- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Is Kyocera’s Latest Buyback Shaping a New Capital Allocation Narrative for TSE:6971?

Reviewed by Sasha Jovanovic

- Kyocera recently completed a share buyback program, repurchasing 26,114,100 shares, representing 1.85% of its outstanding stock, for ¥50,797 million between July 1 and September 30, 2025.

- This substantial repurchase underlines Kyocera’s approach to capital management and may reflect the company’s confidence in its long-term prospects.

- We’ll explore how the completion of this sizable buyback influences Kyocera’s investment narrative and perceived shareholder value.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kyocera's Investment Narrative?

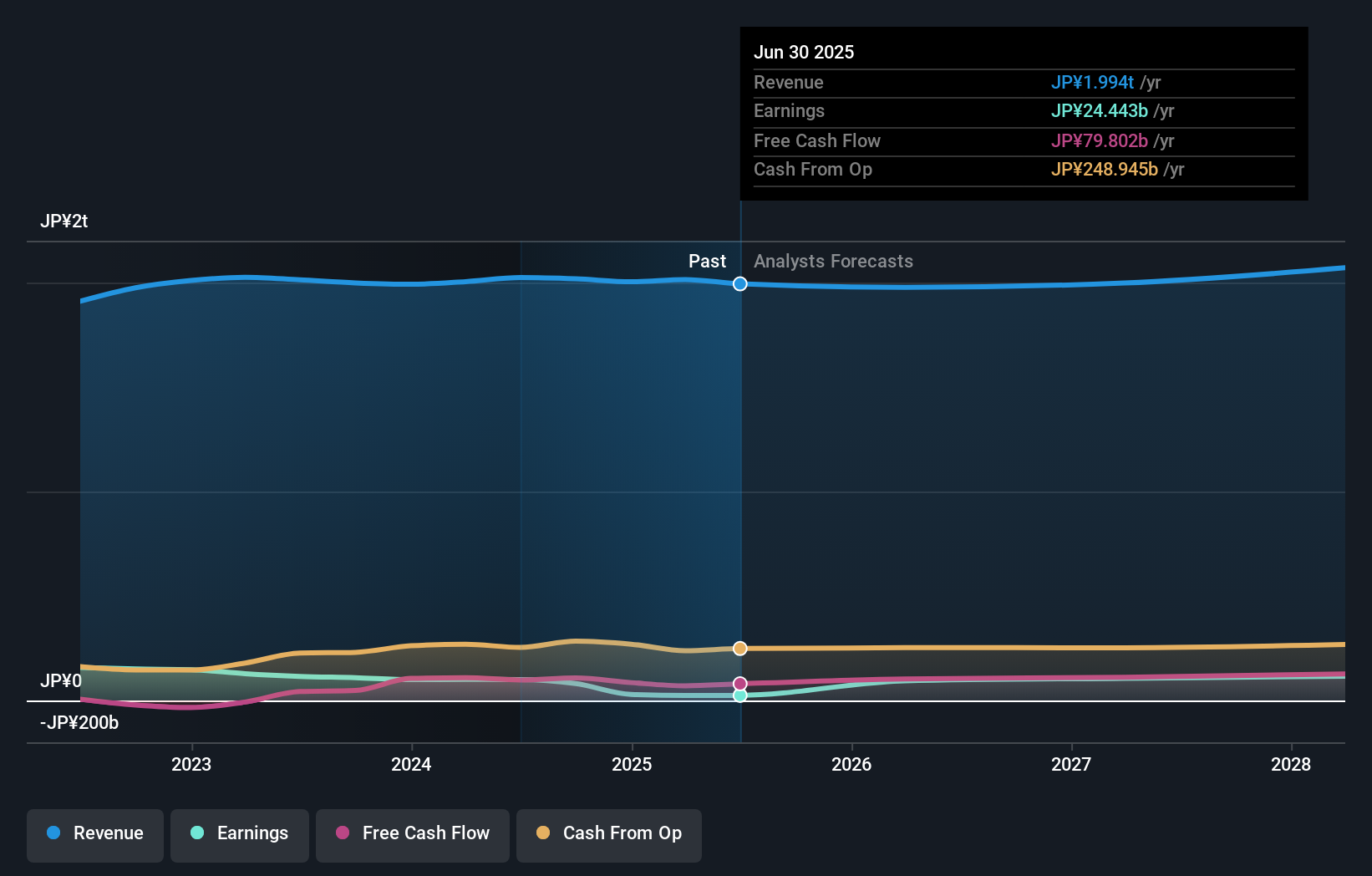

To have conviction as a Kyocera shareholder right now, you need to believe that the company's core electronics and materials businesses can rebound from recent one-off losses and margin pressures, while management steers through slow revenue growth and governance challenges. The completion of the buyback program, while substantial in size, may reinforce management’s message of faith in the business and could modestly cushion near-term share price weakness. However, the fundamental short-term catalysts, such as the recovery in earnings, the launch of new product lines, and updates on governance reforms, are likely unchanged, since this buyback does not directly resolve underlying profitability or market share risks. Given Kyocera’s elevated valuation relative to peers and a forecast for relatively low revenue growth, the latest buyback alone does not materially alter the key risks around profit recovery or the need for operational improvements. Investors should remain alert to persistent margin and leadership concerns.

On the other hand, unresolved governance questions remain a key issue for shareholders. Kyocera's shares have been on the rise but are still potentially undervalued by 22%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Kyocera - why the stock might be worth as much as 29% more than the current price!

Build Your Own Kyocera Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kyocera research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kyocera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kyocera's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives