- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6635

Di-Nikko Engineering (TYO:6635) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Di-Nikko Engineering Co., Ltd. (TYO:6635) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Di-Nikko Engineering

What Is Di-Nikko Engineering's Net Debt?

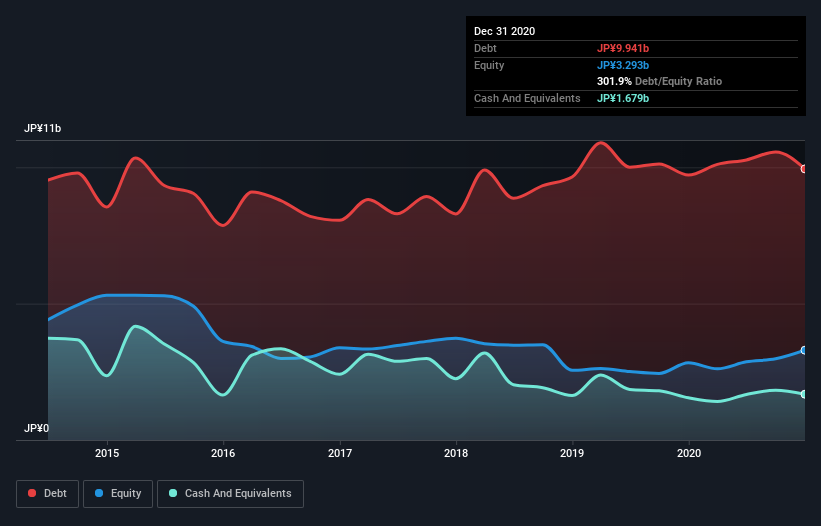

The chart below, which you can click on for greater detail, shows that Di-Nikko Engineering had JP¥9.94b in debt in December 2020; about the same as the year before. However, because it has a cash reserve of JP¥1.68b, its net debt is less, at about JP¥8.26b.

How Strong Is Di-Nikko Engineering's Balance Sheet?

According to the last reported balance sheet, Di-Nikko Engineering had liabilities of JP¥10.3b due within 12 months, and liabilities of JP¥6.02b due beyond 12 months. Offsetting these obligations, it had cash of JP¥1.68b as well as receivables valued at JP¥7.47b due within 12 months. So it has liabilities totalling JP¥7.22b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the JP¥3.29b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Di-Nikko Engineering would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Di-Nikko Engineering shareholders face the double whammy of a high net debt to EBITDA ratio (13.1), and fairly weak interest coverage, since EBIT is just 1.9 times the interest expense. The debt burden here is substantial. On a lighter note, we note that Di-Nikko Engineering grew its EBIT by 22% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. When analysing debt levels, the balance sheet is the obvious place to start. But it is Di-Nikko Engineering's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Di-Nikko Engineering burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Di-Nikko Engineering's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at growing its EBIT; that's encouraging. After considering the datapoints discussed, we think Di-Nikko Engineering has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Di-Nikko Engineering is showing 5 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Di-Nikko Engineering, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:6635

Di-Nikko Engineering

Engages in the contract design and production business from circuit design to electronic component mounting and finished product assembly in Japan.

Moderate risk with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026