- Japan

- /

- Tech Hardware

- /

- TSE:6416

Katsuragawa Electric Co., Ltd.'s (TSE:6416) 30% Share Price Surge Not Quite Adding Up

The Katsuragawa Electric Co., Ltd. (TSE:6416) share price has done very well over the last month, posting an excellent gain of 30%. Looking back a bit further, it's encouraging to see the stock is up 89% in the last year.

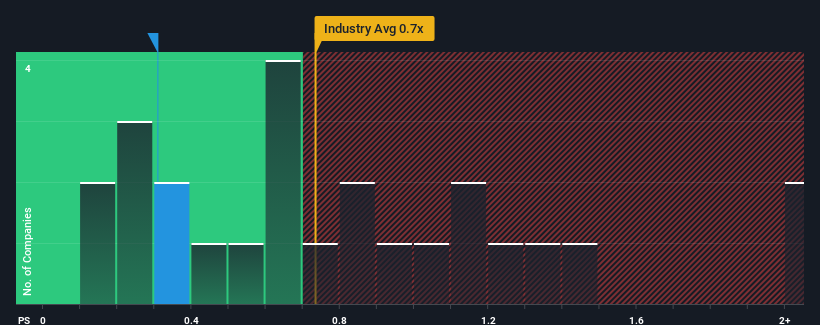

Although its price has surged higher, it's still not a stretch to say that Katsuragawa Electric's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Tech industry in Japan, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Katsuragawa Electric

What Does Katsuragawa Electric's Recent Performance Look Like?

Katsuragawa Electric has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Katsuragawa Electric, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Katsuragawa Electric?

In order to justify its P/S ratio, Katsuragawa Electric would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Still, revenue has fallen 8.9% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 3.4% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Katsuragawa Electric's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Katsuragawa Electric appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Katsuragawa Electric currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Katsuragawa Electric, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Katsuragawa Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6416

Katsuragawa Electric

Develops, manufactures, and sells large format color printers, large format printers/multifunction machines, scanners, and related equipment and software.

Excellent balance sheet and slightly overvalued.