- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

High Growth Tech Stocks To Watch For Potential Opportunities

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite closing a strong year despite recent slumps, investors are keenly watching economic indicators like the Chicago PMI and GDP forecasts that suggest potential headwinds. In this dynamic environment, identifying high-growth tech stocks requires careful consideration of their ability to innovate and adapt amidst fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.38% | 51.81% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.23% | 56.37% | ★★★★★★ |

| TG Therapeutics | 29.99% | 44.07% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1256 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

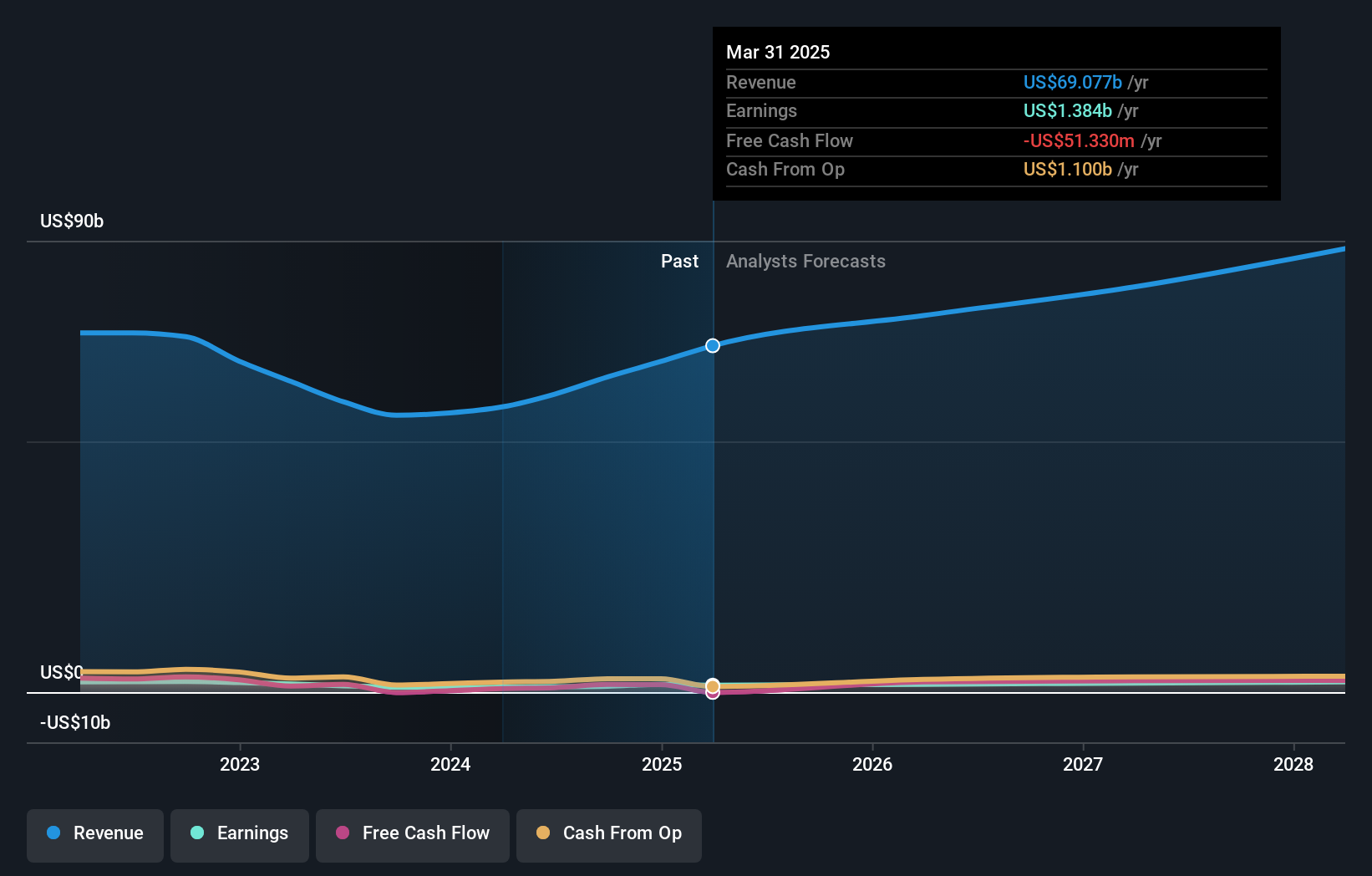

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market capitalization of approximately HK$118.22 billion.

Operations: The company generates revenue primarily through its Intelligent Devices Group (IDG), Solutions and Services Group (SSG), and Infrastructure Solutions Group (ISG), with IDG contributing the largest share at $47.76 billion. The Infrastructure Solutions Group follows with $11.47 billion, while the Solutions and Services Group adds $7.89 billion to the overall revenue stream.

Lenovo Group has demonstrated robust growth in its tech sector, notably outpacing the Hong Kong market with a 21.5% increase in earnings over the past year, significantly higher than the industry average. This performance is underpinned by strategic investments such as the recent US$2 billion infusion into AI technologies and a successful HKD 15.55 billion bond issuance, which highlight Lenovo's aggressive expansion and innovation strategy. The company's focus on integrating AI across its product lines, including the new AI-powered solutions unveiled at CES® 2025, positions it well for sustained growth amidst rising global demand for advanced tech solutions.

- Take a closer look at Lenovo Group's potential here in our health report.

Assess Lenovo Group's past performance with our detailed historical performance reports.

Inmyshow Digital Technology(Group)Co.Ltd (SHSE:600556)

Simply Wall St Growth Rating: ★★★★★☆

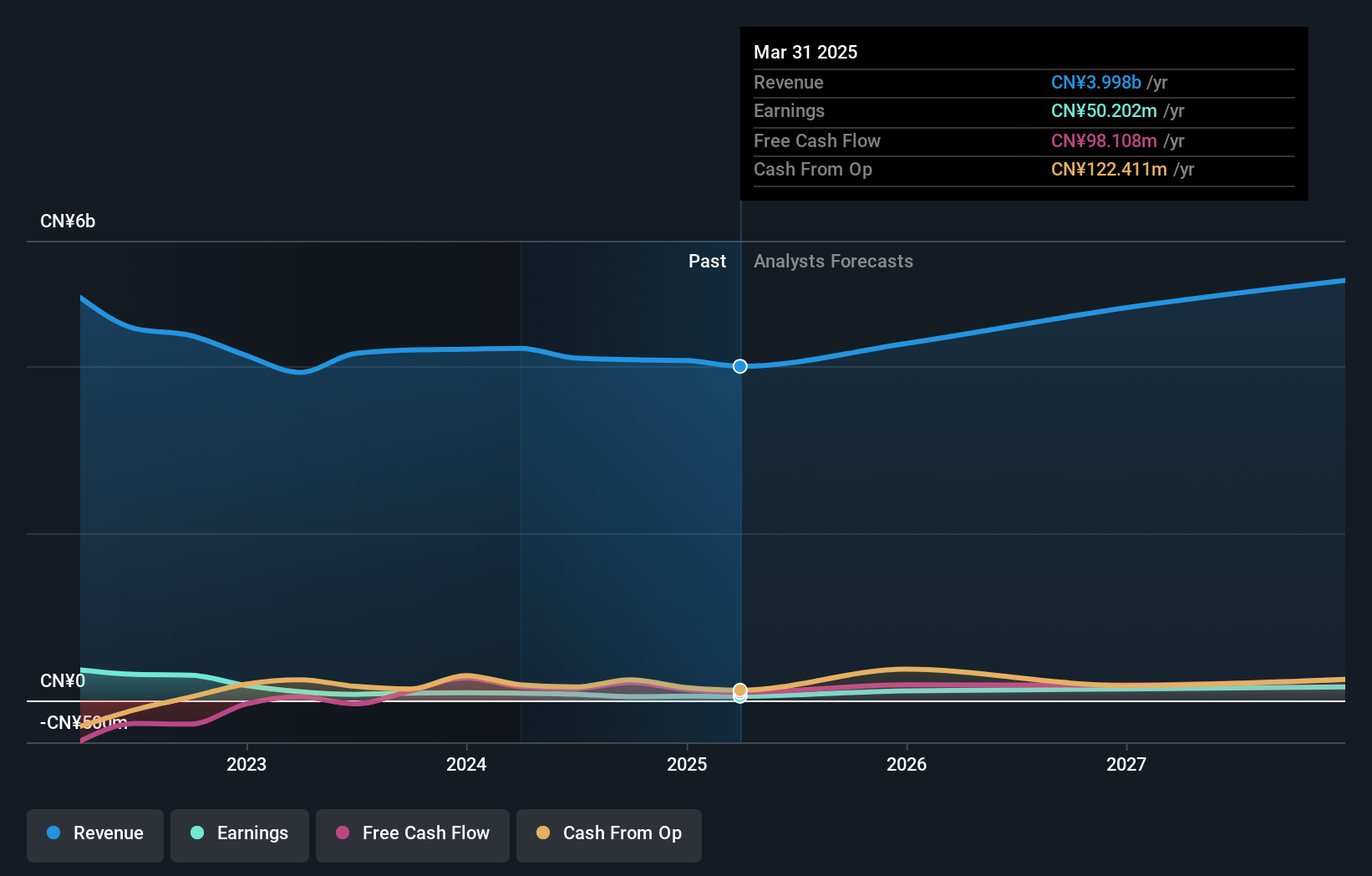

Overview: Inmyshow Digital Technology (Group) Co., Ltd. operates in the digital technology sector with a market cap of CN¥8.97 billion.

Operations: The company generates revenue primarily through digital marketing services and interactive entertainment. It focuses on leveraging technology to enhance advertising effectiveness and consumer engagement. The financial performance highlights a net profit margin trend at 12.5%, indicating efficient cost management relative to revenue generation.

Inmyshow Digital Technology has faced challenges, as evidenced by a notable 48.5% decline in earnings over the past year, contrasting sharply with a less severe industry average downturn of 10.2%. Despite these hurdles, the company's revenue growth forecast at an impressive 23.7% annually signals potential resilience and adaptation in a competitive landscape. Furthermore, with R&D investments aligning closely with evolving market demands—underscored by an ambitious projected annual earnings growth rate of 64.2%—Inmyshow is strategically positioning itself to leverage technological advancements and enhance its market presence effectively.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

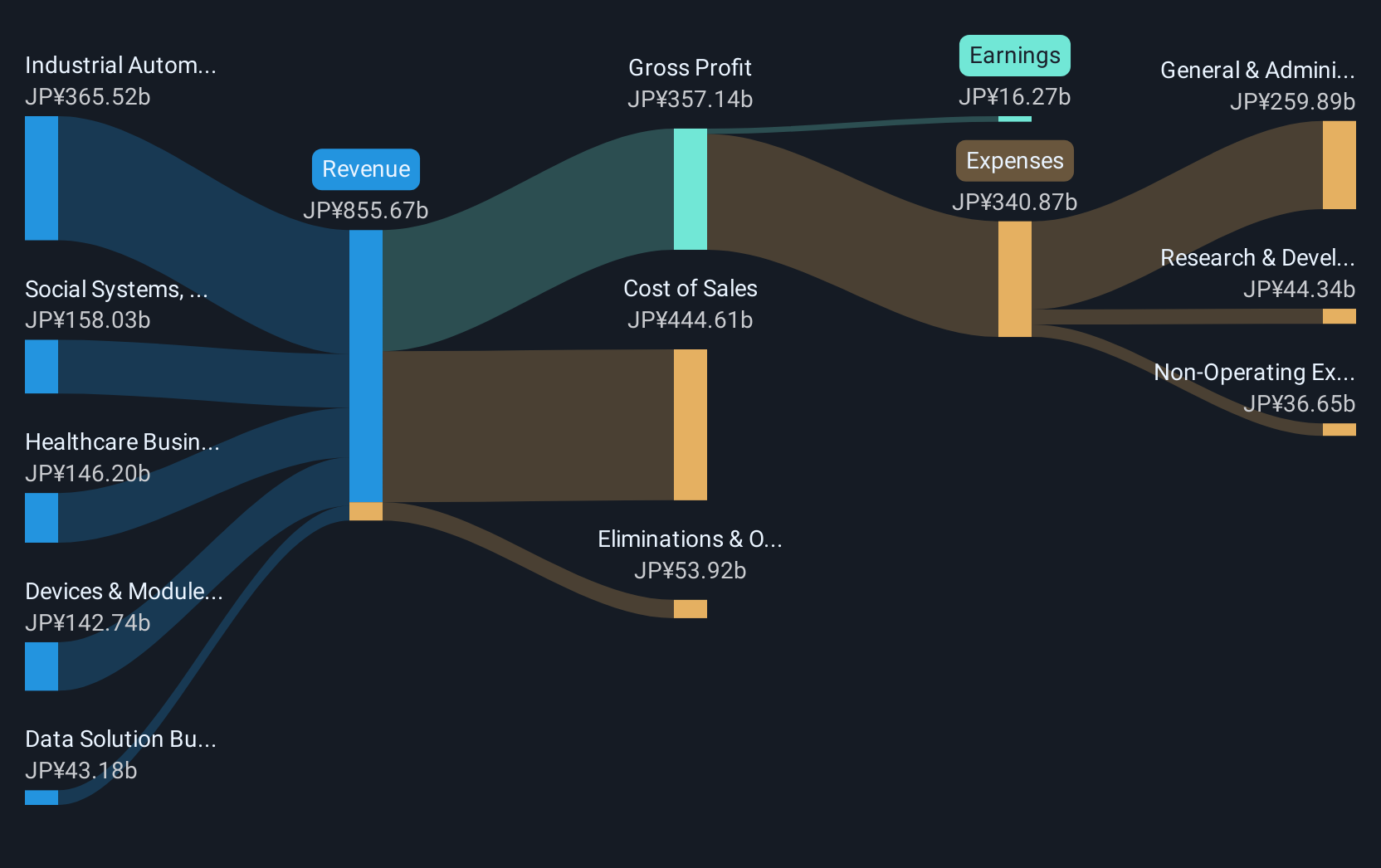

Overview: OMRON Corporation operates globally in the fields of industrial automation, device and module solutions, social systems, and healthcare with a market capitalization of ¥971.28 billion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business, which accounts for ¥362.56 billion, followed by the Social Systems, Solutions and Service Business at ¥157.64 billion, and the Healthcare Business contributing ¥148.58 billion. The Devices & Module Solutions segment adds another significant revenue stream of ¥139.57 billion to the company's diverse portfolio.

OMRON's strategic maneuvers, including a substantial ¥40 billion Shelf Registration for bonds and consistent dividend payouts, underscore its financial agility amidst market fluctuations. With an upward revision in earnings guidance to a net income of ¥11 billion from an earlier ¥8.5 billion, the company is not just navigating but potentially thriving in challenging conditions. This resilience is amplified by its R&D focus, crucial for maintaining competitive edge in the high-tech industry where innovation leads market trends. The firm's commitment to research and development, coupled with a promising forecast of 44.05% annual earnings growth and becoming profitable within three years, positions OMRON as a noteworthy contender in the tech landscape despite current unprofitability.

- Click to explore a detailed breakdown of our findings in OMRON's health report.

Review our historical performance report to gain insights into OMRON's's past performance.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1256 High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives