- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6929

3 Reliable Dividend Stocks With At Least 3.1% Yield

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks showing resilience despite economic uncertainties and European indices experiencing varied performances, investors are increasingly seeking stability in their portfolios. In such an environment, dividend stocks with reliable yields can offer a measure of predictability and income, making them attractive options for those looking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Xxentria Technology Materials (TPEX:8942)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xxentria Technology Materials Co., Ltd. manufactures and sells steel composite materials in the United States, Asia, and internationally, with a market cap of NT$10.56 billion.

Operations: Xxentria Technology Materials Co., Ltd.'s revenue is primarily derived from its Composite Board segment, which accounts for NT$3.43 billion, and its Surface Treatment segment, contributing NT$234.92 million.

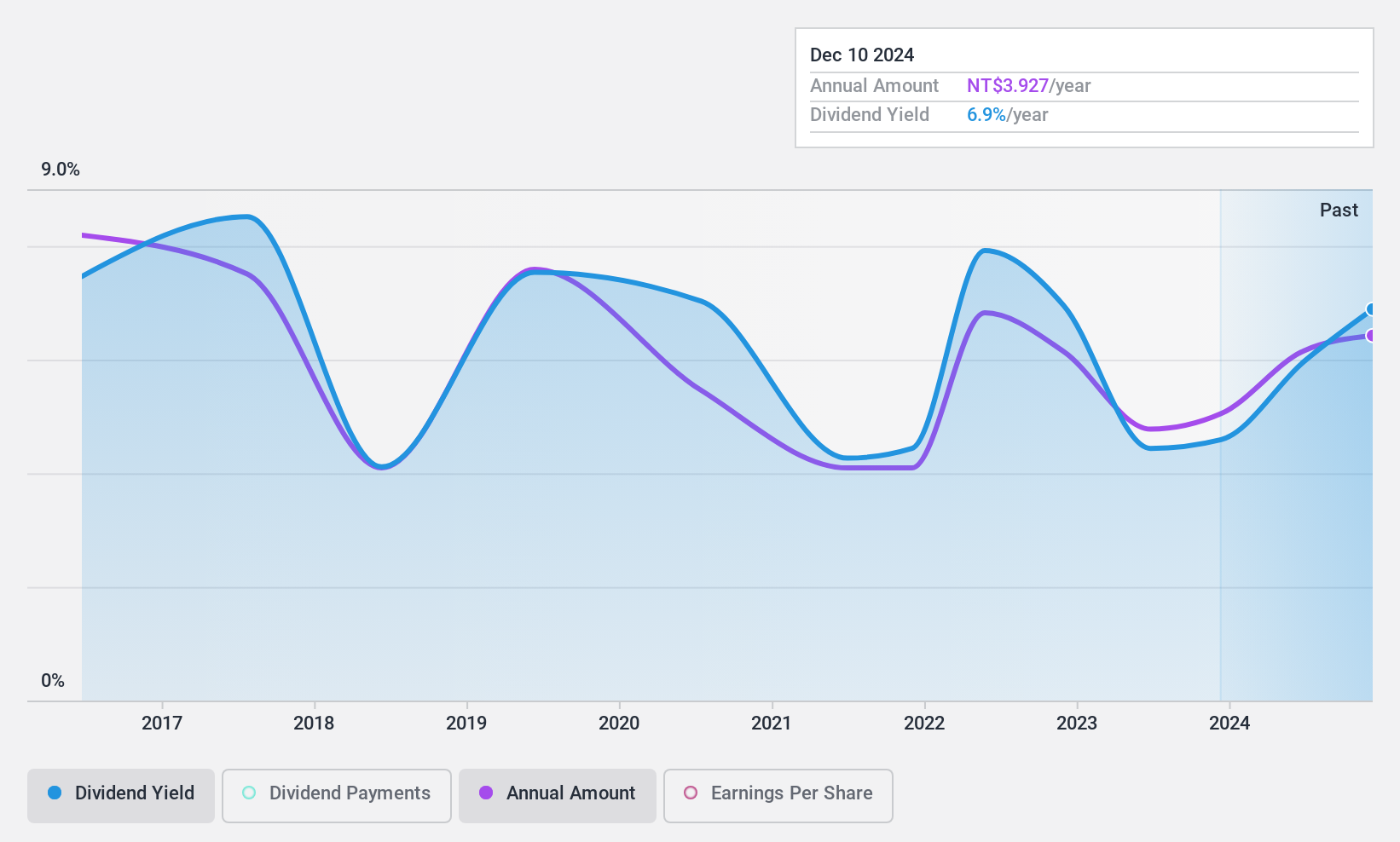

Dividend Yield: 7.4%

Xxentria Technology Materials' dividend yield of 7.39% is among the top in Taiwan, but its sustainability is questionable due to a high payout ratio of 92.3%, not well covered by earnings. Despite being covered by cash flows with a cash payout ratio of 78.8%, past dividends have been volatile and unreliable, showing no consistent growth trend over the last decade. Recent financials indicate declining revenues and earnings, potentially impacting future payouts.

- Dive into the specifics of Xxentria Technology Materials here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Xxentria Technology Materials shares in the market.

Nippon Ceramic (TSE:6929)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Ceramic Co., Ltd. develops, manufactures, and sells ceramic sensors and modules both in Japan and internationally, with a market cap of approximately ¥56.95 billion.

Operations: Nippon Ceramic Co., Ltd. generates revenue primarily from the manufacturing and sales of electronic components and related products, totaling ¥24.47 billion.

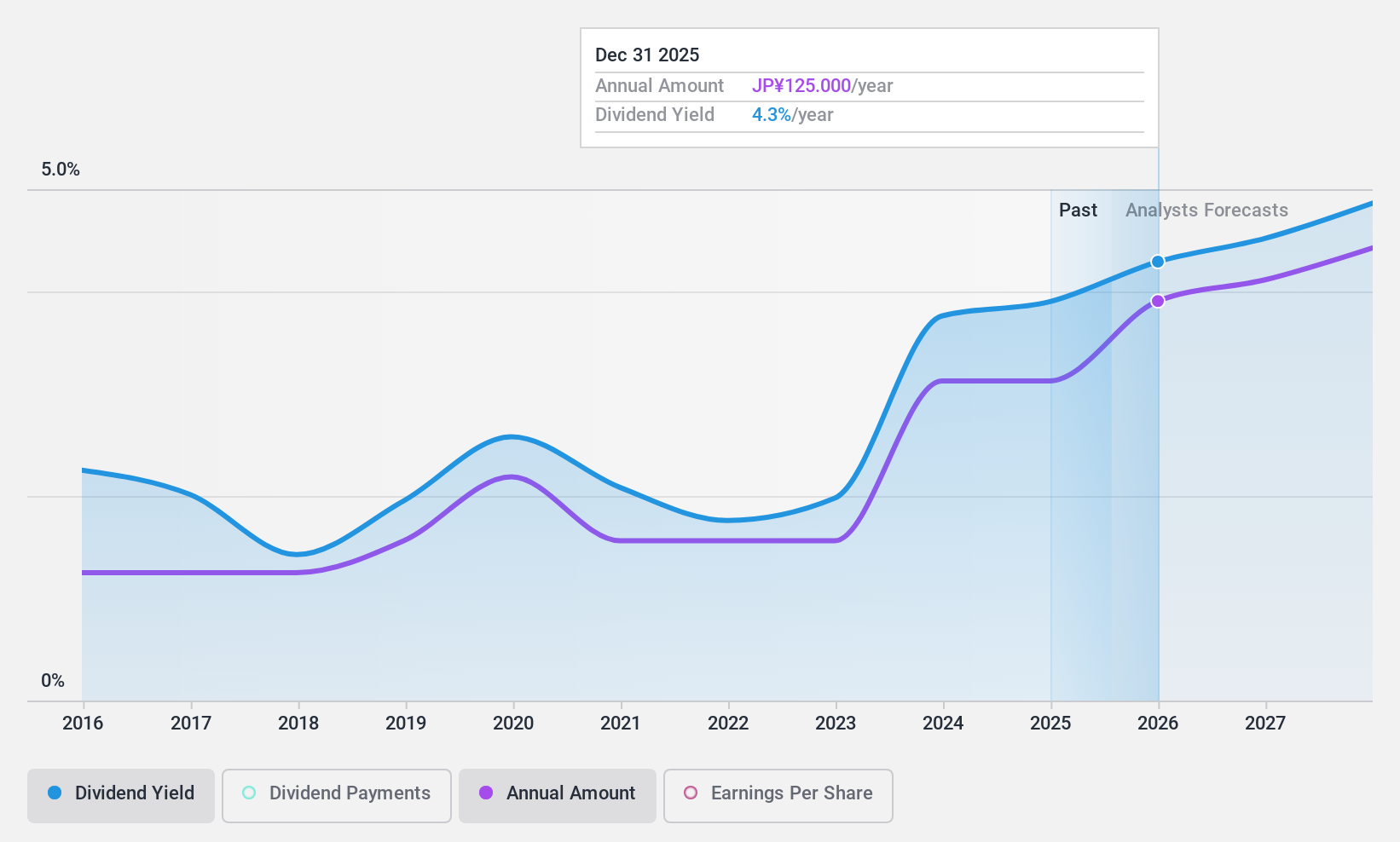

Dividend Yield: 3.9%

Nippon Ceramic's dividend yield of 3.91% ranks in the top 25% of Japanese market payers and is well-supported by a payout ratio of 66% and a cash payout ratio of 36.5%. Despite past volatility, dividends have grown over the last decade. Recent buyback activities, including repurchasing shares worth ¥999.77 million, could signal confidence in financial health but don't necessarily ensure future dividend stability given historical unreliability.

- Get an in-depth perspective on Nippon Ceramic's performance by reading our dividend report here.

- The analysis detailed in our Nippon Ceramic valuation report hints at an deflated share price compared to its estimated value.

Star Micronics (TSE:7718)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Star Micronics Co., Ltd. manufactures and sells CNC automatic lathes and other products across Japan, Asia, the United States, and Europe, with a market cap of ¥60.59 billion.

Operations: Star Micronics Co., Ltd.'s revenue is primarily derived from its Machine Tool Business, including the Precision Part Business, which accounts for ¥52.51 billion, and the Power Products Business, contributing ¥12.97 billion.

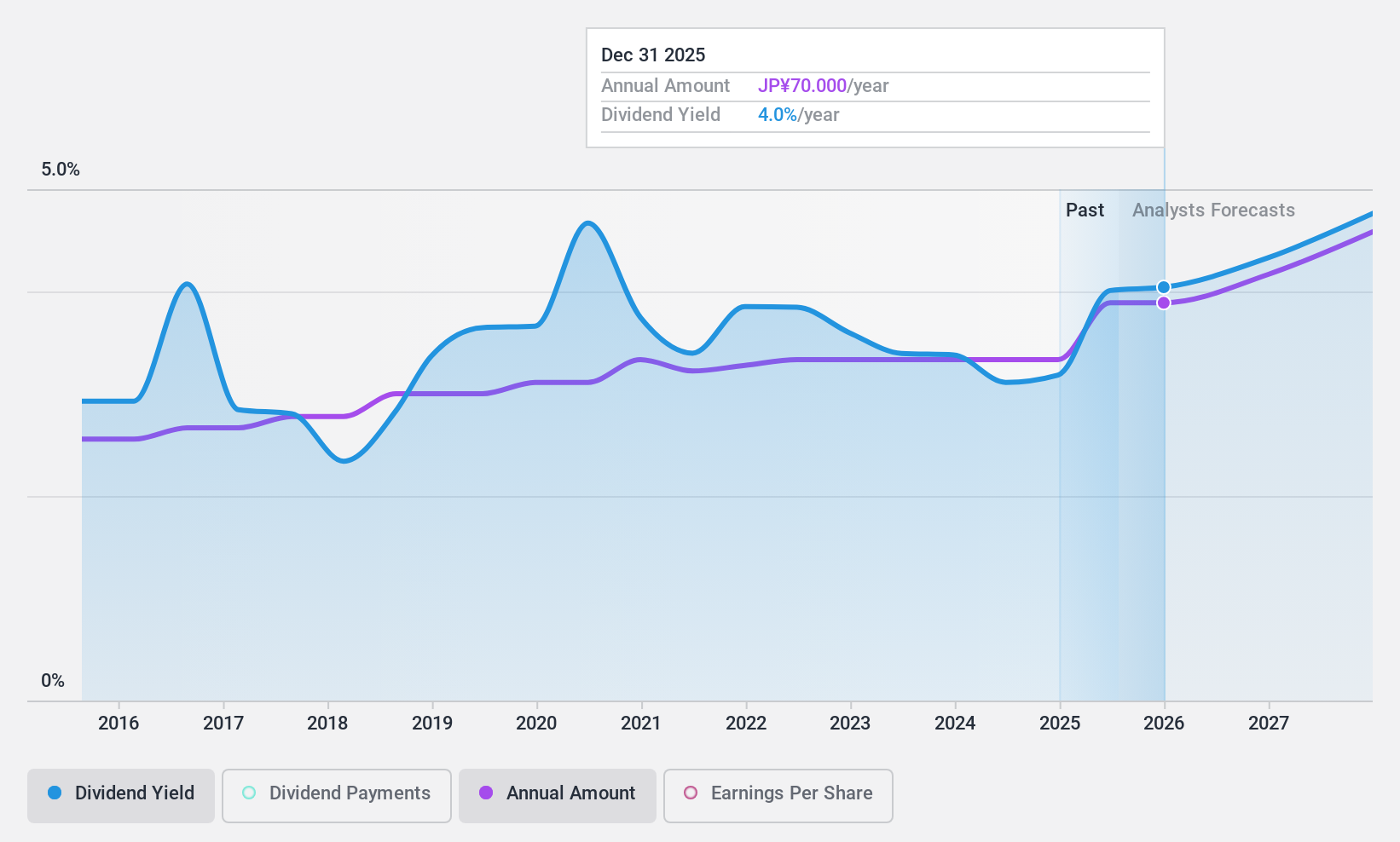

Dividend Yield: 3.2%

Star Micronics offers a stable dividend yield of 3.18%, though below the top 25% in Japan, with robust coverage from both earnings (79.8% payout ratio) and cash flows (20.4% cash payout). Dividends have been reliable and growing over the past decade. However, recent guidance revisions indicate reduced net sales and profits for FY2024, potentially impacting future payouts despite current stability. The stock trades significantly below estimated fair value, suggesting potential undervaluation amidst these challenges.

- Navigate through the intricacies of Star Micronics with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Star Micronics is trading beyond its estimated value.

Summing It All Up

- Investigate our full lineup of 1971 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Ceramic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6929

Nippon Ceramic

Develops, manufactures, and sells ceramic sensors, modules, and other products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives