- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6861

Keyence (TSE:6861): Revisiting Valuation as Share Price Trends Raise Investor Debate

Reviewed by Simply Wall St

Keyence (TSE:6861) isn’t making headlines with a splashy merger or disruptive AI move this week, but its recent share price trends have caught the eye of more than a few investors searching for signals in the current market. Sometimes, it is exactly these quieter moves that stir up the biggest debates. Is this dip an overreaction, or does it reflect something deeper about the company’s prospects? For anyone keeping Keyence on their watchlist, it is a good moment to revisit what is really driving sentiment around the stock.

Looking at the numbers, Keyence has slipped just over 13% over the past year, and remains down roughly 11% from the start of the year. Still, its longer-term story is not all pessimistic. Keyence is sitting on a 14% total return over three years, and 25% over five. Recent momentum has been muted, with shares essentially flat over the past month and quarter, even after booking nearly 10% yearly growth in both revenue and net income.

As the dust settles, the critical question is whether this period of sideways performance is setting up a compelling buying opportunity or if the market is already factoring in every bit of growth Keyence has to offer.

Price-to-Earnings of 34.5x: Is it justified?

Keyence is currently trading at a Price-to-Earnings (P/E) ratio of 34.5x, which is significantly higher than both the peer average of 18x and the broader JP Electronic industry average of 14.6x. This suggests that the market is placing a premium on Keyence compared to its industry peers.

The Price-to-Earnings ratio is a widely used measure that compares a company's share price to its earnings per share. For companies in the technology and electronics sector, a higher P/E can reflect expectations of stronger future growth or market leadership. However, if it is well above industry norms, it can also raise questions about whether those expectations are justified.

In Keyence's case, the elevated P/E ratio indicates that investors may be overpricing its expected earnings and growth prospects relative to the company's actual profit trajectory and that of its competitors.

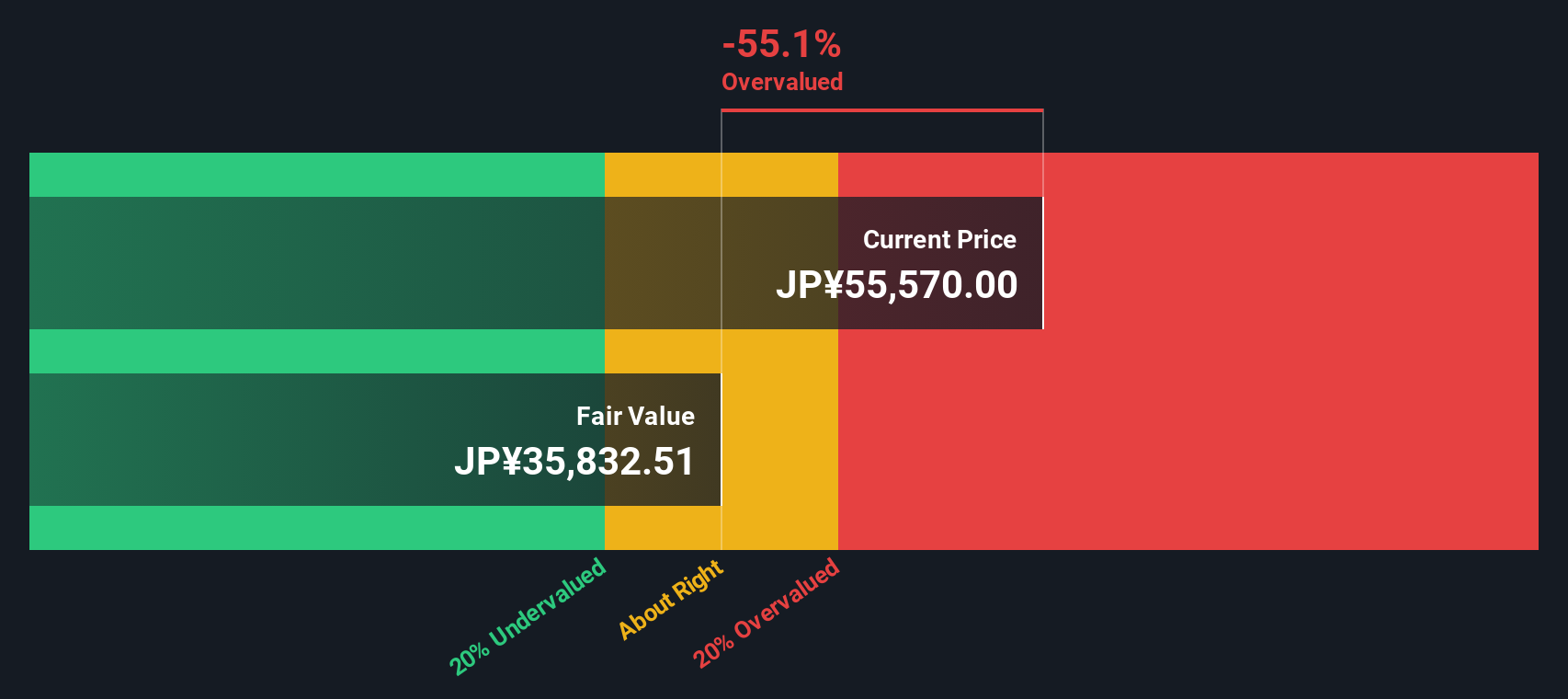

Result: Fair Value of ¥35,807.19 (OVERVALUED)

See our latest analysis for Keyence.However, ongoing high valuation and any slowdown in revenue growth could quickly erode confidence, which may put further pressure on Keyence’s stock price.

Find out about the key risks to this Keyence narrative.Another View: What Does the SWS DCF Model Say?

Taking a step back from market multiples, our SWS DCF model looks at Keyence through a different lens and comes to the same conclusion. The analysis suggests the shares are still above fair value. Could the market be discounting risk, or is there more optimism than the fundamentals support?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Keyence Narrative

If you are not convinced by this view or want to dig deeper, the tools are available to shape your own story and insights in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Keyence.

Looking for more investment ideas?

Don't let opportunity pass you by. With so many stocks vying for attention, the right tools can help you move ahead of the crowd. Power up your portfolio and find strategies that set you apart. Act now and see what you could be missing.

- Unlock the potential of standout companies at bargain prices by checking out undervalued stocks based on cash flows.

- Start building passive income streams and discover top opportunities among dividend stocks with yields > 3%.

- Get ahead of the technology curve by tracking innovations among AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6861

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026