- South Korea

- /

- Luxury

- /

- KOSE:A105630

Global Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As global markets grapple with heightened uncertainty due to unexpected tariffs and trade tensions, investors are increasingly cautious about potential impacts on economic growth and inflation. Amid this backdrop of volatility, dividend stocks can offer a measure of stability by providing regular income streams, making them an attractive consideration for those looking to navigate the current market landscape.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.08% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.75% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.89% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.59% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.04% | ★★★★★★ |

| Torigoe (TSE:2009) | 5.34% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

Click here to see the full list of 1478 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

Hansae (KOSE:A105630)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hansae Co., Ltd. is a company that manufactures and sells finished clothing products in countries including Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti with a market cap of approximately ₩393.43 billion.

Operations: Hansae Co., Ltd. generates its revenue primarily from clothing manufacturing, amounting to approximately ₩1.80 billion.

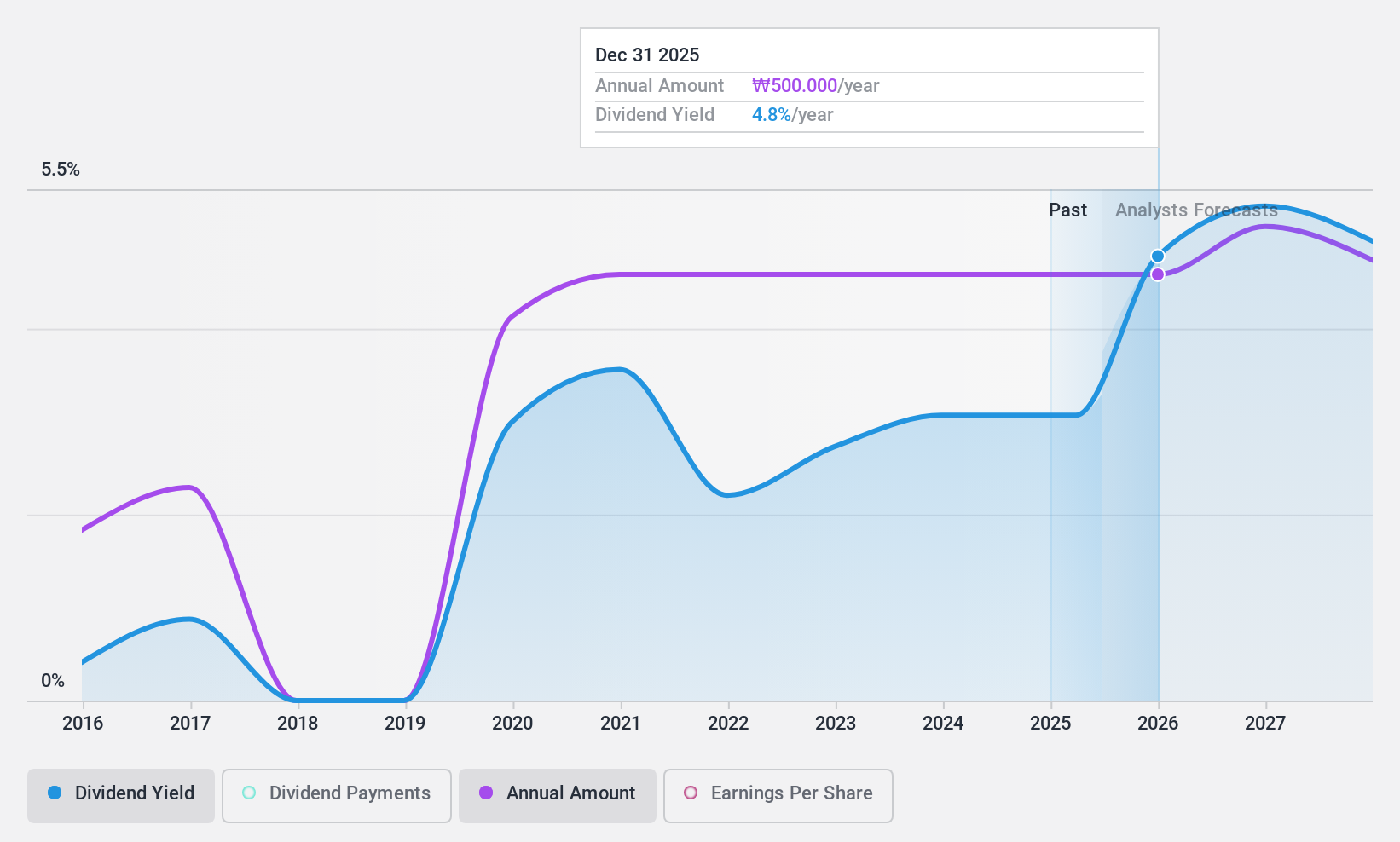

Dividend Yield: 4.6%

Hansae's dividend yield of 4.64% is among the top 25% in the KR market, but it's not well covered by free cash flows or earnings, raising sustainability concerns. Despite stable and growing dividends over the past decade, recent financial results show a decline in net income from KRW 112 billion to KRW 58 billion. While trading at a significant discount to estimated fair value, debt coverage issues persist with operating cash flow challenges.

- Get an in-depth perspective on Hansae's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Hansae is priced lower than what may be justified by its financials.

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shibaura Electronics Co., Ltd. specializes in the manufacturing and sale of thermistor elements and related products in Japan, with a market capitalization of ¥63.17 billion.

Operations: Shibaura Electronics Co., Ltd. generates its revenue from various regions, with ¥25.38 billion from Japan, ¥18.72 billion from Asia, ¥1.06 billion from Europe, and ¥1.04 billion from the U.S.A.

Dividend Yield: 3.2%

Shibaura Electronics' dividend yield of 3.19% is lower than the top 25% in Japan, and its dividends have been volatile over the past decade. Despite this, dividends are covered by earnings with a payout ratio of 60.4% and cash flows with a cash payout ratio of 63%. The company's shares trade at a discount to fair value estimates. A proposed acquisition by Yageo Corporation for ¥65.6 billion could impact future dividend policies if completed as expected in June 2025.

- Unlock comprehensive insights into our analysis of Shibaura ElectronicsLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Shibaura ElectronicsLtd is trading beyond its estimated value.

Inui Global Logistics (TSE:9308)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inui Global Logistics Co., Ltd. operates in shipping, warehousing, and realty sectors both in Japan and internationally, with a market cap of ¥33.70 billion.

Operations: Inui Global Logistics Co., Ltd. generates revenue from its Logistics - Ocean Voyage Business at ¥23.65 billion, the Logistics - Warehousing and Transportation Business at ¥3.87 billion, and the Real Estate Business at ¥4.37 billion.

Dividend Yield: 5.5%

Inui Global Logistics offers a compelling dividend yield of 5.47%, placing it in the top 25% of Japanese dividend payers. Despite a history of volatility, dividends are well-supported by earnings and cash flows, with payout ratios at 9.1% and 43.3%, respectively. The company's price-to-earnings ratio is attractively low at 7.3x compared to the market average of 11.7x, although recent earnings growth was significantly influenced by large one-off items.

- Delve into the full analysis dividend report here for a deeper understanding of Inui Global Logistics.

- According our valuation report, there's an indication that Inui Global Logistics' share price might be on the expensive side.

Where To Now?

- Explore the 1478 names from our Top Global Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hansae might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A105630

Hansae

Manufactures and sells finished clothing products in Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti.

Established dividend payer and good value.

Market Insights

Community Narratives