- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6424

Takamisawa Cybernetics Company, Ltd.'s (TSE:6424) 32% Dip In Price Shows Sentiment Is Matching Earnings

Takamisawa Cybernetics Company, Ltd. (TSE:6424) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

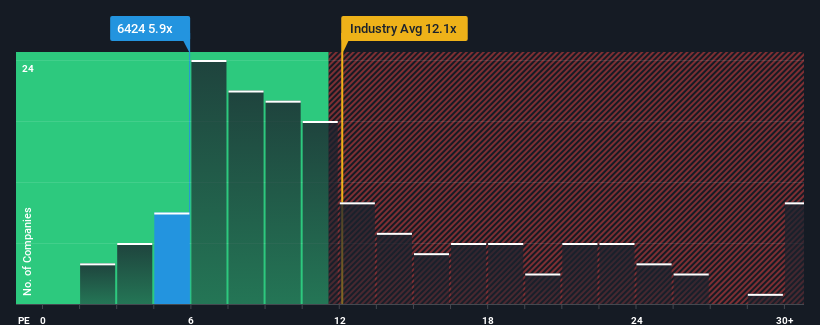

Even after such a large drop in price, Takamisawa Cybernetics Company's price-to-earnings (or "P/E") ratio of 5.9x might still make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Takamisawa Cybernetics Company certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Takamisawa Cybernetics Company

Is There Any Growth For Takamisawa Cybernetics Company?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Takamisawa Cybernetics Company's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 45%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 9.8% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Takamisawa Cybernetics Company is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Takamisawa Cybernetics Company's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Takamisawa Cybernetics Company maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Takamisawa Cybernetics Company has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Takamisawa Cybernetics Company, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Takamisawa Cybernetics Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6424

Takamisawa Cybernetics Company

Manufactures and sells multi-functional automatic ticket vending machines in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026