- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6645

High Growth Tech Stocks In Japan To Watch This September 2024

Reviewed by Simply Wall St

Japan's stock markets have seen a notable rise recently, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weakened yen following the U.S. Federal Reserve's significant rate cut. This positive momentum in Japanese equities creates an opportune backdrop for investors to explore high-growth tech stocks that are poised to capitalize on favorable market conditions and technological advancements.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Infocom (TSE:4348)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infocom Corporation offers IT solutions and services to various sectors including medical institutions, corporations, public agencies, educational institutions, and research facilities in Japan with a market cap of ¥332.05 billion.

Operations: Infocom Corporation generates revenue primarily from IT Services and Internet Business, with ¥27.81 billion and ¥58.87 billion respectively. The company serves a diverse range of sectors in Japan including medical, corporate, public agencies, educational institutions, and research facilities.

Infocom, amidst a dynamic tech landscape in Japan, is navigating through significant shifts with its recent delisting from the Tokyo Stock Exchange and notable acquisition by Blackstone Inc. Despite these changes, Infocom's financial health appears robust; its revenue growth is projected at 15.3% annually, outpacing the Japanese market's 4.2%. Moreover, earnings have surged by 66.3% over the past year alone and are expected to grow at an impressive rate of 27.4% per year moving forward. This growth trajectory is supported by substantial investments in R&D which amounted to ¥5 billion last fiscal year, underscoring a strong commitment to innovation despite market challenges. The company’s strategic focus on enhancing its software offerings could be pivotal in sustaining long-term growth within Japan’s competitive tech sector. With earnings quality considered high and a forecasted Return on Equity of 21.3%, Infocom seems well-positioned to leverage its enhanced capabilities post-acquisition while continuing to innovate and expand its market presence effectively.

- Delve into the full analysis health report here for a deeper understanding of Infocom.

Understand Infocom's track record by examining our Past report.

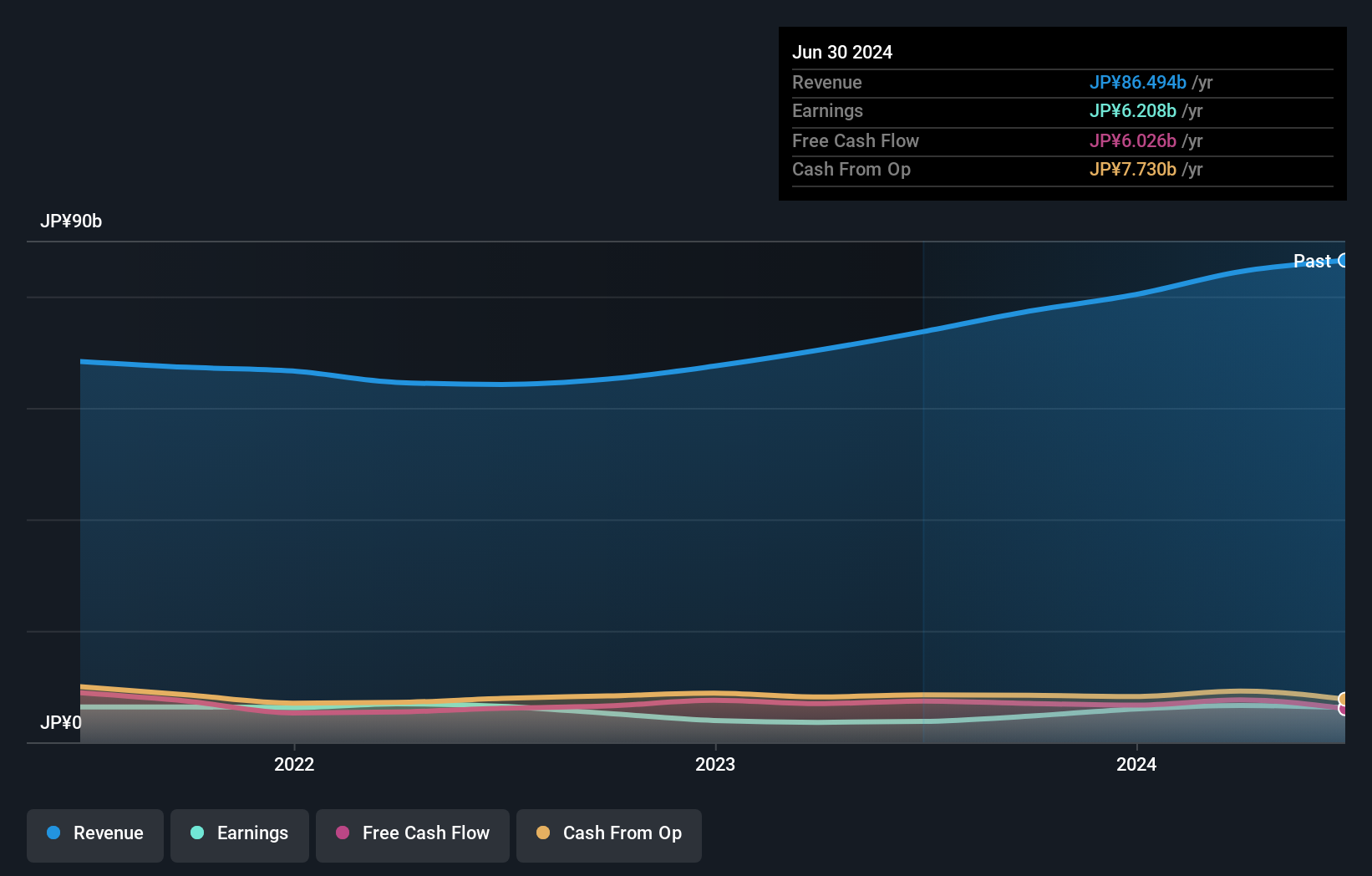

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare businesses with a market cap of ¥1.27 trillion.

Operations: OMRON generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company's diverse operations span multiple sectors, contributing to a robust business model with significant revenue streams from each segment.

OMRON, navigating through a challenging tech environment in Japan, is set to see its revenue grow by 5.6% annually, slightly outpacing the broader Japanese market's growth of 4.2%. Despite currently being unprofitable, OMRON is expected to shift towards profitability within the next three years with an anticipated earnings growth of 46.2% per year. This optimistic outlook is bolstered by significant investments in R&D which have been instrumental in maintaining competitive edge; last year alone, these expenses constituted a substantial portion of their budget, aligning with long-term strategic goals to innovate within the electronic sector. Moreover, the company's future prospects seem promising given these planned enhancements and a forecasted low Return on Equity at 7.6%, suggesting potential for improvement and growth as market conditions evolve.

- Navigate through the intricacies of OMRON with our comprehensive health report here.

Evaluate OMRON's historical performance by accessing our past performance report.

KOA (TSE:6999)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KOA Corporation develops, manufactures, and sells electronic components in Japan and internationally with a market cap of ¥42.99 billion.

Operations: KOA Corporation generates revenue from the sale of electronic components across various regions, with ¥51.10 billion from Japan, ¥32.28 billion from Asia, ¥12.14 billion from Europe, and ¥11.53 billion from the U.S.A., totaling approximately ¥107.06 billion in sales globally.

KOA, amidst Japan's competitive tech landscape, is poised for robust growth with an expected revenue surge of 7% annually, outpacing the national average of 4.2%. This growth trajectory is supported by a projected earnings increase of 27.3% per year. Notably, KOA's commitment to innovation is evident in its R&D spending which significantly contributes to its strategic positioning; last fiscal year, R&D expenses were a key focus area. Despite some industry challenges and a forecasted low return on equity at 4.5%, the company's recent guidance for FY2025 anticipates substantial gains with net sales projected at ¥71.9 billion and operating profit at ¥3.9 billion, signaling potential upward momentum in its market footprint and financial health.

- Take a closer look at KOA's potential here in our health report.

Gain insights into KOA's historical performance by reviewing our past performance report.

Next Steps

- Explore the 124 names from our Japanese High Growth Tech and AI Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6645

OMRON

Engages in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives