- China

- /

- Communications

- /

- SZSE:300590

High Growth Tech Stocks in Asia Featuring Wasion Holdings and Two More

Reviewed by Simply Wall St

As global markets navigate fluctuating economic indicators and policy shifts, the Asian tech sector continues to capture investor attention, particularly with small-cap stocks benefiting from lower interest rate environments similar to those seen in the U.S. The focus on high-growth technology companies in Asia, such as Wasion Holdings and others, highlights the potential for innovation-driven growth amid broader market dynamics that favor sectors poised to leverage technological advancements and consumer demand.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for the energy supply industries, with a market cap of approximately HK$13.49 billion.

Operations: The company generates revenue primarily through its Power Advanced Metering Infrastructure, which contributes CN¥3.65 billion, followed by Advanced Distribution Operations and Communication and Fluid Advanced Metering Infrastructure segments at CN¥2.98 billion and CN¥2.88 billion, respectively.

Wasion Holdings, a key contender in Asia's high-growth tech landscape, recently secured significant contracts totaling approximately HKD 404.48 million from China Southern Power Grid Co. Ltd., underscoring its competitive edge in the metering equipment sector. This achievement coincides with a robust financial performance in the first half of 2025, where revenues surged to CNY 4.39 billion from CNY 3.74 billion year-over-year, and net income climbed to CNY 439.65 million, marking a substantial increase from CNY 331.03 million. These developments reflect Wasion's strong market position and strategic execution capabilities in a rapidly evolving industry.

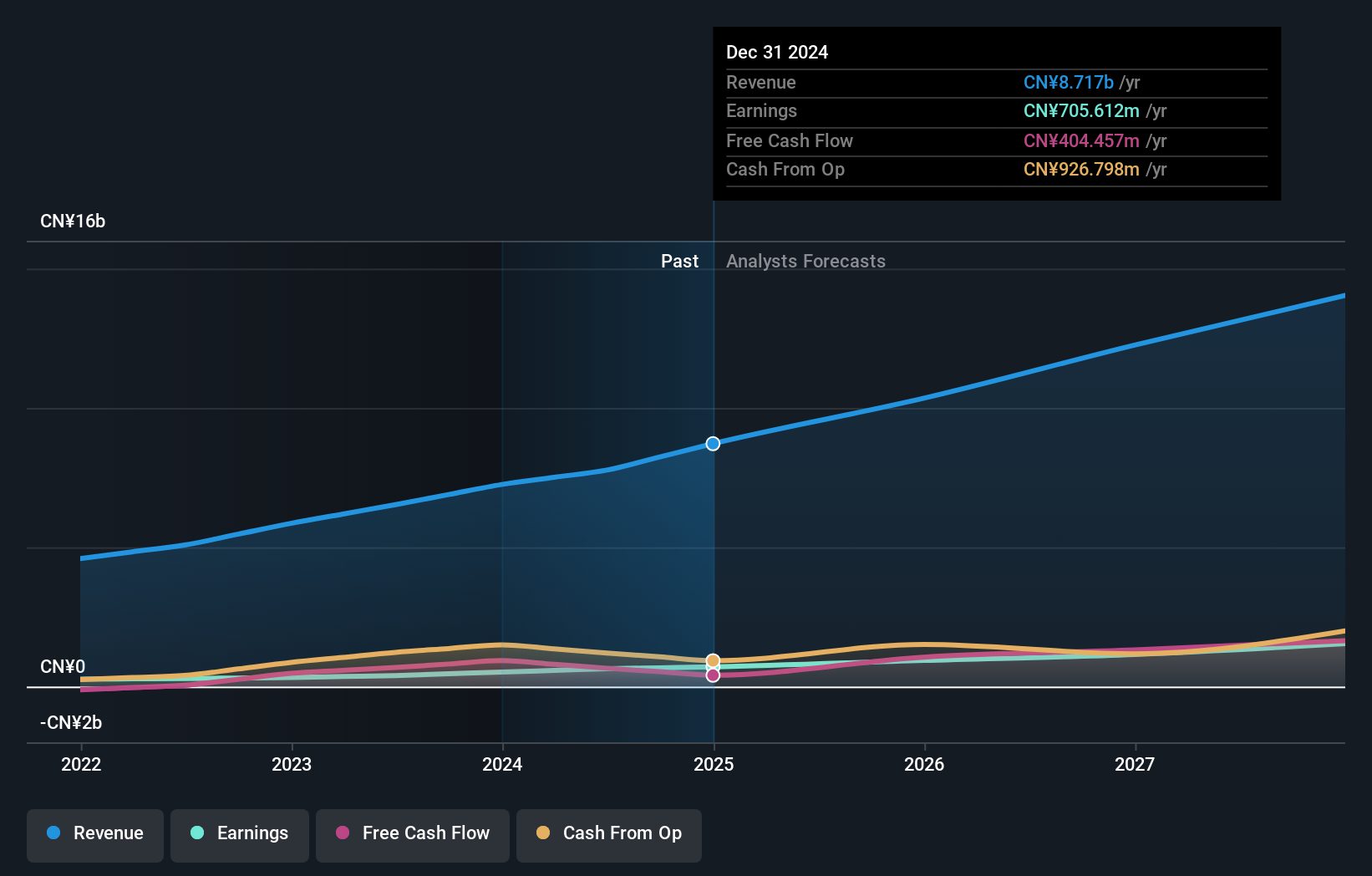

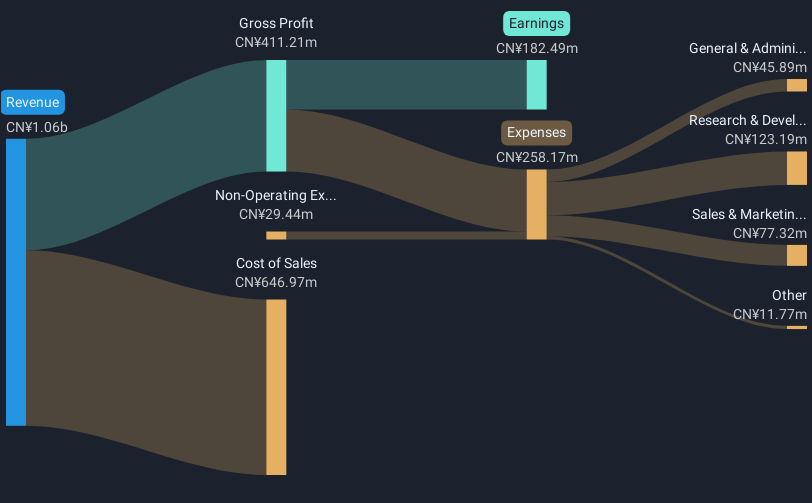

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Queclink Wireless Solutions Co., Ltd. provides IoT solutions globally and has a market capitalization of CN¥5.54 billion.

Operations: Queclink Wireless Solutions Co., Ltd. offers a range of IoT solutions on a global scale.

Despite a challenging half-year with revenues and net income falling to CNY 359.97 million and CNY 31.02 million respectively, Queclink Wireless Solutions demonstrates resilience in the tech sector. The company's commitment to innovation is evident from its R&D investments, maintaining robust growth forecasts with expected revenue and earnings growth at 16.6% and 30.1% annually. This positions Queclink distinctively in Asia’s competitive tech landscape, especially as it navigates market fluctuations and invests in future capabilities.

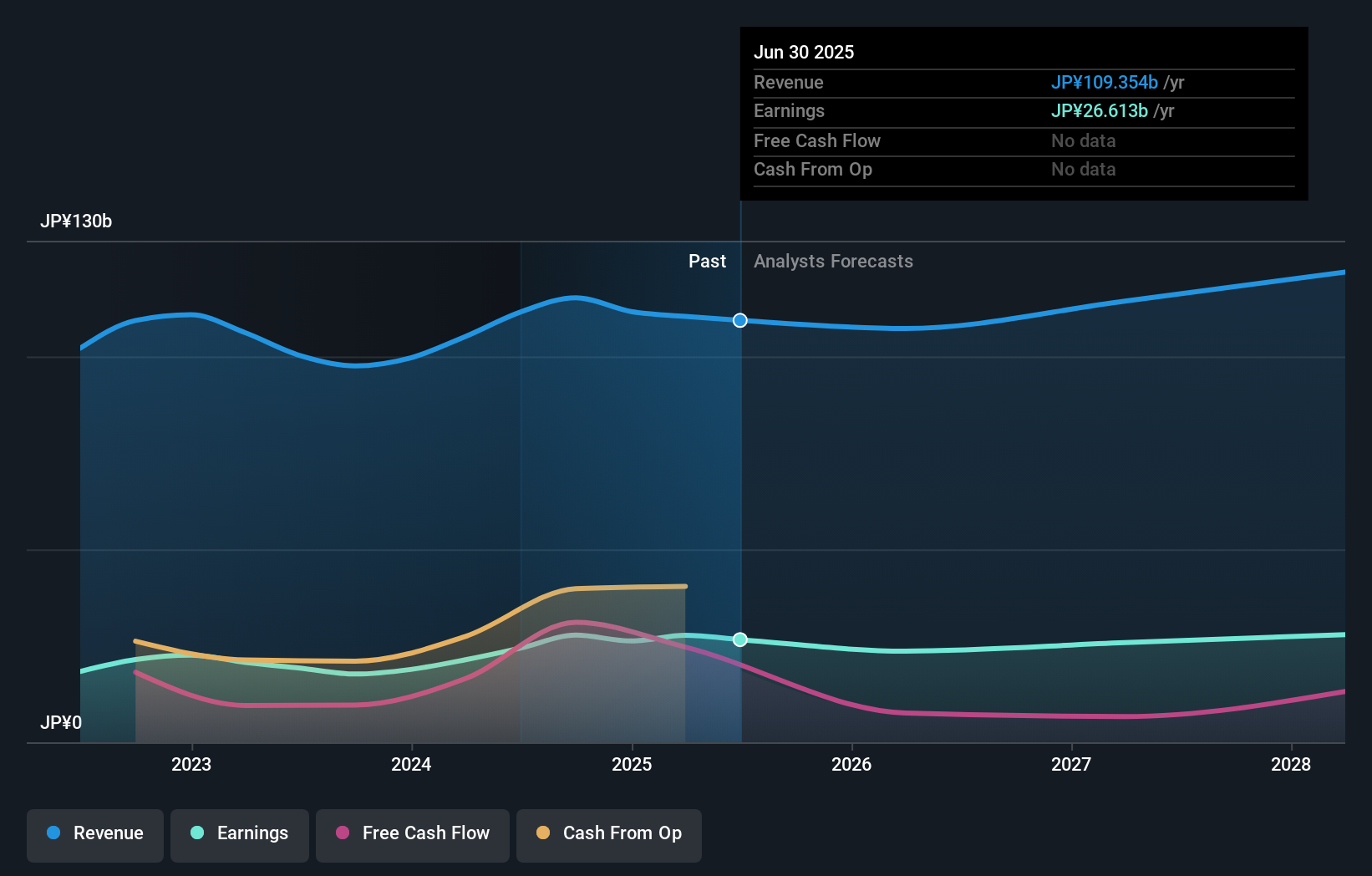

Dexerials (TSE:4980)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dexerials Corporation is a Japanese company specializing in the manufacture and sale of electronic components, bonding materials, and optics materials with a market cap of ¥398.86 billion.

Operations: Dexerials generates revenue primarily from its electronic materials and components segment, which accounts for ¥60.06 billion, followed by optical materials and components at ¥50.01 billion. The company's business model focuses on producing specialized materials for various industries in Japan.

Dexerials has shown a promising trajectory with an annual revenue growth of 7.2% and earnings expansion at 9%, outpacing the Japanese market's average. Significant investments in R&D, amounting to 15% of their total revenue, underscore their commitment to innovation, particularly in electronic materials where they lead with cutting-edge solutions. Their strategic focus is evident from recent earnings calls highlighting advancements in adhesive technologies for electronics, positioning them well amidst Asia's tech evolution despite broader market challenges. This approach not only drives current performance but also sets the stage for sustained relevance in a rapidly advancing industry sector.

- Dive into the specifics of Dexerials here with our thorough health report.

Understand Dexerials' track record by examining our Past report.

Key Takeaways

- Reveal the 185 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Queclink Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300590

Queclink Wireless Solutions

Researches, develops, manufactures, and sells wireless IoT equipment and solutions in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026