As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are increasingly looking towards dividend stocks as a potential source of stability and income. In this environment, identifying strong dividend stocks involves assessing their ability to maintain payouts amidst fluctuating interest rates and economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.30% | ★★★★★★ |

| Globeride (TSE:7990) | 4.26% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.14% | ★★★★★★ |

| Innotech (TSE:9880) | 4.73% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

Click here to see the full list of 2030 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (publ) offers non-life insurance services to private and business customers across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and internationally with a market cap of SEK1.58 billion.

Operations: Solid Försäkringsaktiebolag's revenue segments include Product (SEK311.85 million), Assistance (SEK371.42 million), and Personal Safety (SEK441.04 million).

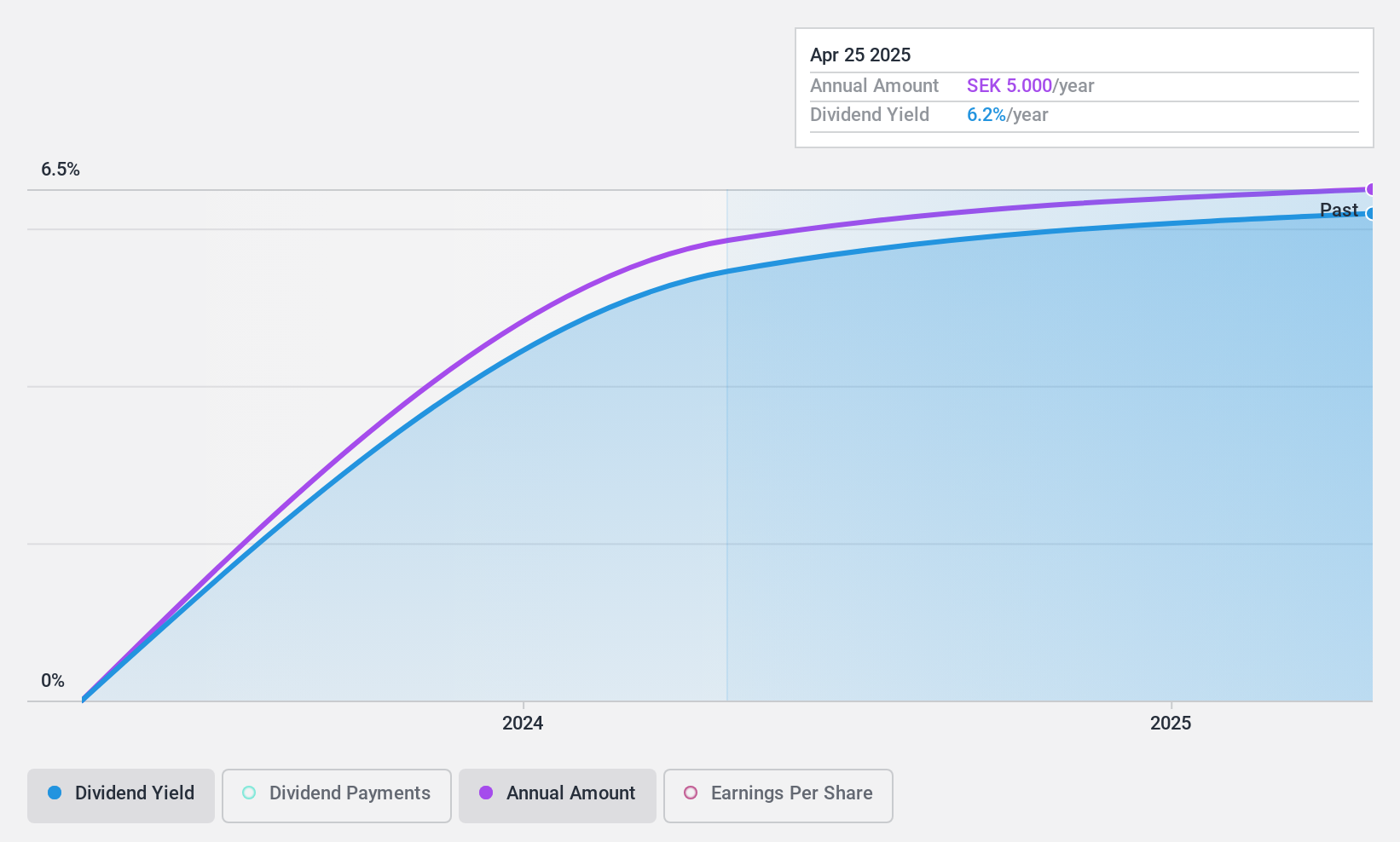

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag's dividend payments are new, making it too early to assess their reliability, growth, or stability. However, the dividends are well covered by earnings (46.4% payout ratio) and cash flows (60.3% cash payout ratio). The company trades at 58.1% below its estimated fair value and boasts a top-tier dividend yield of 5.17%. Recent earnings show growth with Q3 net income rising to SEK 48.8 million from SEK 40.38 million year-over-year.

- Dive into the specifics of Solid Försäkringsaktiebolag here with our thorough dividend report.

- According our valuation report, there's an indication that Solid Försäkringsaktiebolag's share price might be on the cheaper side.

Nihon Kagaku Sangyo (TSE:4094)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nihon Kagaku Sangyo Co., Ltd. is engaged in the production and sale of industrial chemicals and building materials both within Japan and internationally, with a market capitalization of ¥28.35 billion.

Operations: Nihon Kagaku Sangyo Co., Ltd.'s revenue is derived from its industrial chemicals and building materials segments, serving both domestic and international markets.

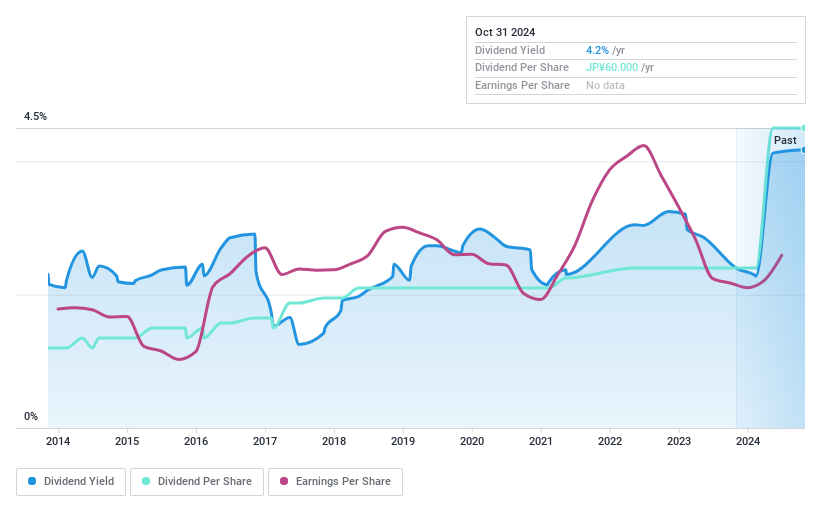

Dividend Yield: 4.1%

Nihon Kagaku Sangyo's dividends have been stable and growing over the past decade, supported by a low payout ratio of 44.4%, ensuring coverage by both earnings and cash flows (60.3% cash payout ratio). The dividend yield of 4.12% ranks in the top 25% of Japanese market payers, offering an attractive option for income-focused investors. Additionally, the stock trades at a significant discount to its estimated fair value, enhancing its appeal as a value investment.

- Click here to discover the nuances of Nihon Kagaku Sangyo with our detailed analytical dividend report.

- The analysis detailed in our Nihon Kagaku Sangyo valuation report hints at an inflated share price compared to its estimated value.

Iriso Electronics (TSE:6908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iriso Electronics Co., Ltd. develops, manufactures, and sells connectors across Japan, the rest of Asia, Europe, and North America with a market cap of ¥61.45 billion.

Operations: Iriso Electronics generates revenue from various regions, with ¥54.68 billion from Asia, ¥41.24 billion from Japan, ¥9.58 billion from Europe, and ¥6.51 billion from North America.

Dividend Yield: 3.6%

Iriso Electronics has an unstable dividend history, with payments being volatile over the past decade. However, its dividends are well covered by earnings and cash flows, with payout ratios of 44.9% and 57.5%, respectively. Despite a lower yield of 3.64% compared to top-tier Japanese payers, the stock trades at a significant discount to its estimated fair value. Recent share buybacks totaling ¥3.37 billion may indicate management's confidence in the company's financial health.

- Delve into the full analysis dividend report here for a deeper understanding of Iriso Electronics.

- Our expertly prepared valuation report Iriso Electronics implies its share price may be lower than expected.

Where To Now?

- Discover the full array of 2030 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Kagaku Sangyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4094

Nihon Kagaku Sangyo

Produces and sells industrial chemicals and building materials in Japan and internationally.

Flawless balance sheet 6 star dividend payer.