- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6814

Furuno Electric (TSE:6814): Assessing Valuation After a Surge in Share Price Momentum

Reviewed by Simply Wall St

Price-to-Earnings of 12.6x: Is it Justified?

Based on its price-to-earnings (P/E) ratio, Furuno Electric is trading at 12.6 times its earnings, which is lower than both the industry and peer averages. This suggests the stock could be undervalued relative to its sector, at least by this measure.

The P/E ratio compares a company's share price to its earnings per share. It serves as a quick gauge of whether investors are paying more or less for each unit of earnings compared to similar businesses. For technology and electronics companies, P/E ratios help investors weigh current profits against the business's future growth prospects.

Given that Furuno Electric's multiple is below the average for the Japanese electronic industry, the market may not be fully pricing in its recent profitability growth or could be cautious about future earnings. The current valuation suggests some room for upside if the company continues to execute or surprises with stronger-than-expected financial performance.

Result: Fair Value of ¥5460 (ABOUT RIGHT)

See our latest analysis for Furuno Electric.However, sluggish net income growth and a recent dip in short-term returns could signal that optimism around Furuno Electric may be getting ahead of itself.

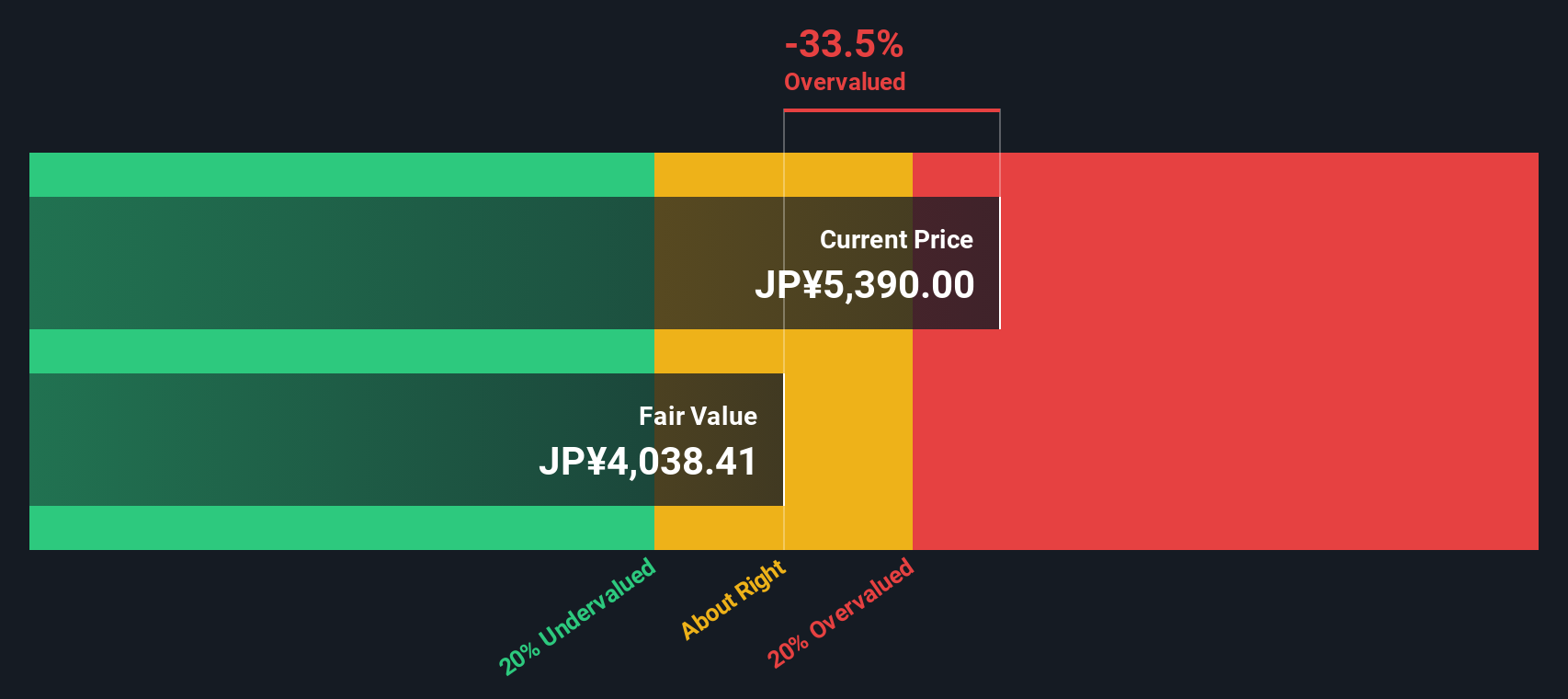

Find out about the key risks to this Furuno Electric narrative.Another View: What Does the SWS DCF Model Say?

Taking a different approach, our DCF model currently points in the opposite direction and suggests the shares could be trading well above their estimated fair value. When valuation methods disagree, it is worth asking what the market sees that the models do not. Could sentiment or future expectations be skewing the picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Furuno Electric Narrative

If you see things differently or like to dig into the numbers on your own, you can assemble your own take in just a few minutes. Do it your way

A great starting point for your Furuno Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never stop at just one idea. Make the most of your research with Simply Wall Street’s powerful tools and uncover stocks that could offer exceptional value, potential, and innovation. Don’t miss out—these screens can help you spot tomorrow’s winners today.

- Tap into steady earnings and build your wealth by exploring companies paying out dividend stocks with yields > 3% for yields over 3%.

- Spot hidden gems trading below their true worth with our screen for undervalued stocks based on cash flows and elevate your investment strategy.

- Capture early growth in groundbreaking tech by scanning rising stars among AI penny stocks pushing artificial intelligence forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6814

Furuno Electric

Manufactures and sells marine and industrial electronics equipment, wireless LAN system, and handheld terminal in Japan, the Americas, Europe, rest of Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives