- Japan

- /

- Tech Hardware

- /

- TSE:6736

Assessing Sun (TSE:6736) Valuation Following Completion of 1.33% Share Buyback Program

Reviewed by Kshitija Bhandaru

Sun (TSE:6736) has just wrapped up its latest buyback, repurchasing 297,200 shares, about 1% of its outstanding stock, between August and September 2025. This move concludes the buyback program launched earlier this year and adds a new angle for investors to consider as they evaluate Sun’s valuation and future direction.

See our latest analysis for Sun.

Sun’s share price has posted a remarkable rebound, climbing 37% in the past month and 70% over the last quarter. This signals gathering momentum after its recent buyback and caps off an 18.8% total shareholder return over the past year. Despite some volatility earlier in the year, Sun’s longer-term performance metrics hint at persistent growth potential beyond this recent surge.

If you’re looking for a fresh angle or the next breakout, this is a perfect opportunity to explore fast growing stocks with high insider ownership.

With shares now trading near recent highs, the pressing question is whether Sun’s robust rally signals ongoing undervaluation or if the market has already factored in the company’s future growth. Could there still be a buying opportunity here?

Price-to-Earnings of 11x: Is it justified?

Sun trades at a price-to-earnings (P/E) ratio of 11x, noticeably below both its immediate industry peers and the broader JP market. With shares last closing at ¥9,310, this multiple suggests investors are paying less for each yen of current earnings compared to competitors.

The price-to-earnings ratio is a widely used benchmark for valuing companies, especially in the tech sector where growth expectations often play a central role. A lower-than-average P/E usually signals skepticism over the sustainability of current earnings, or it can present a hidden bargain if profits are set to grow.

Compared to the JP Tech industry average of 15x and the market’s 14.7x, Sun’s 11x ratio stands out as a relative value play. Not only is it cheaper than its industry and market, but it also highlights that the market might be underestimating Sun’s earnings potential following its profitable turn.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11x (UNDERVALUED)

However, Sun’s growth could still be interrupted by unforeseen market shifts or weaker than expected earnings, both of which may challenge its current valuation.

Find out about the key risks to this Sun narrative.

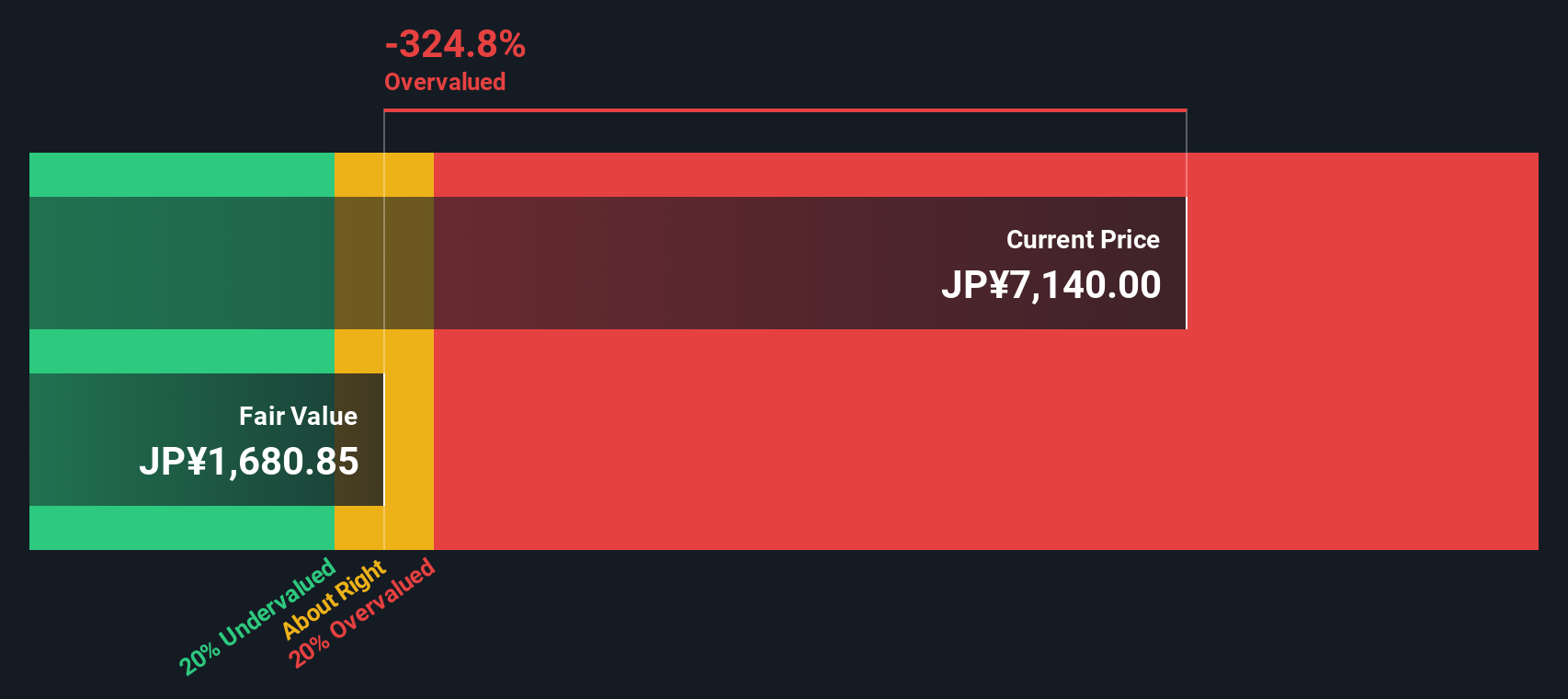

Another View: The DCF Model Signals Caution

While Sun's low price-to-earnings ratio points to relative value, our SWS DCF model tells a much different story. According to this method, the stock is trading well above its estimated fair value. This suggests that the recent optimism may be running ahead of fundamentals. Could this mean investors are ignoring key risks, or is the market seeing something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sun for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sun Narrative

If you’re inclined to dig into the numbers yourself or take a different perspective, you can piece together your own take in just a few minutes, and Do it your way.

A great starting point for your Sun research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next investing move count by putting smart, pre-screened ideas at your fingertips. Don't wait while others seize the latest trends and emerging winners.

- Tap into hidden value by checking out these 895 undervalued stocks based on cash flows based on strong, forward-looking cash flows.

- Maximize your search for income and stability with these 19 dividend stocks with yields > 3% featuring high yield and solid fundamentals.

- Ride the wave of innovation and examine these 25 AI penny stocks leading the AI transformation across industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6736

Sun

Engages in the mobile data solutions, entertainment, information technology, and other businesses in Japan.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives