- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7433

Hakuto's (TSE:7433) Conservative Accounting Might Explain Soft Earnings

The market for Hakuto Co., Ltd.'s (TSE:7433) shares didn't move much after it posted weak earnings recently. Our analysis suggests that while the profits are soft, the foundations of the business are strong.

Examining Cashflow Against Hakuto's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to June 2025, Hakuto recorded an accrual ratio of -0.13. Therefore, its statutory earnings were quite a lot less than its free cashflow. To wit, it produced free cash flow of JP¥15b during the period, dwarfing its reported profit of JP¥4.25b. Given that Hakuto had negative free cash flow in the prior corresponding period, the trailing twelve month resul of JP¥15b would seem to be a step in the right direction. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Check out our latest analysis for Hakuto

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hakuto.

The Impact Of Unusual Items On Profit

While the accrual ratio might bode well, we also note that Hakuto's profit was boosted by unusual items worth JP¥533m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. If Hakuto doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Hakuto's Profit Performance

Hakuto's profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Considering the aforementioned, we think that Hakuto's profits are probably a reasonable reflection of its underlying profitability; although we'd be confident in that conclusion if we saw a cleaner set of results. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. At Simply Wall St, we found 2 warning signs for Hakuto and we think they deserve your attention.

Our examination of Hakuto has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

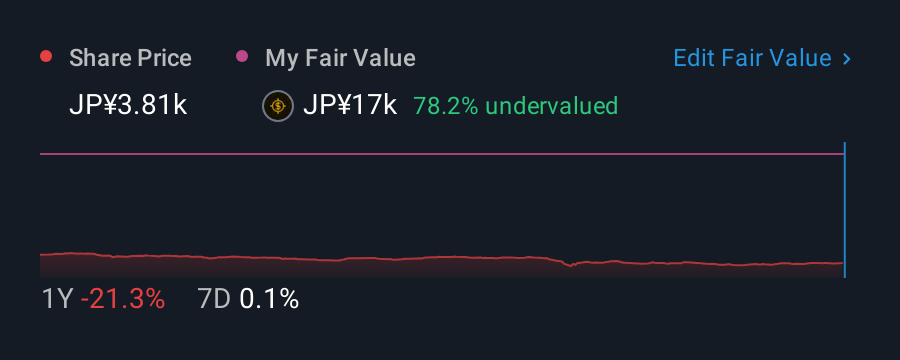

Valuation is complex, but we're here to simplify it.

Discover if Hakuto might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7433

Hakuto

Hakuto Co., Ltd. procures and sells electronic materials, parts, and equipment in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026