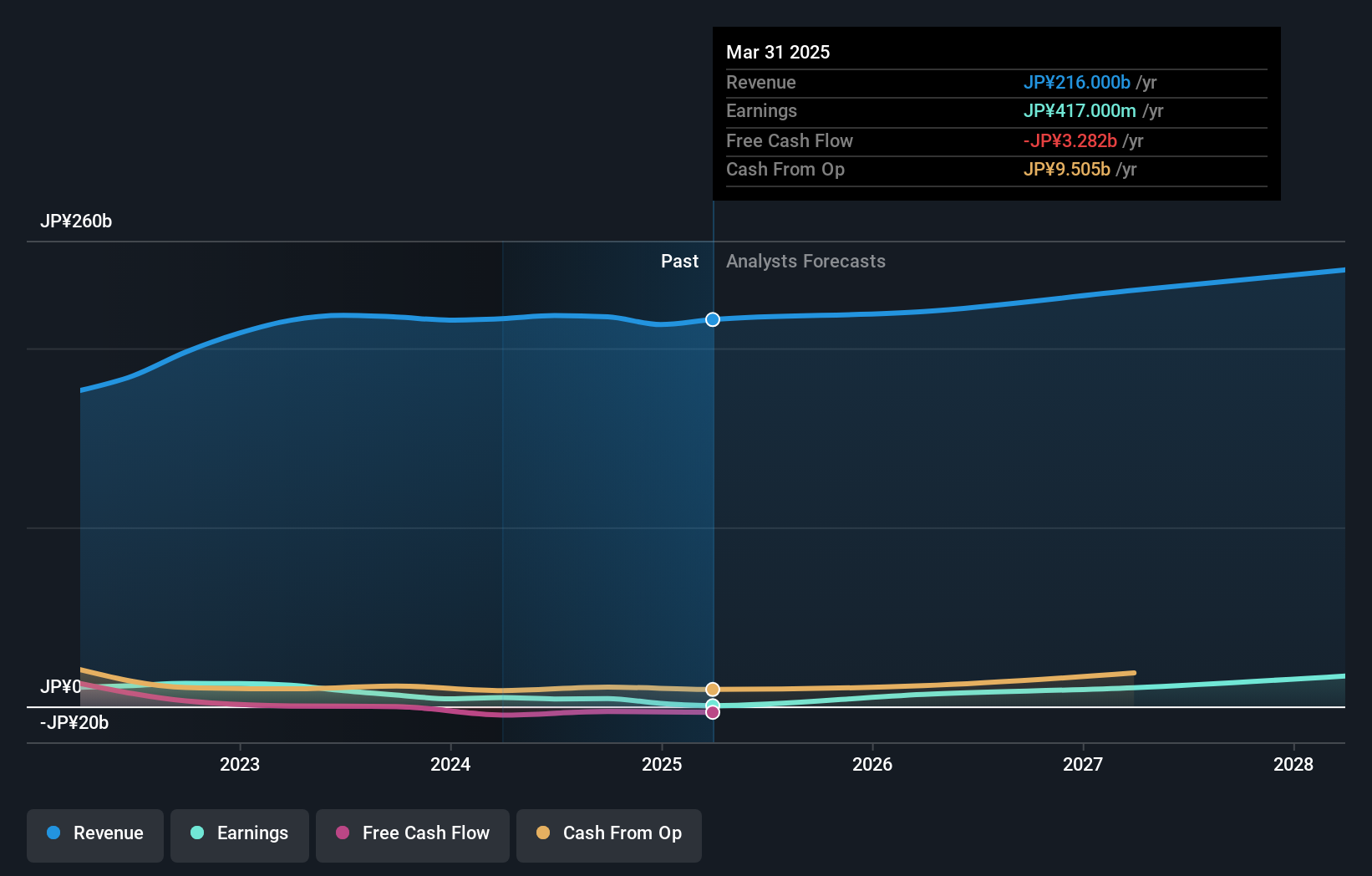

Topcon (TSE:7732)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topcon Corporation, along with its subsidiaries, develops, manufactures, and sells positioning, eye care, and smart infrastructure products in Japan and internationally with a market cap of ¥153.64 billion.

Operations: Topcon generates revenue primarily from its Positioning Business and Eye Care Business, with the Positioning segment contributing ¥148.60 billion and the Eye Care segment adding ¥67.89 billion. The company operates in both domestic and international markets, focusing on advanced technological solutions for various industries.

Topcon's R&D expenses have been pivotal, with ¥8.5 billion ($57.6 million) spent last year, driving advancements in precision agriculture and healthcare solutions. Despite a challenging year with a 52.5% earnings drop due to a ¥2.8 billion one-off loss, revenue is expected to grow by 5.4% annually, surpassing the broader JP market's 4.2%. Earnings are forecasted to surge by 24.51% per year over the next three years, indicating robust future potential despite current profit margins of just 1.9%.

- Click here and access our complete health analysis report to understand the dynamics of Topcon.

Gain insights into Topcon's past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our Japanese High Growth Tech and AI Stocks screener has unearthed 115 more companies for you to explore.Click here to unveil our expertly curated list of 118 Japanese High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topcon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7732

Topcon

Develops, manufactures, and sells positioning, eye care, and smart infrastructure products in Japan and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives