- Japan

- /

- Tech Hardware

- /

- TSE:6588

Toshiba Tec's (TSE:6588) Shareholders Will Receive A Bigger Dividend Than Last Year

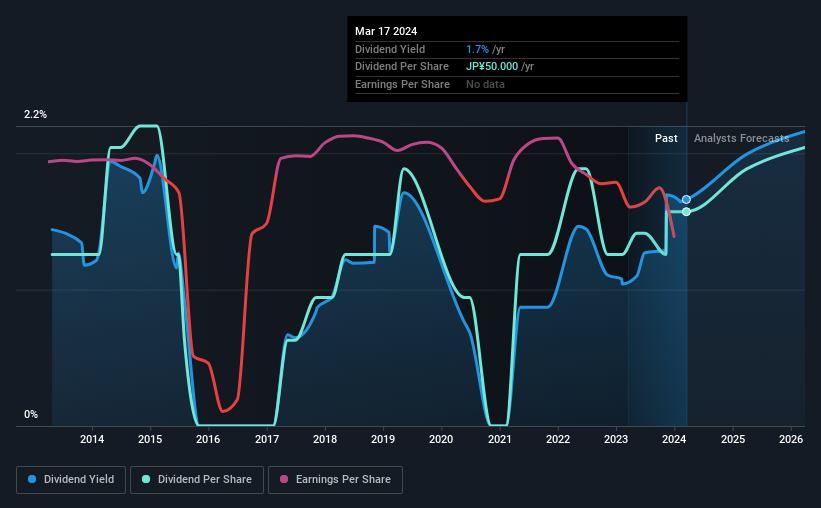

Toshiba Tec Corporation (TSE:6588) will increase its dividend from last year's comparable payment on the 10th of June to ¥25.00. This takes the annual payment to 1.7% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for Toshiba Tec

Toshiba Tec's Distributions May Be Difficult To Sustain

If it is predictable over a long period, even low dividend yields can be attractive. Toshiba Tec is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Analysts are expecting EPS to grow by 59.1% over the next 12 months. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from ¥40.00 total annually to ¥50.00. This implies that the company grew its distributions at a yearly rate of about 2.3% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though Toshiba Tec's EPS has declined at around 47% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Toshiba Tec's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Toshiba Tec will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think Toshiba Tec is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Toshiba Tec that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Toshiba Tec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6588

Toshiba Tec

Offers retail and workplace solutions in Japan and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026