- Japan

- /

- Tech Hardware

- /

- TSE:4902

Despite shrinking by JP¥16b in the past week, Konica Minolta (TSE:4902) shareholders are still up 41% over 1 year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. For example, the Konica Minolta, Inc. (TSE:4902) share price is up 40% in the last 1 year, clearly besting the market return of around 11% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! It is also impressive that the stock is up 39% over three years, adding to the sense that it is a real winner.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Konica Minolta

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Konica Minolta saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

We doubt the modest 0.8% dividend yield is doing much to support the share price. We think that the revenue growth of 3.3% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

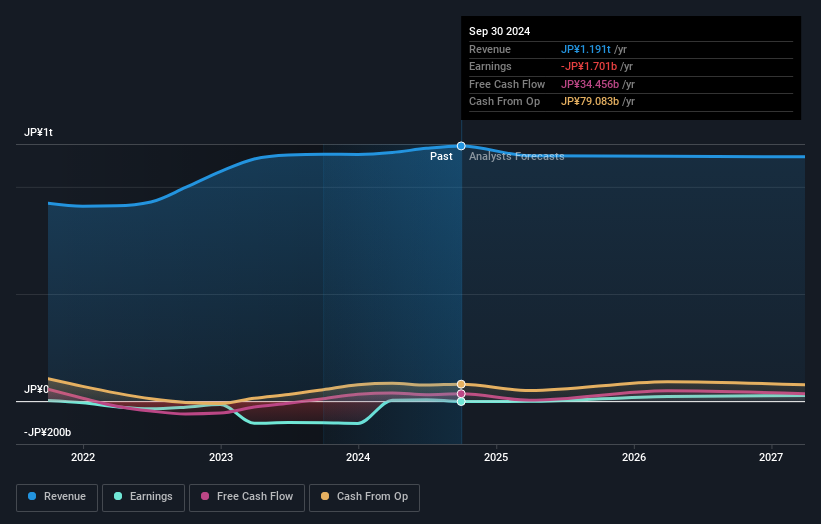

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Konica Minolta has rewarded shareholders with a total shareholder return of 41% in the last twelve months. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.2% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Konica Minolta (1 is concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Konica Minolta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4902

Konica Minolta

Engages in digital workplace, professional print, healthcare, and industrial businesses in Japan, China, other Asian countries, the United States, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives