- Japan

- /

- Construction

- /

- TSE:9765

Discover AP (Thailand) And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing the implications of recent interest rate adjustments and economic data. Amidst these fluctuations, dividend stocks continue to attract attention for their potential to provide steady income streams in volatile times. In this context, understanding what makes a strong dividend stock—such as consistent payouts and financial stability—can be particularly valuable for those seeking resilience in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AP (Thailand) (SET:AP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AP (Thailand) Public Company Limited, with a market cap of THB26.90 billion, operates in the real estate development sector in Thailand through its subsidiaries.

Operations: AP (Thailand) Public Company Limited generates revenue from its Low-Rise Segment, which accounts for THB32.09 billion, and its High-Rise Segment, contributing THB3.46 billion.

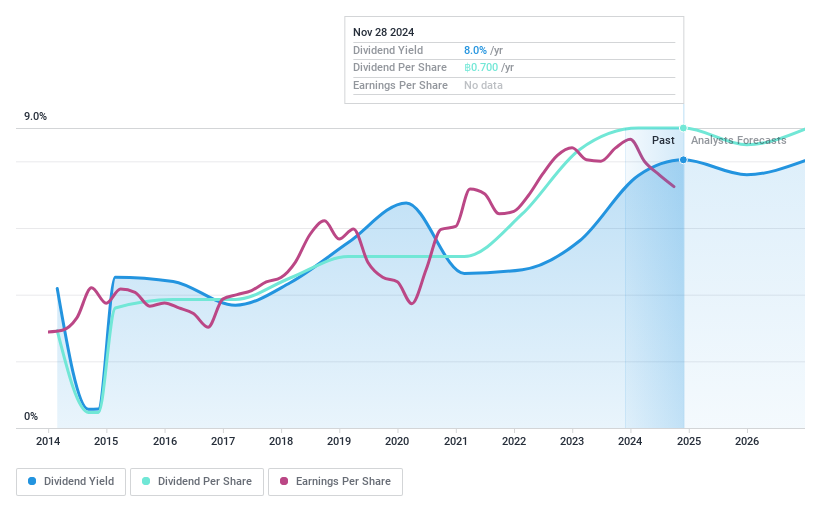

Dividend Yield: 8.2%

AP (Thailand) offers a high dividend yield of 8.19%, placing it in the top 25% of payers in the Thai market. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 234.4%. Despite a low payout ratio of 43.5%, indicating coverage by earnings, past dividend payments have been volatile and unreliable. Recent earnings showed decreased net income year-over-year, highlighting potential financial challenges.

- Unlock comprehensive insights into our analysis of AP (Thailand) stock in this dividend report.

- According our valuation report, there's an indication that AP (Thailand)'s share price might be on the cheaper side.

Nihon Dempa Kogyo (TSE:6779)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nihon Dempa Kogyo Co., Ltd. manufactures and sells quartz crystal devices across Japan, the rest of Asia, Europe, and North America, with a market cap of ¥19.81 billion.

Operations: Nihon Dempa Kogyo Co., Ltd. generates its revenue through the production and distribution of quartz crystal devices across various regions, including Japan, Asia, Europe, and North America.

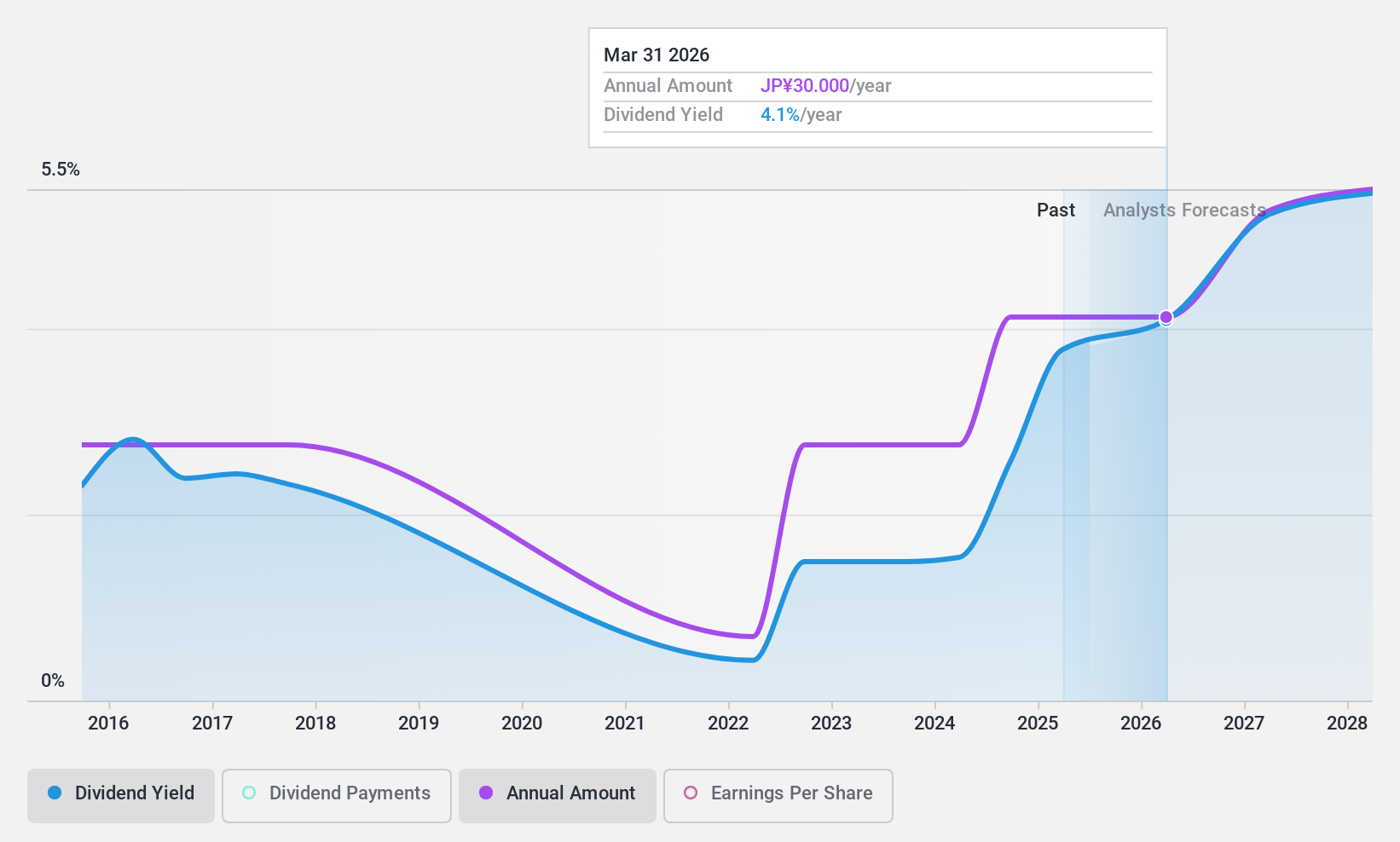

Dividend Yield: 3.5%

Nihon Dempa Kogyo's dividend payments are supported by both earnings and cash flows, with a payout ratio of 27.1% and a cash payout ratio of 67.4%. However, its dividend yield of 3.49% is below the top quartile in Japan, and past dividends have shown volatility. The stock trades at a significant discount to its estimated fair value, suggesting potential upside despite its unstable dividend history. Earnings are projected to grow significantly, which may enhance future payouts.

- Get an in-depth perspective on Nihon Dempa Kogyo's performance by reading our dividend report here.

- Our expertly prepared valuation report Nihon Dempa Kogyo implies its share price may be lower than expected.

Ohba (TSE:9765)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ohba Co., Ltd. offers consulting services for city planning projects in Japan and has a market capitalization of approximately ¥15.79 billion.

Operations: Ohba Co., Ltd.'s revenue segments include consulting services for city planning projects in Japan.

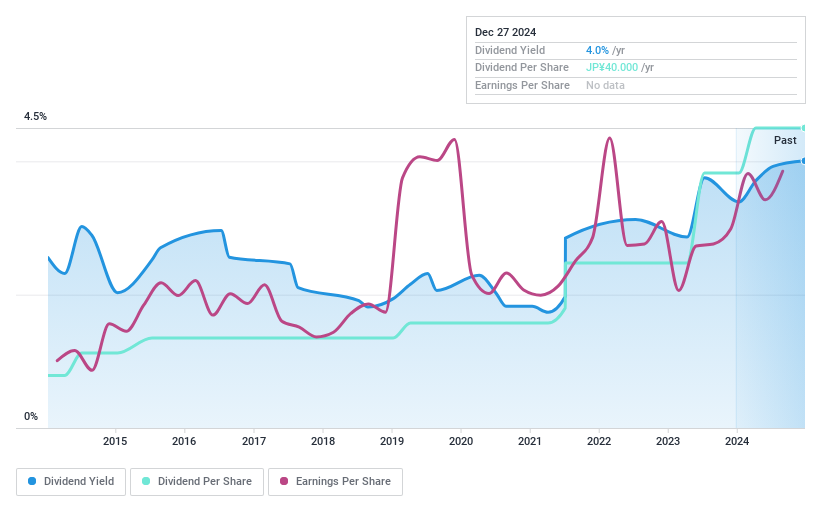

Dividend Yield: 4%

Ohba's dividend yield of 4.04% ranks in the top 25% of Japanese dividend payers, with stable and growing dividends over the past decade. Despite a low payout ratio of 39.3%, dividends aren't covered by free cash flows, raising sustainability concerns. The company recently completed a share buyback, acquiring shares worth ¥149.99 million, which may impact future financial flexibility but reflects management's confidence in its valuation given its lower P/E ratio than the market average.

- Take a closer look at Ohba's potential here in our dividend report.

- The analysis detailed in our Ohba valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Click this link to deep-dive into the 1953 companies within our Top Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9765

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives