What's Cooking Group/SA And 2 Other Excellent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from the European Central Bank and fluctuating oil prices, investors are keenly observing sectors that show resilience and potential for steady returns. In this environment, dividend stocks have garnered attention for their ability to provide consistent income streams, making them an attractive option for those looking to balance growth with stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.40% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Globeride (TSE:7990) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.27% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.31% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.26% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.73% | ★★★★★★ |

Click here to see the full list of 2041 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

What's Cooking Group/SA (ENXTBR:WHATS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: What's Cooking Group NV/SA, along with its subsidiaries, produces and sells meat products and ready meals, with a market cap of €196.76 million.

Operations: The company's revenue is derived from two main segments: Savoury, contributing €463.60 million, and Ready Meals, generating €384.84 million.

Dividend Yield: 4%

What's Cooking Group/SA's dividend profile is robust, with stable and reliable payments over the past decade. The dividends are well-covered by earnings (51.6% payout ratio) and cash flows (15.6% cash payout ratio). Despite a volatile share price recently, the company trades at a favorable P/E ratio of 12.8x compared to the Belgian market average of 14.1x. Recent earnings growth underscores its potential for sustained dividend payouts, though its yield is modest at 4.04%.

- Get an in-depth perspective on What's Cooking Group/SA's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of What's Cooking Group/SA shares in the market.

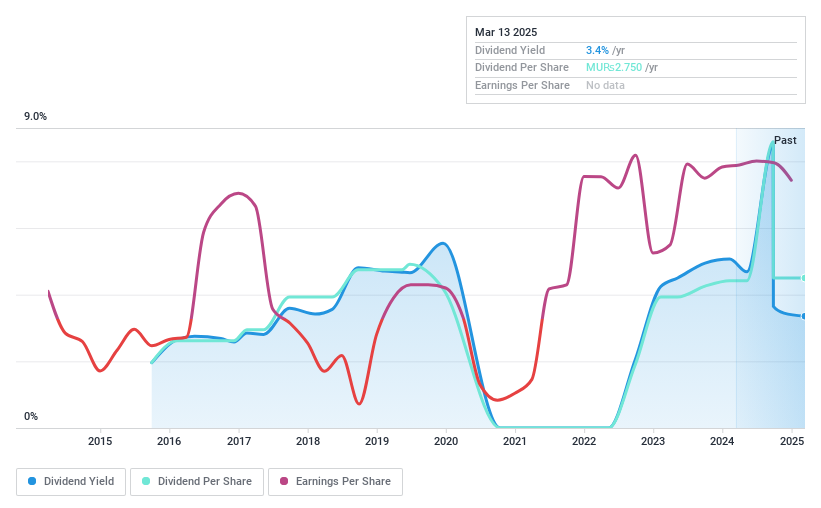

Medine (MUSE:MSE.N0000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Medine Limited, with a market cap of MUR8.61 billion, operates in Mauritius primarily through the cultivation of sugar cane alongside its subsidiaries.

Operations: Medine Limited generates revenue from several segments, including Casela (MUR432.66 million), Property (MUR3.76 billion), Education (MUR60.77 million), Agriculture (MUR917.98 million), and Sports & Hospitality (MUR266.26 million).

Dividend Yield: 6.4%

Medine Limited's dividend profile shows potential with a high yield of 6.4%, placing it in the top 25% of dividend payers in the MU market. The dividends are well-covered by earnings (45.4% payout ratio) and cash flows (14.9% cash payout ratio). However, its dividend history is less stable, having been paid for only nine years with some volatility. Recent earnings results indicate modest growth, which may support future payouts despite an unstable track record.

- Click here to discover the nuances of Medine with our detailed analytical dividend report.

- The analysis detailed in our Medine valuation report hints at an deflated share price compared to its estimated value.

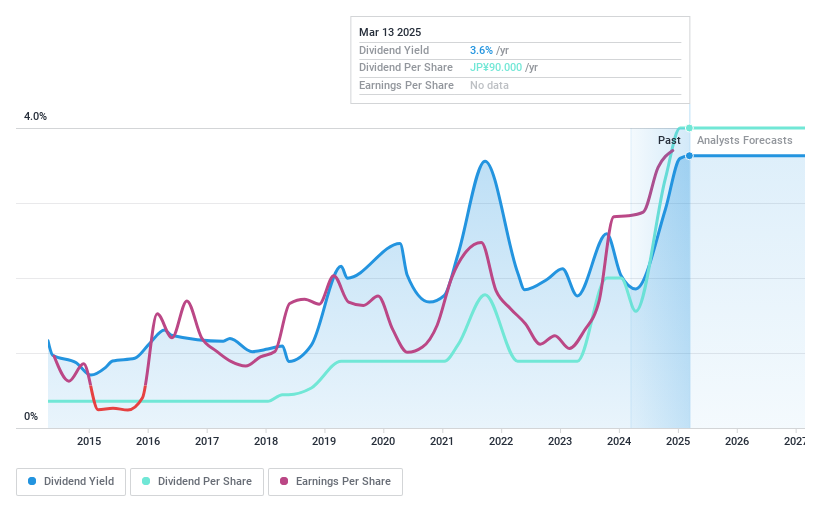

Furuno Electric (TSE:6814)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals globally, with a market cap of ¥69.71 billion.

Operations: Furuno Electric Co., Ltd. generates revenue from its marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and other international markets.

Dividend Yield: 3.3%

Furuno Electric's dividend yield of 3.3% is below the top quartile in Japan, and its dividends have shown volatility over the past decade despite growth. The payout ratio of 37.4% suggests dividends are well-covered by earnings, but cash flow coverage at 73.5% indicates some pressure. While trading significantly below estimated fair value, recent high share price volatility and forecasted earnings decline raise concerns about future dividend stability and sustainability.

- Dive into the specifics of Furuno Electric here with our thorough dividend report.

- The valuation report we've compiled suggests that Furuno Electric's current price could be quite moderate.

Taking Advantage

- Unlock our comprehensive list of 2041 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if What's Cooking Group/SA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:WHATS

What's Cooking Group/SA

Produces and sells meat products and ready meals.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives