- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6787

Assessing Meiko Electronics (TSE:6787) Valuation After Strategic AI Server Alliance and Vietnam Expansion

Reviewed by Kshitija Bhandaru

Meiko Electronics (TSE:6787) has unveiled plans for a business alliance with Allied Circuit, aiming at the growing AI server market. The partnership will result in a new joint venture and manufacturing facility in Vietnam.

See our latest analysis for Meiko Electronics.

Meiko Electronics’ latest strategic partnership with Allied Circuit arrives at an intriguing moment, with the company’s 1-year total shareholder return of 0.57% signaling muted but positive momentum amid ambitious expansion plans. As investors weigh the potential for growth in the AI server sector against recent stability in share price, the announcement could mark a turning point for market sentiment.

If this move into AI hardware piques your interest, you may want to see how other tech innovators are advancing. Check out See the full list for free..

Given Meiko Electronics’ solid fundamentals and its current discount to analyst price targets, the question for investors is whether this strategic expansion signals an undervalued growth story or if the market has already priced in the next chapter.

Price-to-Earnings of 15.8x: Is it justified?

With Meiko Electronics priced at a 15.8x price-to-earnings multiple, investors are paying slightly less for each unit of earnings compared to its peer group, but a premium versus the broader industry peer average. The latest close price of ¥9,450 sits below analyst targets, making this an intriguing valuation setup.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of current earnings. It is especially telling for established tech manufacturers like Meiko Electronics, as it reflects the balance of earnings quality, growth prospects, and broader market sentiment toward the company's core business.

At 15.8x, Meiko stands as a relative value compared to the peer average (17.3x). This suggests the market is not overstating its growth or profitability prospects versus direct competitors. However, this multiple appears expensive against the overall Japanese Electronic industry average (14.2x). This indicates that the market is assigning a modest premium, potentially driven by Meiko's above-market profit growth and improved margins. Notably, this multiple is still below the company’s estimated fair price-to-earnings ratio (21.5x), implying there may be room for re-rating if the narrative around profitability strengthens and market conditions remain supportive.

Explore the SWS fair ratio for Meiko Electronics

Result: Price-to-Earnings of 15.8x (ABOUT RIGHT)

However, competitive pressures in the AI hardware space and uncertainty around global supply chains could quickly alter Meiko Electronics' current trajectory.

Find out about the key risks to this Meiko Electronics narrative.

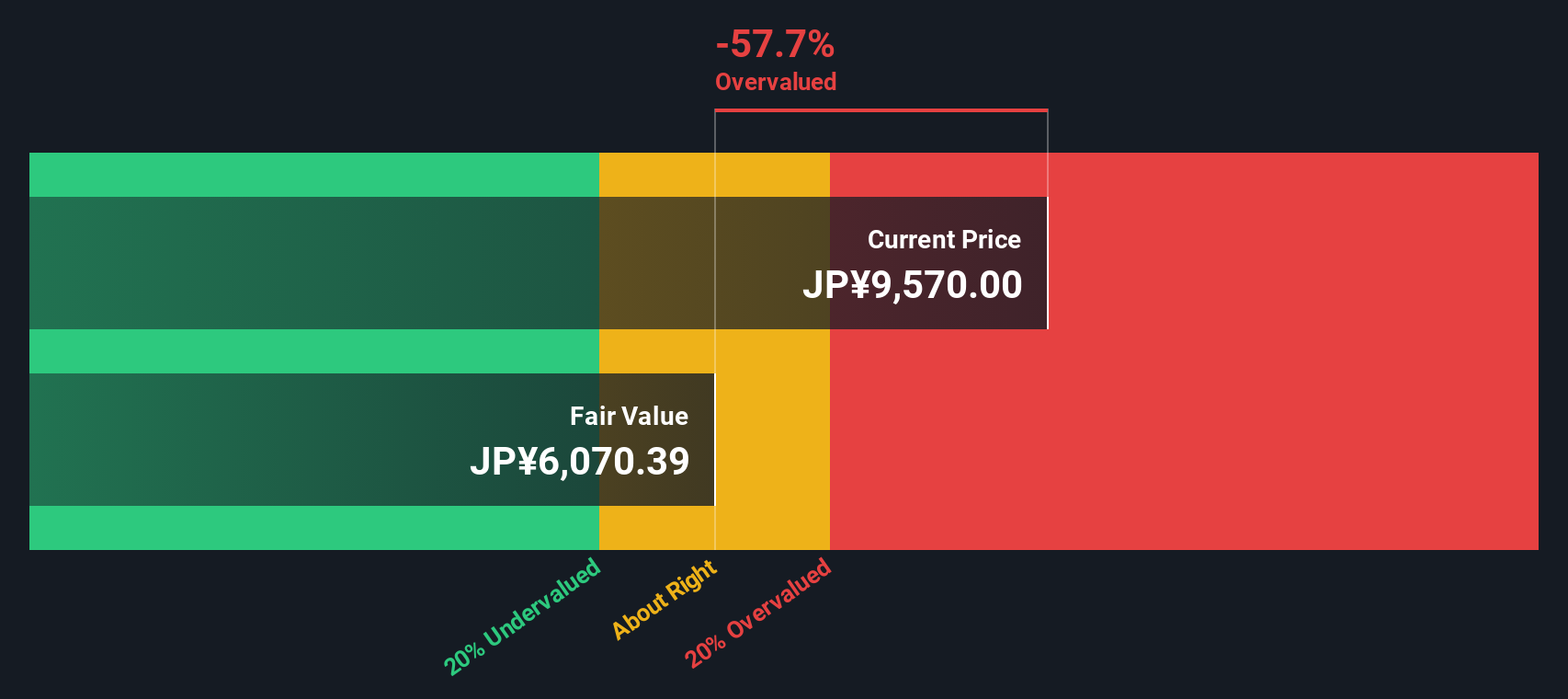

Another View: SWS DCF Model Suggests Overvaluation

While valuation based on earnings multiples hints at potential upside, our SWS DCF model offers a different perspective. It indicates that Meiko Electronics may be trading above its estimated intrinsic value, suggesting the market could be overvaluing future cash flows. Could the multiples be misleading in the face of uncertain growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meiko Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meiko Electronics Narrative

If you see things differently or prefer to dive into the details yourself, you can craft your own analysis in just a few minutes. Do it your way.

A great starting point for your Meiko Electronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on stocks making headlines for the right reasons. Use Simply Wall Street’s powerful Screener to spot fresh opportunities that could electrify your portfolio.

- Capture consistent income streams by targeting these 19 dividend stocks with yields > 3% offering yields above 3% and strong payout reliability.

- Seize the edge in artificial intelligence by finding leaders among these 24 AI penny stocks as they transform tomorrow’s industries and upgrade today’s portfolios.

- Ride the momentum of rapid innovation by scanning these 26 quantum computing stocks to connect with companies pioneering groundbreaking quantum computing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6787

Meiko Electronics

Engages in the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics in Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives