The board of Seiko Epson Corporation (TSE:6724) has announced that it will pay a dividend of ¥37.00 per share on the 2nd of December. This means the dividend yield will be fairly typical at 2.9%.

View our latest analysis for Seiko Epson

Seiko Epson's Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, Seiko Epson was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 11.1%. If the dividend continues on this path, the payout ratio could be 44% by next year, which we think can be pretty sustainable going forward.

Seiko Epson Has A Solid Track Record

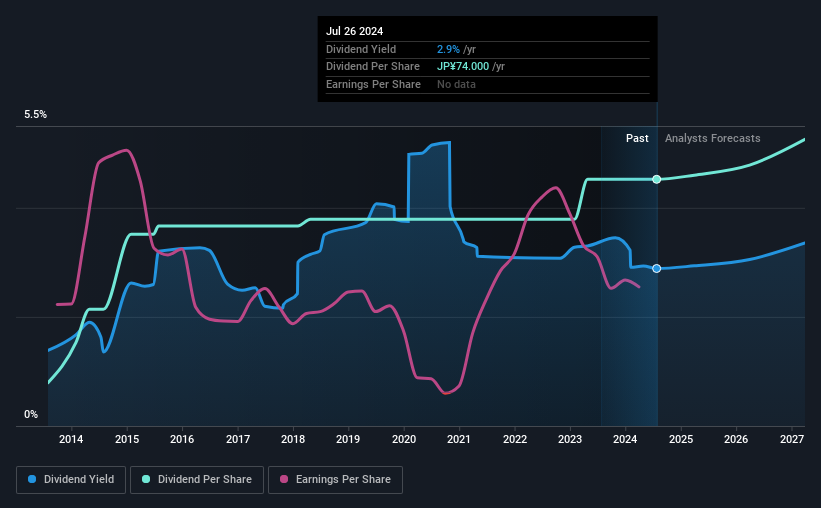

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the annual payment back then was ¥13.00, compared to the most recent full-year payment of ¥74.00. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

Seiko Epson May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately, Seiko Epson's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. Growth of 0.8% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

We Really Like Seiko Epson's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 8 analysts we track are forecasting for Seiko Epson for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6724

Seiko Epson

Develops, manufactures, sells, and provides services for products in the printing solutions, visual communications, manufacturing-related and wearables, and other businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026