- Japan

- /

- Tech Hardware

- /

- TSE:6840

AKIBA Holdings Co.,Ltd. (TSE:6840) Screens Well But There Might Be A Catch

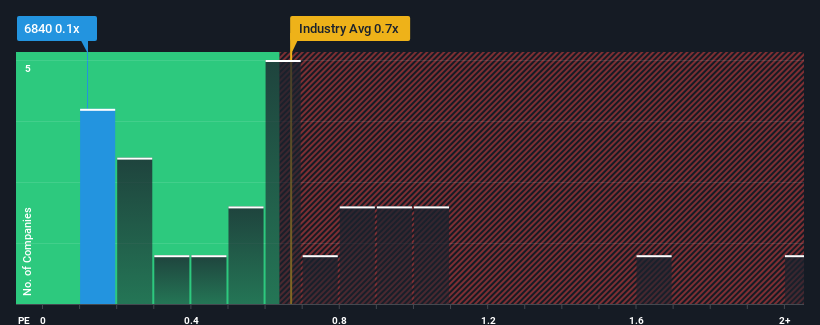

When close to half the companies operating in the Tech industry in Japan have price-to-sales ratios (or "P/S") above 0.7x, you may consider AKIBA Holdings Co.,Ltd. (TSE:6840) as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for AKIBA HoldingsLtd

What Does AKIBA HoldingsLtd's P/S Mean For Shareholders?

AKIBA HoldingsLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on AKIBA HoldingsLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on AKIBA HoldingsLtd will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For AKIBA HoldingsLtd?

The only time you'd be truly comfortable seeing a P/S as low as AKIBA HoldingsLtd's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Revenue has also lifted 5.3% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 3.0% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that AKIBA HoldingsLtd's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From AKIBA HoldingsLtd's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of AKIBA HoldingsLtd revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Having said that, be aware AKIBA HoldingsLtd is showing 5 warning signs in our investment analysis, and 2 of those can't be ignored.

If these risks are making you reconsider your opinion on AKIBA HoldingsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6840

AKIBA HoldingsLtd

Manufactures and sells electronic equipment and communication-related products.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026