- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6703

How Investors May Respond To Oki Electric Industry (TSE:6703) Expanding Digital Manufacturing Solutions in Southeast Asia

Reviewed by Sasha Jovanovic

- On November 25, 2025, Oki Electric Industry Co., Ltd. launched its Projection Assembly System in Thailand and Indonesia, introducing projector-based task guidance and image sensing technologies to local manufacturing sites as part of its global digital transformation solutions expansion.

- This expansion leverages OKI’s experience from over 100 sites in Japan to help address workforce diversity and quality control challenges in Southeast Asia, providing multilingual support and local collaboration.

- We'll now explore how OKI’s move to expand digital transformation solutions in manufacturing could shape its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Oki Electric Industry's Investment Narrative?

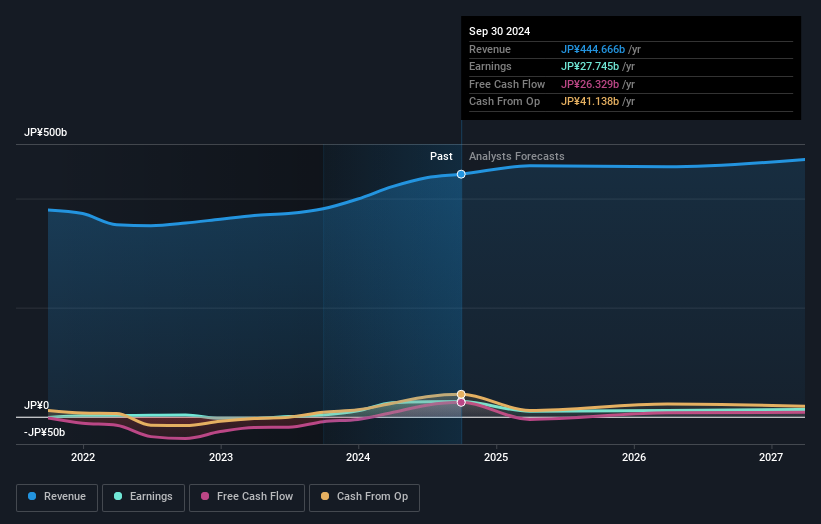

For investors considering Oki Electric Industry today, the big picture rests on whether the company can successfully translate its track record of digital transformation and innovation into sustainable growth, especially as it steps up global expansion. The recent launch of the Projection Assembly System in Southeast Asia highlights OKI’s ambition to address ongoing challenges in manufacturing, such as workforce diversity and quality control, by leveraging proprietary technologies proven in Japan. This move could become a meaningful short-term catalyst if early adoption in Thailand and Indonesia leads to wider acceptance and revenue contributions outside Japan. It also counters some previous concerns about the pace of internationalization and competitive differentiation. However, the business still faces real risks, including volatile profit margins, slow forecast revenue growth compared to the broader market, and high board turnover. While the news is a step forward strategically, it does not eliminate these hurdles completely. On the flip side, high board turnover still remains an issue investors should watch closely.

Oki Electric Industry's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Oki Electric Industry - why the stock might be worth as much as ¥263!

Build Your Own Oki Electric Industry Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oki Electric Industry research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oki Electric Industry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oki Electric Industry's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6703

Oki Electric Industry

Manufactures and sells products, technologies, software, and solutions for telecommunication and information systems in Japan and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.