- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2469

One Analyst Thinks Hibino Corporation's (TYO:2469) Revenues Are Under Threat

The latest analyst coverage could presage a bad day for Hibino Corporation (TYO:2469), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

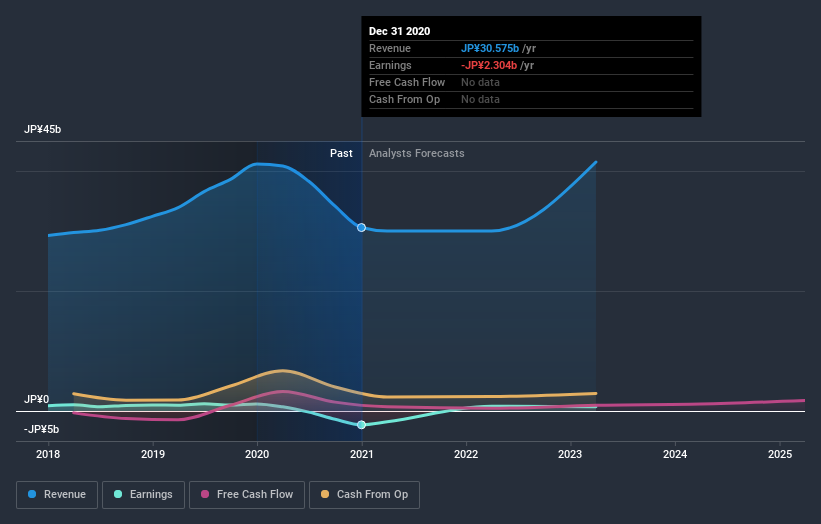

Following the latest downgrade, Hibino's one analyst currently expects revenues in 2022 to be JP¥30b, approximately in line with the last 12 months. Before the latest update, the analyst was foreseeing JP¥40b of revenue in 2022. The consensus view seems to have become more pessimistic on Hibino, noting the pretty serious reduction to revenue estimates in this update.

View our latest analysis for Hibino

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast revenue decline of 1.9%, a significant reduction from annual growth of 5.0% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.0% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Hibino is expected to lag the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for Hibino next year. They're also anticipating slower revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Hibino after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

We also provide an overview of the Hibino Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

If you’re looking to trade Hibino, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hibino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:2469

Hibino

Designs, sells, installs, and maintains audio equipment in Japan and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives