- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6645

OMRON (TSE:6645): A Fresh Look at Valuation Following Subtle Share Price Moves

Reviewed by Kshitija Bhandaru

OMRON (TSE:6645) Stock Moves Prompt Fresh Questions for Investors

When a stock like OMRON (TSE:6645) starts to make subtle but persistent moves, it is only natural for investors to sit up and take notice. While there has not been a specific headline-grabbing event, the recent shifts in OMRON’s share price are catching the attention of market watchers, especially those watching for early signs of a turnaround or further pressure. For anyone considering what to do with their OMRON holdings, it is a moment that invites a deeper look. Are these movements just noise, or could there be more to the story?

Zooming out, OMRON’s performance over the past year has been marked by a pronounced downturn, with the stock seeing a 31% decline in total return. Shorter-term momentum, however, hints at something different: over the past month, shares have rebounded by 11%. A similar pattern is visible over the past quarter, suggesting that while the long-term trend remains negative, there may be a shift underway following a particularly rough stretch. Annual growth in revenue and net income also adds some color to the recent moves, though the broader context remains cautious.

After a year defined by setbacks and a recent uptick in price, is OMRON now at a compelling entry point, or is the market already factoring in its future growth?

Price-to-Earnings of 25.3x: Is it justified?

Based on its Price-to-Earnings (P/E) ratio of 25.3x, OMRON appears expensive when compared to both its peer group average of 29.1x and the broader Japanese Electronic industry, which posts an average of 14.7x.

The Price-to-Earnings ratio is a commonly used metric that expresses a company's current share price relative to its per-share earnings. For technology and electronics companies like OMRON, it reflects how optimistic investors are about future profitability and growth. This makes it especially relevant in assessing whether a stock is priced attractively or carries a premium.

Although OMRON boasts higher-quality earnings and an experienced management team, its P/E multiple stands out as rich given its slower revenue growth and below-average return on equity. This suggests that the market may be overestimating near-term growth or is pricing in a faster turnaround than fundamentals support.

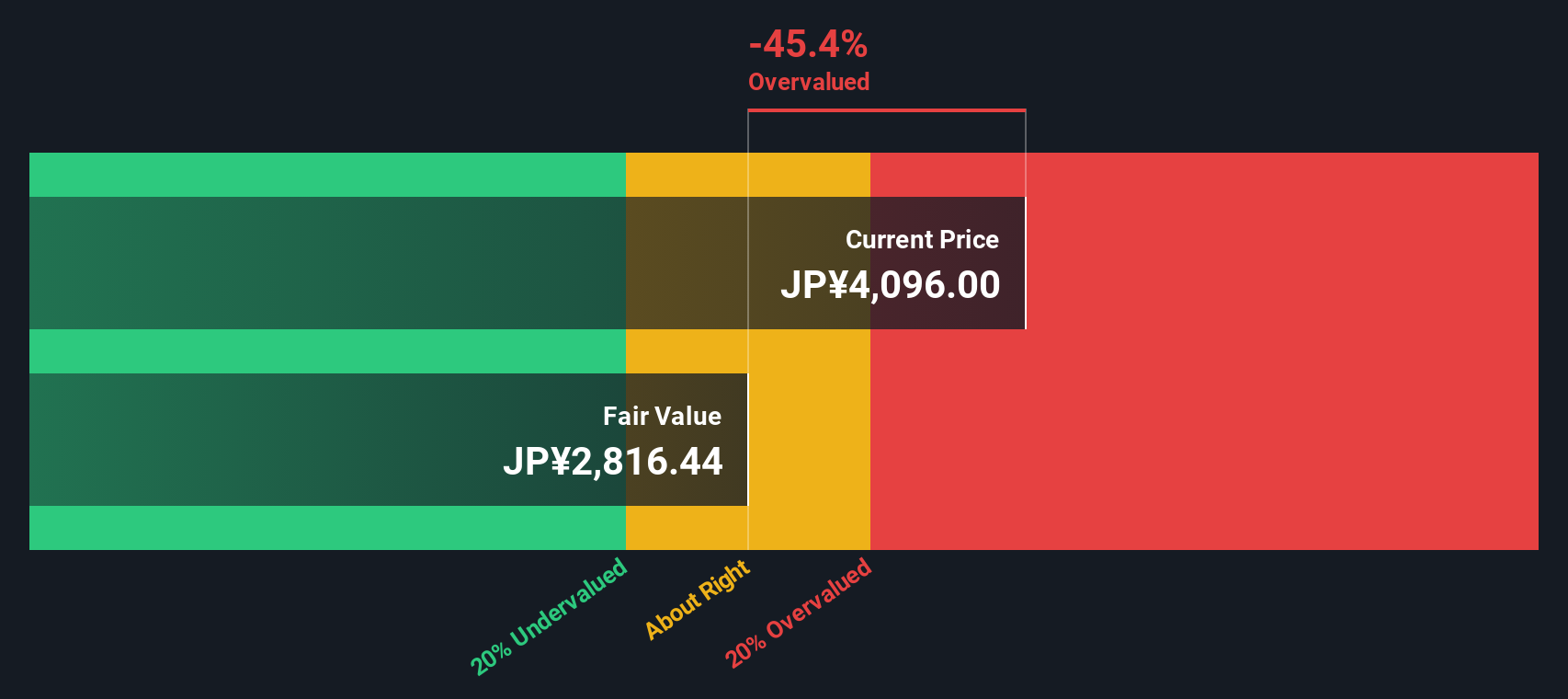

Result: Fair Value of ¥2,795.85 (OVERVALUED)

See our latest analysis for OMRON.However, weaker long-term returns and slow revenue growth may present challenges to any sustained recovery in OMRON’s share price in the near term.

Find out about the key risks to this OMRON narrative.Another View: SWS DCF Model Offers a Contrasting Take

While the earnings multiple suggests OMRON is trading at a premium, our SWS DCF model provides a very different perspective. This indicates the stock is overvalued based on underlying cash flows. Could one method be missing what the other sees?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OMRON Narrative

If this perspective does not resonate, or you would rather dig into the numbers firsthand, it is quick and easy to form your own view. Often, this can be done in just a few minutes. Do it your way

A great starting point for your OMRON research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let your next opportunity pass you by. Upgrade your investing strategy and spot standout stocks with these powerful, hand-picked ideas from Simply Wall Street:

- Grow your portfolio with steady income by tapping into high-yield opportunities through our dividend stocks with yields > 3%.

- Uncover the next technology game-changers in the quantum space by accessing the quantum computing stocks.

- Catch strong companies trading below their real value by starting with our exclusive list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6645

OMRON

Engages in industrial automation, device and module solutions, data solution business, social systems, and healthcare businesses internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives