- Thailand

- /

- Personal Products

- /

- SET:KAMART

Exploring Undiscovered Gems with Strong Potential This February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and small-cap stocks lagging behind their larger counterparts, investors are keenly watching for opportunities that might be overlooked amidst broader market movements. In this environment, identifying stocks with strong fundamentals and potential for growth becomes crucial, particularly those that may not yet have captured widespread attention.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

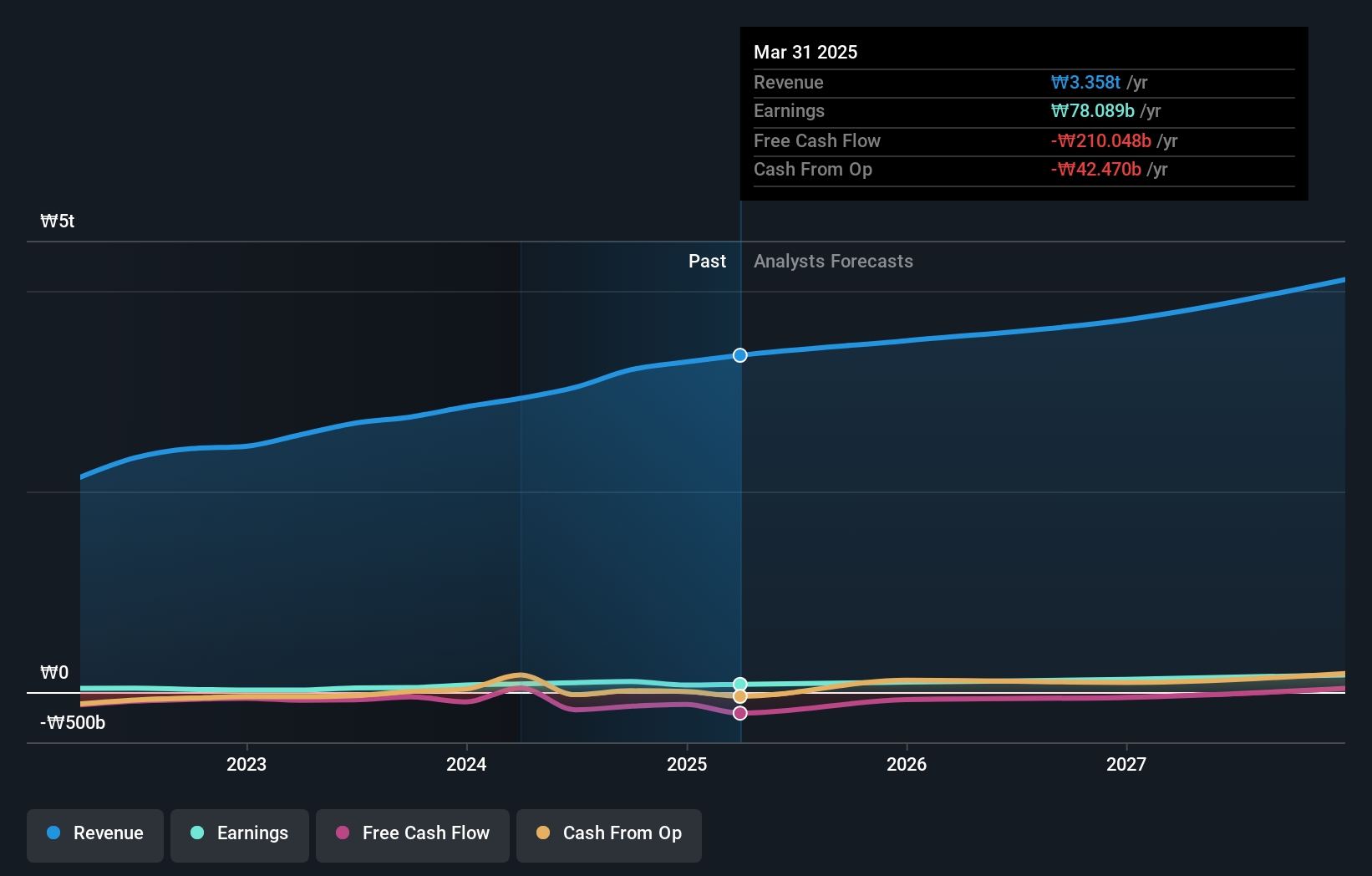

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. is a global manufacturer and seller of electric wires, cables, and related products with a market cap of ₩2.40 trillion.

Operations: The company's primary revenue stream comes from the sale of electric wires, generating approximately ₩3.62 billion. Sales between divisions amount to -₩406.96 million, impacting overall revenue figures.

Taihan Cable & Solution is making waves with its impressive earnings growth of 134% over the past year, outpacing the Electrical industry average of 14%. The company has reduced its debt to equity ratio from 202% to 22% in five years, indicating a more balanced financial structure. Despite this progress, shareholders experienced significant dilution recently. A private placement raised KRW 110 billion through convertible bonds, which will convert into shares at a fixed price. Although free cash flow remains negative, interest payments are well covered by EBIT at a ratio of 7.7 times.

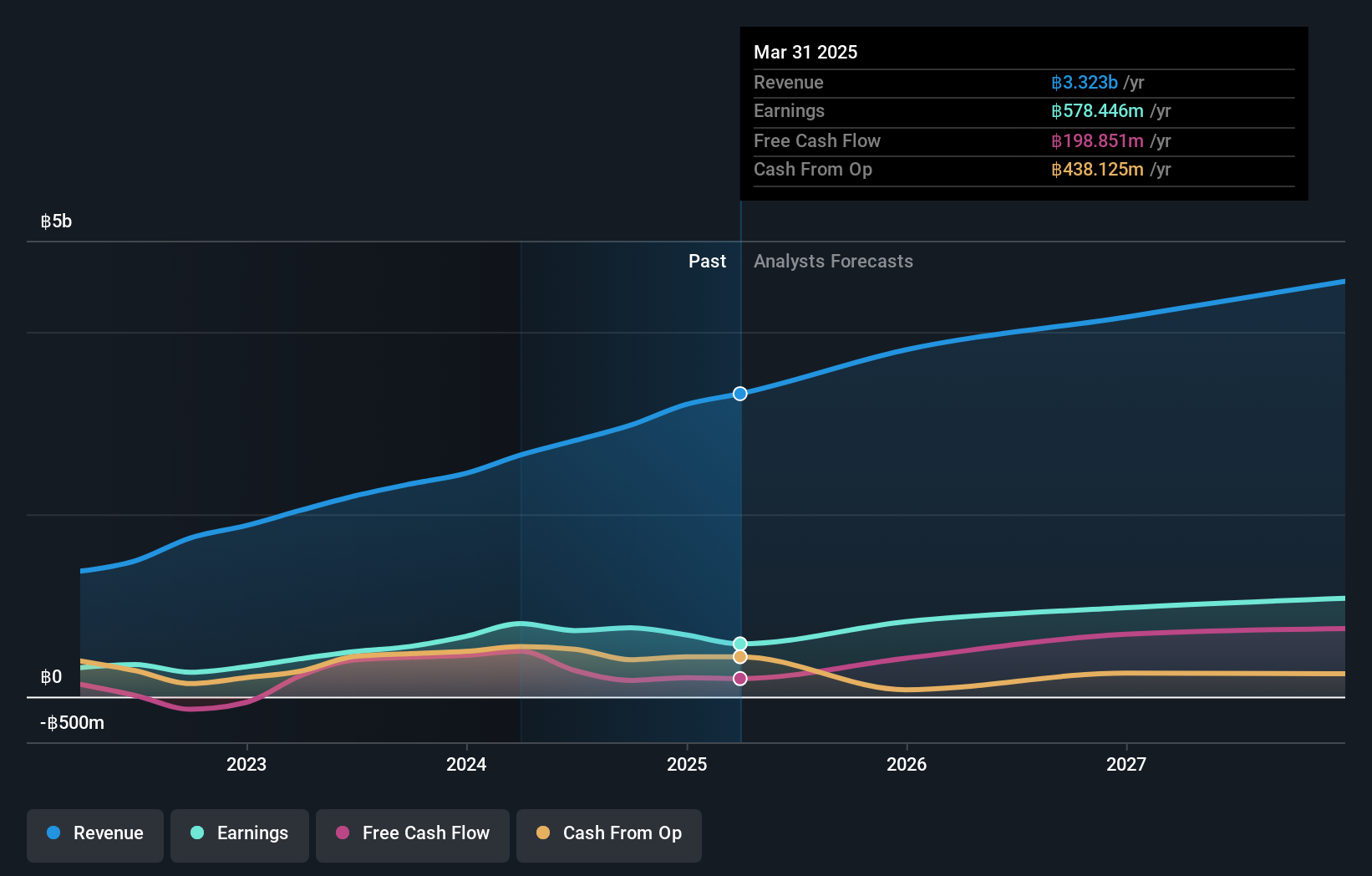

Karmarts (SET:KAMART)

Simply Wall St Value Rating: ★★★★★★

Overview: Karmarts Public Company Limited, along with its subsidiary, operates in the manufacturing, packaging, import, and distribution of cosmetics and consumer products in Thailand with a market capitalization of THB11.87 billion.

Operations: Karmarts generates revenue primarily from the manufacture and distribution of consumer products, contributing THB2.96 billion. Warehouse rental also adds to its income with THB26.15 million. The company experienced a negative impact from investment properties and distribution of by-products and agriculture, which recorded a loss of THB4.01 million.

Karmarts, a nimble player in the personal products sector, shows promising signs of growth. With earnings surging 37% last year, it outpaced the industry average of -3.6%. The company seems to be on solid footing with a debt-to-equity ratio dropping from 30.1 to 18.5 over five years and more cash than total debt, indicating prudent financial management. Trading at a price-to-earnings ratio of 16.9x against an industry average of 23x suggests it's well-valued compared to peers. Karmarts' high level of non-cash earnings further underscores its robust financial health and potential for sustained profitability in the future.

- Navigate through the intricacies of Karmarts with our comprehensive health report here.

Gain insights into Karmarts' past trends and performance with our Past report.

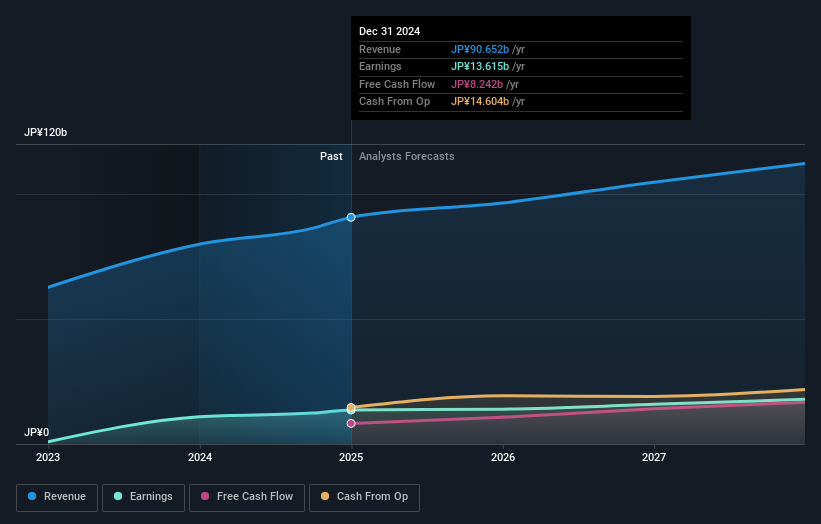

Rigaku Holdings (TSE:268A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rigaku Holdings Corporation manufactures and sells scientific instruments with a focus on x-ray technologies across various regions including Japan, Asia, the United States, Europe, the Middle East, and Africa; it has a market cap of approximately ¥224.57 billion.

Operations: Rigaku Holdings generates revenue primarily through the sale of scientific instruments with a focus on x-ray technologies. The company's net profit margin is a key indicator of its financial performance, reflecting the efficiency in converting revenue into actual profit.

Rigaku Holdings, a compact player in the electronics sector, has shown impressive earnings growth of 24.9% over the past year, outpacing the industry average of 7.2%. The company is trading at a discount, approximately 15.9% below its estimated fair value, suggesting potential upside for investors. With a satisfactory net debt to equity ratio of 33.5%, Rigaku's financial health appears stable and its interest payments are well covered by EBIT at an impressive 47 times coverage. Recent developments include plans to establish a subsidiary in Taiwan by March 2025 to bolster regional operations and efficiency.

- Unlock comprehensive insights into our analysis of Rigaku Holdings stock in this health report.

Review our historical performance report to gain insights into Rigaku Holdings''s past performance.

Next Steps

- Discover the full array of 4716 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Karmarts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:KAMART

Karmarts

Engages in the manufacturing, packaging, import, and distribution of cosmetics and consumer products in Thailand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion