- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2760

Tokyo Electron Device's (TSE:2760) Dividend Will Be ¥65.00

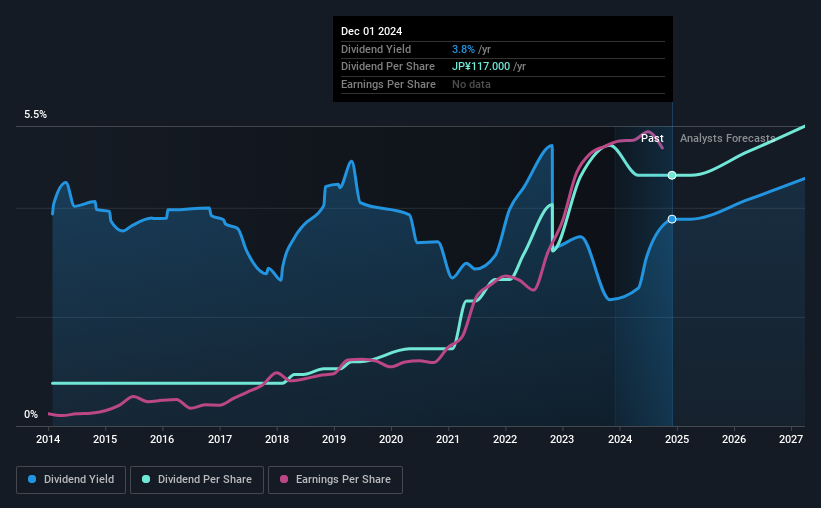

Tokyo Electron Device Limited's (TSE:2760) investors are due to receive a payment of ¥65.00 per share on 30th of May. This means the annual payment is 3.8% of the current stock price, which is above the average for the industry.

See our latest analysis for Tokyo Electron Device

Tokyo Electron Device's Projected Earnings Seem Likely To Cover Future Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Tokyo Electron Device was paying a whopping 160% as a dividend, but this only made up 39% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Over the next year, EPS is forecast to expand by 10.6%. Assuming the dividend continues along recent trends, we think the payout ratio could be 40% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was ¥20.00 in 2014, and the most recent fiscal year payment was ¥117.00. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's encouraging to see that Tokyo Electron Device has been growing its earnings per share at 34% a year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

Our Thoughts On Tokyo Electron Device's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Tokyo Electron Device (of which 1 is a bit concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron Device might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2760

Tokyo Electron Device

A technology trading company, engages in the electronic components and computer networks businesses worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026