- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6834

The Price Is Right For SEIKOH GIKEN Co., Ltd. (TSE:6834) Even After Diving 34%

SEIKOH GIKEN Co., Ltd. (TSE:6834) shares have retraced a considerable 34% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 28% in the last year.

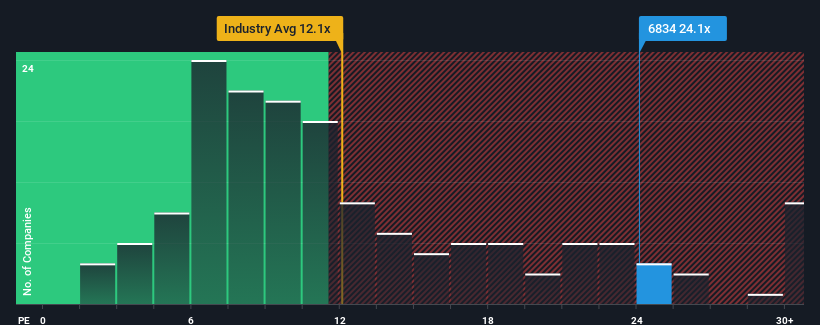

Although its price has dipped substantially, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may still consider SEIKOH GIKEN as a stock to avoid entirely with its 24.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

SEIKOH GIKEN hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for SEIKOH GIKEN

How Is SEIKOH GIKEN's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like SEIKOH GIKEN's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 30%. As a result, earnings from three years ago have also fallen 23% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the sole analyst watching the company. With the market only predicted to deliver 9.6% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that SEIKOH GIKEN's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, SEIKOH GIKEN's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of SEIKOH GIKEN's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - SEIKOH GIKEN has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6834

SEIKOH GIKEN

Engages in design, manufacture, and sale of optical components and lens, and radio over fiber products in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026