- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6814

Furuno Electric (TSE:6814): Valuation in Focus After Upgraded Earnings and Dividend Forecasts

Reviewed by Simply Wall St

Furuno Electric (TSE:6814) announced a higher full-year earnings forecast after reporting better-than-expected second quarter results. The company also raised its annual and interim dividend guidance due to a positive profit outlook.

See our latest analysis for Furuno Electric.

It’s been a blockbuster run for Furuno Electric, with the share price jumping over 72% in the past month alone and notching a stunning 257% gain year-to-date. These moves follow a series of upbeat announcements, including upgraded earnings forecasts and sharply higher dividend guidance after the company outpaced expectations in the second quarter. The company’s one-year total shareholder return of 299% highlights sustained outperformance that has caught investors’ attention and adds context to the strong trading momentum now underway.

If you’re keen to see what else is surging in the market, consider broadening your search and discover fast growing stocks with high insider ownership

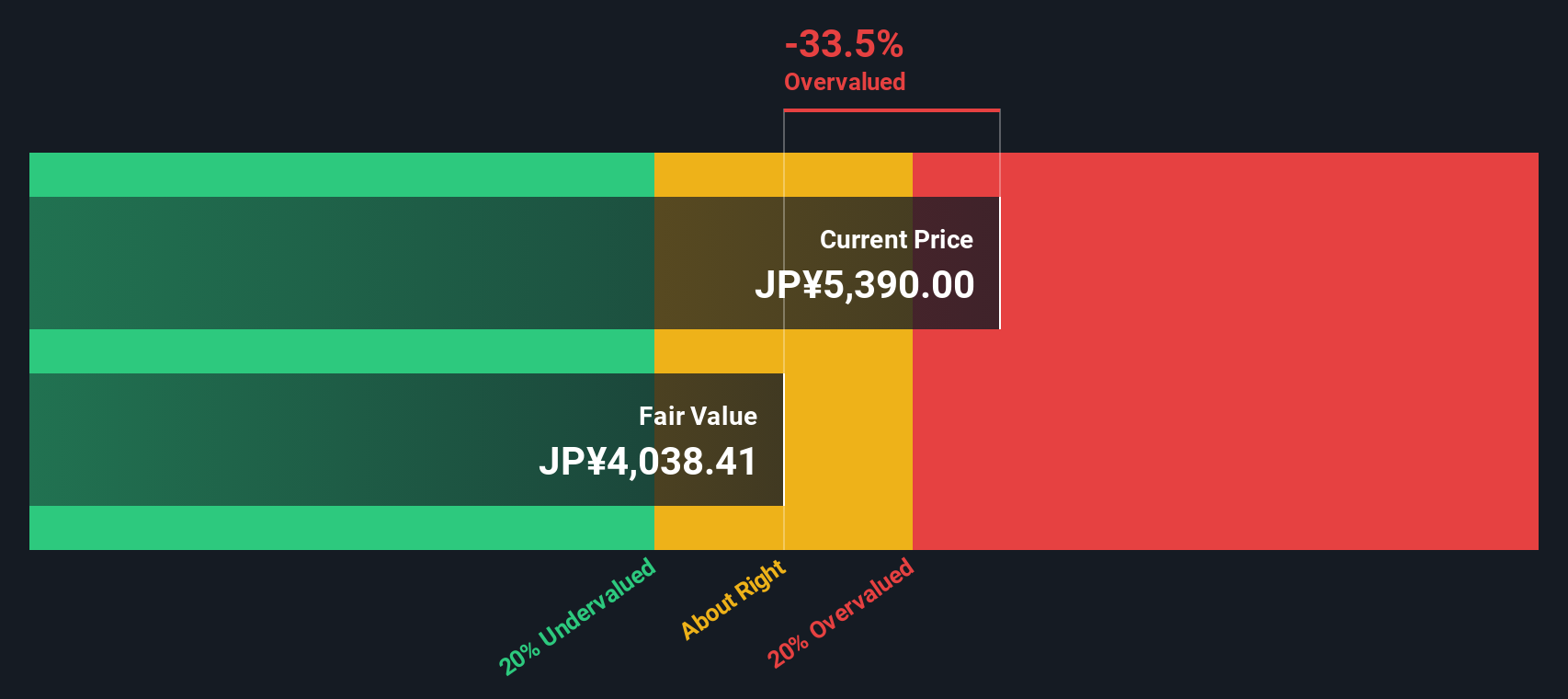

After this powerful rally, investors have to wonder if Furuno Electric’s valuation has room to run or if the current price already reflects its upgraded prospects. Is there a genuine buying opportunity here, or has the market already priced in future growth?

Price-to-Earnings of 17.7x: Is it justified?

Furuno Electric is trading at a price-to-earnings (P/E) ratio of 17.7x, which is notably higher than both its peer and industry averages. Despite recent share price performance, the current valuation signals that the market is assigning a premium for its prospects.

The P/E ratio is a common measure used to assess how much investors are willing to pay for a company’s earnings. For Furuno Electric, this higher multiple indicates strong expectations for future profits. It may also reflect the company’s rapid earnings growth and quality results in recent periods.

However, when compared to the JP Electronic industry average P/E of 14.9x and the peer average of 15.5x, Furuno Electric’s valuation appears considerably more expensive. According to fair value analysis, the estimated fair P/E for the stock stands lower at 13x, implying the market could eventually re-rate the shares closer to this benchmark if growth does not stay ahead.

Explore the SWS fair ratio for Furuno Electric

Result: Price-to-Earnings of 17.7x (OVERVALUED)

However, risks such as declining annual net income growth and Furuno Electric trading well above analyst price targets could challenge its strong bullish narrative.

Find out about the key risks to this Furuno Electric narrative.

Another View: Discounted Cash Flow Suggests Undervaluation

Looking at Furuno Electric through the SWS DCF model tells a very different story. This approach estimates the fair value at ¥28,522 per share, which is far above the recent market price. By this method, the shares appear significantly undervalued rather than expensive. Which view will the market trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Furuno Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Furuno Electric Narrative

If you want to reach your own conclusion or prefer to dig into the numbers yourself, you can quickly put together a personalized take in just a few minutes. So why not Do it your way.

A great starting point for your Furuno Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stepping beyond Furuno Electric, seize your chance to get ahead by exploring high-potential investment ideas that others might overlook. Don't leave opportunities on the table; your next standout pick could be just a click away.

- Tap into the unstoppable momentum of artificial intelligence by reviewing these 24 AI penny stocks, which are revolutionizing industries and driving tomorrow’s growth.

- Capture strong cash flow opportunities with these 879 undervalued stocks based on cash flows, highlighting companies trading below intrinsic value before they move higher.

- Harness the power of future medicine with these 33 healthcare AI stocks, featuring leading innovators improving health outcomes and reshaping the medical landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6814

Furuno Electric

Manufactures and sells marine and industrial electronics equipment, wireless LAN system, and handheld terminal in Japan, the Americas, Europe, rest of Asia, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives