- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Is Taiyo Yuden (TSE:6976) Quietly Repositioning as an Automotive Power Electronics Specialist?

Reviewed by Sasha Jovanovic

- TAIYO YUDEN CO., LTD. has launched revamped HVX (-J) and HTX (-J) conductive polymer hybrid aluminum electrolytic capacitors, now in mass production at its Shirakawa and Aomori plants for automotive power steering and ADAS-related power circuits.

- By combining low-ESR conductive polymers with the self-repairing traits of aluminum electrolytic capacitors, these hybrid parts aim to offer compact, high-ripple, AEC-Q200-qualified solutions tailored to the growing electrification of vehicles.

- We will now examine how this push into higher-performance automotive hybrid capacitors, backed by mass production capacity, may influence Taiyo Yuden’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Taiyo Yuden's Investment Narrative?

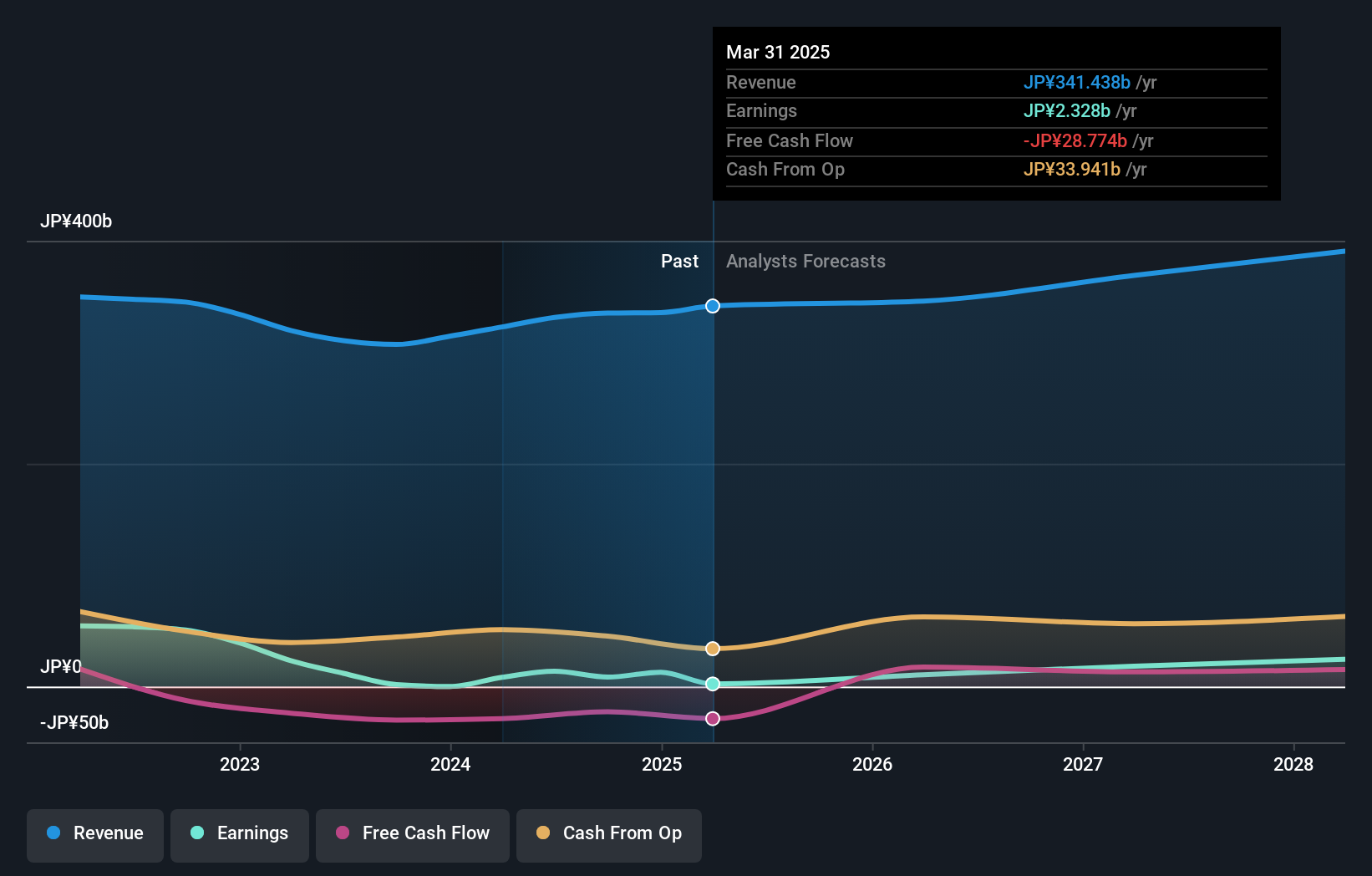

To own Taiyo Yuden, you really have to believe that its niche in high‑performance passive components can translate modest top‑line growth into much stronger earnings, even off thin margins and a rich earnings multiple. The revamped HVX (-J) and HTX (-J) hybrid capacitors fit neatly into that story: they reinforce the pivot toward auto and ADAS content, a key short‑term catalyst alongside guidance upgrades and solid 1‑year share returns. That said, this product launch alone is unlikely to move the needle enough to resolve the tension between expensive headline valuation and low current profitability, especially after recent share price volatility. Instead, it slightly strengthens the case that management can fill existing capacity with higher‑value automotive demand, while also sharpening execution risk if volumes or pricing disappoint.

However, one issue around earnings quality and dividend cover is worth looking at more closely. Taiyo Yuden's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Taiyo Yuden - why the stock might be worth just ¥4600!

Build Your Own Taiyo Yuden Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taiyo Yuden research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Taiyo Yuden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taiyo Yuden's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, North America, China, Europe, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026