- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6874

Returns On Capital At Kyoritsu Electric (TYO:6874) Have Hit The Brakes

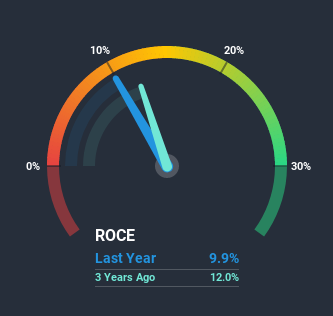

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. In light of that, when we looked at Kyoritsu Electric (TYO:6874) and its ROCE trend, we weren't exactly thrilled.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Kyoritsu Electric, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.099 = JP¥1.6b ÷ (JP¥23b - JP¥7.7b) (Based on the trailing twelve months to December 2020).

So, Kyoritsu Electric has an ROCE of 9.9%. In absolute terms, that's a low return, but it's much better than the Electronic industry average of 7.3%.

Check out our latest analysis for Kyoritsu Electric

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Kyoritsu Electric, check out these free graphs here.

What Can We Tell From Kyoritsu Electric's ROCE Trend?

In terms of Kyoritsu Electric's historical ROCE trend, it doesn't exactly demand attention. The company has employed 46% more capital in the last five years, and the returns on that capital have remained stable at 9.9%. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

On a side note, Kyoritsu Electric has done well to reduce current liabilities to 33% of total assets over the last five years. Effectively suppliers now fund less of the business, which can lower some elements of risk.

The Bottom Line On Kyoritsu Electric's ROCE

As we've seen above, Kyoritsu Electric's returns on capital haven't increased but it is reinvesting in the business. Although the market must be expecting these trends to improve because the stock has gained 71% over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you want to continue researching Kyoritsu Electric, you might be interested to know about the 1 warning sign that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Kyoritsu Electric, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kyoritsu Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:6874

Kyoritsu Electric

Provides various systems, testing and measuring instruments, etc.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026